Hockey's pension plan will hurt

Summary: The Government is almost certain to reduce the taper rate for the age pension, which will reduce the number of people receiving some part age pension, and reduce the amount of age pension others receive. The biggest difference will be for retirees with $600,000 to $800,000 of assets, who are set to lose $200 per week. |

Key take-out: An increased asset taper rate could reduce the incentive to save extra money for retirement, leading to an increase in people spending the assets they have accumulated to enjoy the early years of retirement, then relying on the part age pension. |

Key beneficiaries: General investors. Category: Retirement. |

It is now almost certain the government will introduce sharp changes to the pension system in the Budget, and indeed if the daily leaks to the media are anything to go by, they will also pass through the Senate – a crucial factor in any new legislation.

In summary the government aims to reduce the ‘threshold' amount beyond which you are not entitled to a part pension and most importantly halve the ‘taper rate' which is the mechanism for deciding what level of a part pension you can get based on the amount of assets (excluding the family home) that you own.

Here's how the taper rate works: Currently a person or couple loses $1.50 per fortnight of age pension for every $1,000 of assets they have over the asset test limit. The proposal is to increase the ‘taper rate' so that for every $1,000 of assets over the asset test threshold $3.00 of age pension will be lost. This will effectively reduce the number of people receiving some part age pension, and reduce the amount of age pension others receive.

With yesterday's interest rate cut to record lows, meaning lower returns that ever before for retirees from their cash investments, reducing the part age pension will be a significant blow to some retirees.

What an increased asset test taper rate means to pension incomes

While there has been a significant amount of talk about this possibility of an increased taper rate, the ‘show me the money' test is what actually happens to age pension income received for different people with different levels of assets.

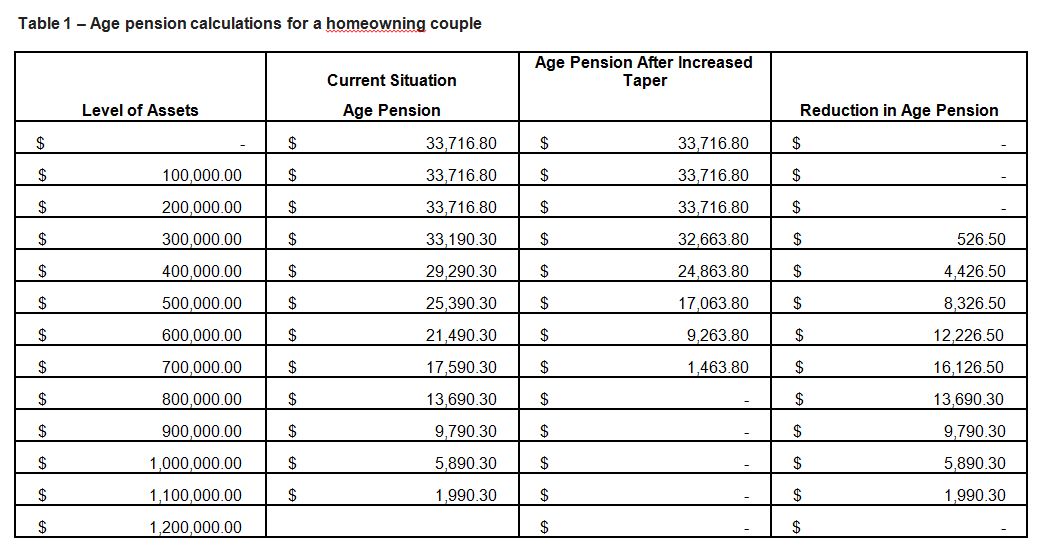

The following table sets out the impact of the possible change in the asset test taper rate on a homeowning couple with various levels of assets. It assumes that the threshold where the age pension starts to reduce, which is $286,500, remains the same. For every $1,000 of assets over this level the couple currently loses $1.50 per fortnight of age pension. The proposal to lose $3.00 per fortnight of age pension for every extra $1,000 of assets is shown.

The biggest difference is for those retirees with $600,000 to $800,000 of assets, losing more than $10,000 per year in part age pension or $200 per week. A person with $700,000 worth of assets, for example, goes from receiving around $17,600 as a part age pension down to less than $1,500.

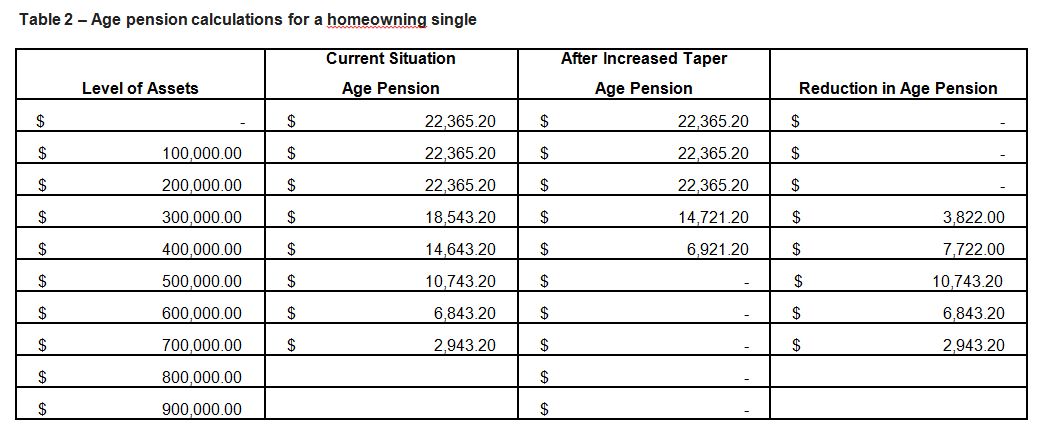

The following table sets out the calculations for a homeowning single person – with again the biggest impact being those people who are currently receiving around half the full age pension.

