Hedge Funds Keep the Faith in Crypto Investments

You could be forgiven for thinking the crypto and digital asset space has fallen out of favour. But, as with other investment classes, investors should always keep an eye on what the professionals are doing.

Two recent reports provide a window into the state of hedge fund crypto investing in 2022. While PricewaterhouseCooper’s 4th Annual Global Crypto Hedge Fund Report pre-dates the Terra/Luna implosion and subsequent crypto market meltdown, it provides a valuable insight into perspectives held by crypto specialists as well as traditional hedge fund managers.

Meantime, Messari and Dove Metrics, which provides fundraising data and intelligence for the cryptocurrency industry, has put out a crypto fundraising report which reports that 1,199 fundraising rounds by 4,300 hedge funds under review raised over $US30 billion in the first half of this year. That amount was split as follows:

- Decentralised Finance (DeFI): USD$1.8B.

- Web3 and NFTs: USD$8.6b.

- Infrastructure: USD$9.7B.

- Centralised Finance (CeFI): USD$10.2B.

DeFI projects covered the gamut of use cases and applications, including decentralised crypto exchanges (DEXs), digital assets funds management, yield generating vehicles, stablecoins, borrowing and lending, index funds, regenerative finance (“ReFI”) and payments. Messari and Dove Metrics reported 195 fundraising rounds for the $US1.8 billion raised.

Web3 and NFT projects drew $US8.6 billion across 530 fundraising rounds. Gaming dominated the NFT segment, but investors also allocated funds to other use cases such as marketplaces, art, fashion, real estate, social networks, DeFI for NFTs and avatars. Web3 projects also caught investors’ attention across an intriguing mix of applications including media, entertainment, Distributed Autonomous Organisations (DAOs), Augmented Reality / Virtual Reality, the environment, identity, publishing, education, and eCommerce.

Infrastructure plays attracted $US9.7 billion to fund smart contract platforms, crypto mining, data, custody, software developer tools, blockchain-as-a-service, scalability, security, wallets, bridges (between different blockchains) and other projects.

CeFI projects attracted the most funds, with $US10.2 billion raised for investments in exchanges, payments, market makers, banking, digital assets funds management, borrowing and lending, funding/grants, stablecoins, compliance, tax/accounting, staking and insurance.

The key takeaway from PwC’s report is that both crypto specialist and traditional hedge fund managers are bullish about crypto and digital assets over the long term. Fund manager expertise is increasing as is their focus on higher quality assets. They’re also employing greater sophistication by generating alpha from a variety of strategies including digital asset selection, yield/income generation both “on-chain” and “off-chain” and using derivatives.

According to PwC, the following metrics support the generally bullish view of the overall crypto and digital asset space:

- Crypto funds’ assets under management (AuM) grew by an average of 150 per cent in 2021 compared to 2020.

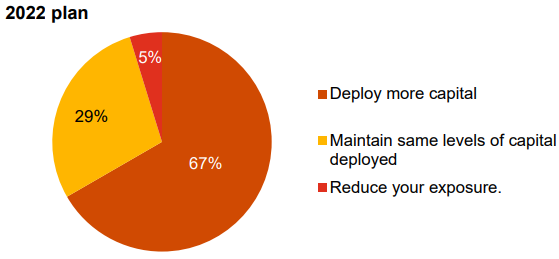

- 67 per cent of traditional hedge funds that are already invested in crypto and digital assets expect to deploy more capital by the end of 2022.

- 29 per cent of traditional hedge funds that have no crypto and digital asset investments plan to have some by the end of 2022.

- As of April 2022, 42 per cent of crypto specialist hedge funds predicted a BTC price of between USD$75K – USD$100K by the end of 2022, with 35 per cent predicting a range of USD$50K – USD$75K.

- 82 per cent of crypto specialist funds use an independent custodian to hold/secure their crypto and digital assets.

- 91 per cent of crypto specialist funds use an independent auditor.

- 27 per cent per cent of traditional hedge funds say they would actively accelerate their investment in crypto and digital assets if the main barriers were removed.

