Hidden estate traps from the pension cap

|

Summary: Death will potentially have a different impact on superannuation and pensions after July 1. These changes have largely been overlooked. |

|

Key take-out: Depending on your situation, it may be necessary to review your will and amend your SMSF trust deed to avoid complications arising from the new $1.6 million pension cap. |

|

Key beneficiaries: General investors. Category: Superannuation. |

The impending superannuation changes do not just impact contributions, the transfer balance cap and related issues.

There are significant hidden estate planning issues arising from the changes upon the death of a member, which have largely been overlooked.

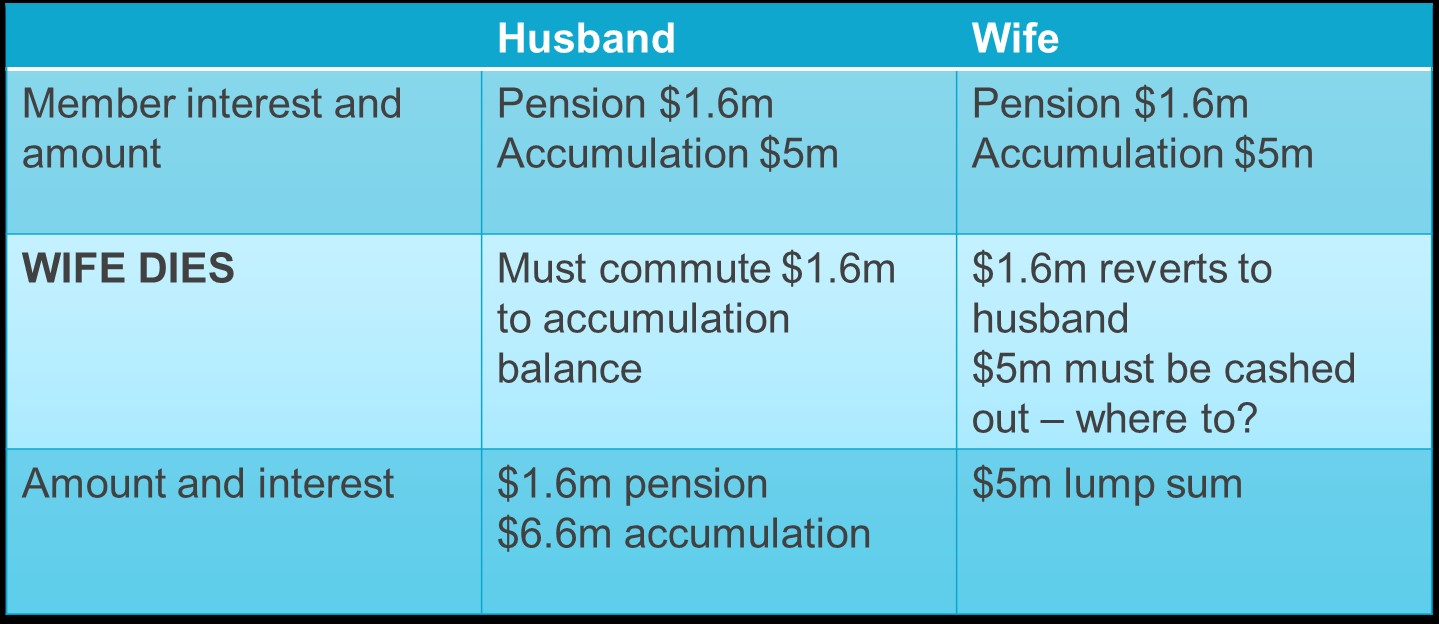

A key challenge occurs where the death benefit exceeds the recipient's transfer balance cap (currently $1.6 million), as the excess must be cashed out as a lump sum. This particularly affects those who wish to retain benefits within superannuation by reverting or paying a pension to their dependants upon their death.

For example, consider what happens on the death of a member where a spouse has their own pension benefits after July 1, 2017:

.jpg)

The surviving spouse may commute their own pension to retain more of the deceased's death benefits in superannuation. However, depending on the amounts involved, part of the deceased spouse's death benefit may have to be cashed out of the superannuation system entirely.

Where should this lump sum be paid? Death benefit nominations and wills need to be reviewed and possibly updated, paying attention to the following:

- If significant sums will be cashed out, a superannuation proceeds trust, where all the beneficiaries are death benefit dependents, or testamentary trust(s) in the will(s), may be appropriate depending on the tax position;

- Second marriages create complexity. Superannuation may have been used as an estate planning tool to provide for the spouse of the second marriage, and to protect the capital for the children from the first marriage (for example, by paying a non-commutable pension). Such arrangements may need to be unwound and alternative arrangements considered, such as a superannuation proceeds trust with restrictions on access to capital;

- Non-lapsing flexible binding death benefit nominations could be used to give a trustee the power to pay the death benefit to the survivor, or to their respective legal personal representative, or a combination of both, on the death of the first spouse. This may depend on the transfer balance account of the spouses, which may be subject to indexation. These must be carefully drafted: case law is clear that nominations must be clear, precise and in accordance with the terms of the trust deed, or else they will be invalid.

When it comes to estate planning, you should also consider whether a nomination is auto-reversionary or reversionary. Auto-reversionary means the trustee has no discretion as to whether the pension is paid to the reversionary beneficiary (i.e., it must revert). The trust deed and pension documents must be reviewed to determine this:

- If a pension is auto-reversionary, then the reversionary beneficiary has 12 months from the date of death to decide whether to cash the pension out of superannuation entirely or receive the pension. If no election is made, the pension will be added to the transfer balance account of the reversionary beneficiary; or

- If a pension is not auto-reversionary, then the trustee must decide where to pay the deceased's benefit in accordance with superannuation law and the terms of the deed. If the trustee decides to pay a pension, then it will add to the transfer balance account of the reversionary beneficiary as at the date of the decision. A binding death benefit nomination can direct where the trustee pays the pension in this scenario.

On top of this, other hidden estate planning issues arise from the transfer balance cap. Here are some other items to be considered:

- The need to bring SMSF deeds up to date with the new legislation, and to allow estate planning objectives to be achieved – often older deeds do not allow for non-lapsing nominations.

- Members with balances exceeding the transfer balance cap may consider setting up a new SMSF for their pension interest, and retaining their remaining accumulation interest in their existing fund. In my view this strategy should not trigger part IVA, as using two funds does not create a tax benefit per se but rather achieves ‘segregation' (which is a method of calculating tax). Appropriate tax advice should be sought.

- As there is different tax treatment for death benefit dependants compared to non-dependants (which will also differ depending on the taxed and untaxed elements of a member's benefits in the fund), and lump sums compared to pensions, tax advice should determine the tax implications of each strategy. Sometimes the best strategy from an estate planning perspective may be the worst from a tax perspective.

- If a death benefit is required to be paid as a lump sum, this may force the sale of illiquid assets where there are insufficient liquid assets to satisfy the lump sum. To avoid this, it may be possible to cash part of the benefit in specie by transferring part of an asset out of the superannuation system (to the estate or a dependant) and retain the other part of the asset or benefit in the fund by paying it as a pension to the dependant. This would effectively require splitting the asset into parts.

James Whiley is special counsel at Hall & Wilcox