These calculations have been done assuming that the only change from the current system of pension calculations is an increased taper rate. The proposed ‘cut out' level at which any part age pension would stop has been suggested in the media to be around $820,000 for a homeowning couple and $550,000 for a homeowning single. This is slightly higher than the figure arrived at in the calculations here – so some care must be taken to realise that the calculations in the article are just an indication. That said, the end game will still be a very significant cut to age pensioners relying on the part age pension.

The disincentive of an increased asset test taper rate

It is interesting to isolate the issue of the taper rate being increased so that the part age pension will reduce at the rate of $3.00 per fortnight for every extra $1,000 worth of assets, rather than at the current rate of $1.50 per fortnight for every extra $1,000 worth of assets.

To lose $1.50 per fortnight equates to an annual figure of $39 per year of age pension lost. A person loses $39 of part age pension for every $1,000 of extra assets they accumulate. Given that the gross income from investing in Australian shares is a little over 5 per cent, or $50 based on $1,000 worth of assets, a person will be ahead on an income basis plus they have another $1,000 of capital to spend if they need/choose to.

To lose $3.00 per fortnight equates to an annual figure of $78 per year of age pension lost. Suddenly the incentive to save an extra $1,000 is reduced. If you invest that $1,000 in shares you might receive gross income of a little over $50, in exchange for losing $78 of age pension. Sure you have an extra $1,000 to spend if you choose, however you are well behind on an income basis. Of course, in the current low interest environment you are even further behind if you invest in cash – your $1,000 of extra cash investments might provide $30 of income compared to $78 of age pension lost.

Once concern about the maths of this is that if the incentive to save extra money for retirement is reduced – and it absolutely is if the pension taper rate is increased as proposed – is that there will be an increase in people ‘spending' the assets they have accumulated to enjoy the early years of retirement, and then choosing to be fully reliant on the part age pension.

Conclusion

The intent behind the proposed change in the age pension asset test taper rate is to save money for the Government. This saving will be coming out of the pockets of those homeowning couples who have around $700,000 in assets and homeowning singles who have around $500,000 in assets in the form of reduced part age pension payments. The implication is that these people are ‘wealthy retirees' who can afford to fund their own retirement.

$700,000 of assets under the assets test probably means $650,000 of investment assets and around $50,000 of ‘lifestyle' assets. In a previous article I reviewed a range of evidence and came to the conclusion that 4.5 per cent a year, increasing with inflation, is a reasonable rate to withdraw from investment assets over a long period (eg a 30 to 40 year retirement) provided investors are comfortable with a reasonable amount of growth asset exposure (see Spending in retirement: How much is enough?, April 22, 2013). On this basis $650,000 of investment assets for a couple equates to a sustainable portfolio withdrawal rate of about $30,000 per year. Currently they will be receiving around half of the full age pension, if you like saving the Government 50 per cent of the cost of a part age pension, around $16,000. Under changes to the pension taper rate they will be looking at a part age pension of less than $2,000.

I am not a fan of the Government's ‘lifters and leaners' rhetoric, however I can't help but think that a couple who have worked all their life, paid taxes and saved $700,000 for their retirement so they are less dependent on the age pension are hardly leaners – and they will be most hurt by these changes.

Scott Francis is a personal finance commentator, and previously worked as an independent financial adviser. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.

Frequently Asked Questions about this Article…

The government plans to increase the age pension taper rate, meaning retirees will lose $3.00 of age pension for every $1,000 of assets over the asset test threshold, instead of the current $1.50.

Retirees with $600,000 to $800,000 in assets could lose more than $10,000 per year in part age pension, which equates to about $200 per week.

The government aims to save money by reducing the number of people eligible for the part age pension and decreasing the amount others receive, targeting those considered 'wealthy retirees.'

The increased taper rate reduces the incentive to save extra money for retirement, as the loss in age pension could outweigh the income gained from additional savings.

Homeowning couples with around $700,000 in assets will see a significant reduction in their part age pension, potentially receiving less than $2,000 annually.

The current threshold where the age pension starts to reduce is $286,500 for a homeowning couple, and the proposed changes do not alter this threshold.

With the new taper rate, investing an extra $1,000 in shares might yield about $50 in income, but would result in a $78 loss in age pension, making it less beneficial.

The increased taper rate may lead retirees to spend their accumulated assets more quickly to enjoy early retirement years, potentially increasing reliance on the part age pension later.