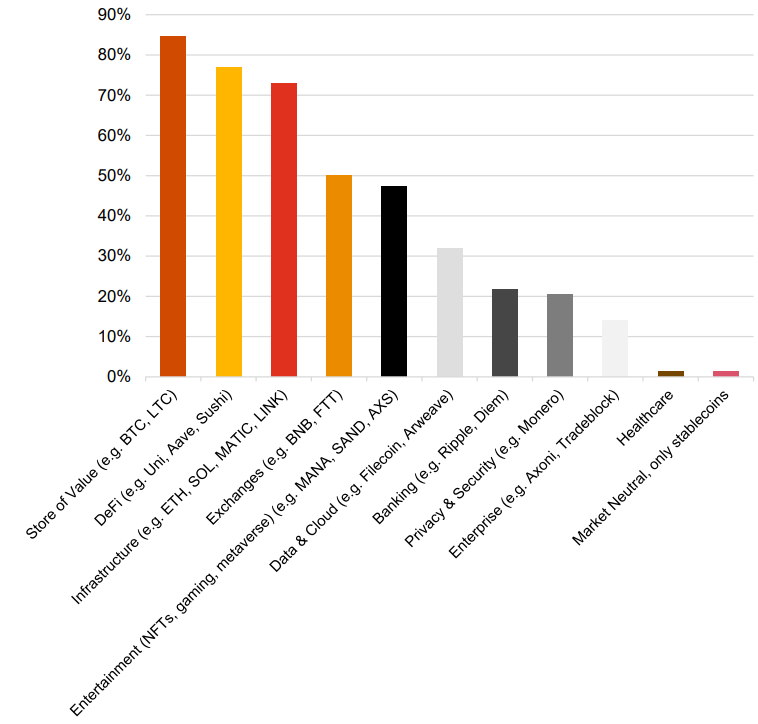

Of particular interest are various metrics describing the asset allocation and strategies employed by the crypto specialist hedge funds.

The following chart illustrates the percentage of funds invested in each asset class:

Source: PwC

PwC notes that hedge funds are more diversified across several asset classes than in previous years, reflecting the maturation of the industry. DeFI was a notable flyer to second place, perhaps reflecting the unregulated nature of DeFI compared to traditional asset classes.

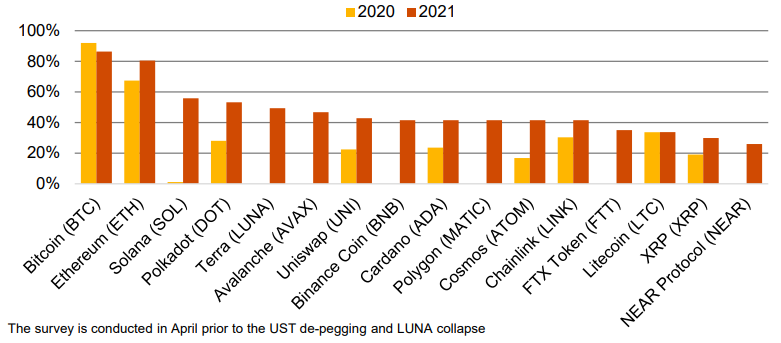

The survey also looked at the main tokens traded by crypto specialist hedge funds. While BTC and ETH continued to attract most hedge fund interest, other “layer-1” blockchains such as SOL, DOT and AVAX attracted significant investment due to their rapid adoption since 2020 and their promise of faster transaction throughout and lower transaction cost relative to BTC or ETH respectively.

Source: PwC

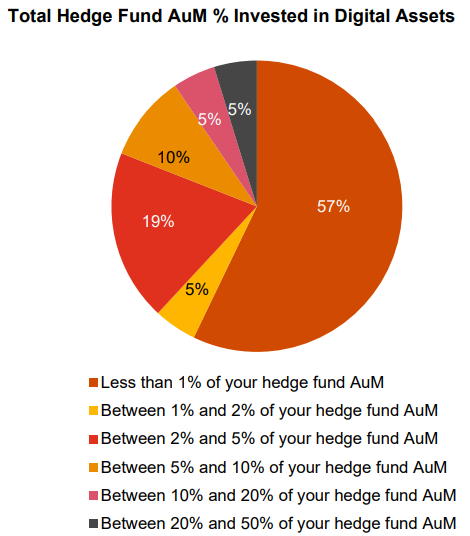

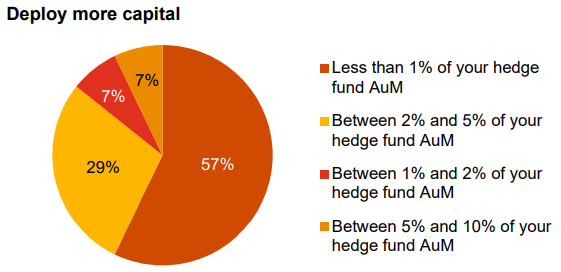

Looking at traditional hedge funds, a metric that may interest individual and family office investors is the percentage allocation to crypto and digital assets:

Source: PwC

Although more than half of all traditional hedge funds surveyed had an allocation less than 1 per cent of total AuM, almost 20 per cent were invested between 2-5 per cent of total AuM, and 10 per cent between 5-10 per cent of AuM. Put another way, almost a third of traditional hedge funds are exposed to crypto and digital assets of between 2-10 per cent AuM.

Of traditional hedge funds already exposed to crypto and digital assets, around two-thirds planned to increase exposure and nearly one-third to maintain existing exposure (bearing in mind that the recent crypto market bust might alter their behaviour).

Source: PwC

Over half of traditional hedge funds planning to deploy more capital held less than 1 per cent AuM, with nearly a third (29 per cent) holding between 2-5 per cent AuM. This demonstrates a willingness amongst traditional hedge funds with smaller exposure to increase their AuM.

Source: PwC

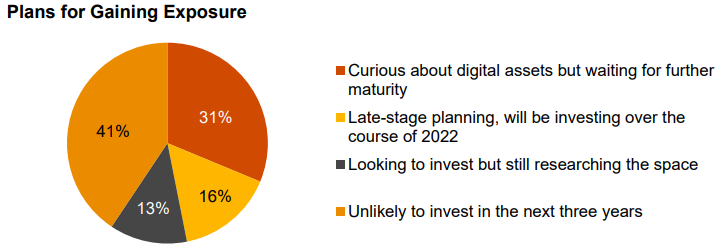

PwC also found traditional hedge funds with no exposure to crypto or digital assets. When asked about plans to do so, these traditional hedge funds responded:

Source: PwC

Forty-one per cent have no plans to invest over the next three years, with the remaining 59 per cent either planning to invest by the end of 2022, looking to invest but still researching, or curious and waiting for the industry to mature.

PwC found that traditional hedge funds were concerned about the following obstacles:

- 83 per cent cited regulatory and tax uncertainty.

- 79 per cent client reaction and reputational risk.

- 77 per cent lack of infrastructure (e.g. audit, custody, tax etc) and service provider availability.

- 76 per cent outside the hedge fund mandate.

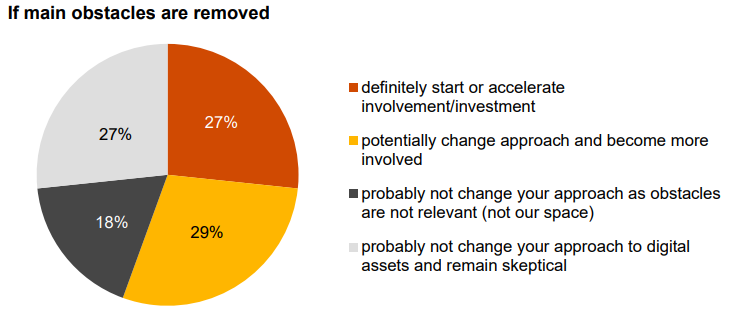

When asked about their response should obstacles be removed, respondents answered:

Source: PwC

Over half said that the removal of obstacles would likely prompt active investment or at least a change to their existing approach. But slightly more than one quarter still said they were unlikely to alter behaviour due to an inherent scepticism about crypto and digital assets.

While the crypto and digital asset space is currently experiencing a bear market cycle, specialist and traditional hedge funds continue to actively invest, trade and monitor developments. While the professionals don’t always get it right (and arguably struggle to match most benchmarks over the longer term), their structured approach may offer valuable insights to individual and family office investors interested in the potential for crypto and digital assets to outperform traditional asset classes.

Frequently Asked Questions about this Article…

Hedge funds continue to invest in crypto because they see long-term potential in digital assets. Both crypto specialists and traditional hedge fund managers are bullish about the future, focusing on higher quality assets and employing sophisticated strategies to generate returns.

Hedge funds are investing in various areas within the crypto space, including Decentralised Finance (DeFi), Web3 and NFTs, infrastructure, and Centralised Finance (CeFi). These areas cover a wide range of applications from digital asset management to gaming and smart contract platforms.

Traditional hedge funds are gradually increasing their exposure to crypto and digital assets. While some have a small allocation, many plan to increase their investments, especially if regulatory and infrastructure barriers are removed. They are cautious but recognize the potential for growth in this sector.

Hedge funds face several challenges when investing in crypto, including regulatory and tax uncertainty, client reaction and reputational risk, lack of infrastructure, and service provider availability. These obstacles can hinder their ability to invest more heavily in digital assets.

Individual investors can learn from hedge funds' structured approach to crypto investments. By focusing on high-quality assets and employing diverse strategies, hedge funds aim to generate returns even in volatile markets. This approach can offer valuable insights for those interested in the potential of crypto to outperform traditional asset classes.