Has the property boom run out of steam?

Has the housing downturn already begun? Or does it reflect a statistical anomaly? Possibly a bit of both, but there are certainly some significant headwinds facing the Australian housing market.

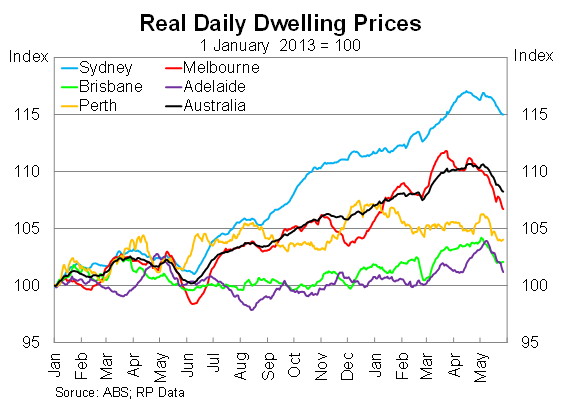

Nominal dwelling prices are down 1.7 per cent in May, following a fairly modest April outcome. Growth has been particularly weak in Melbourne where prices have fallen by 3 per cent in the month to date to be 4.2 per cent below their March peak.

In Sydney, prices have also slowed -- albeit to a lesser extent -- and are now at their lowest level since late March. Prices in the other three mainland capitals have declined to such an extent that it is fair to conclude the house price boom was entirely isolated in Melbourne and Sydney.

Real dwelling prices -- which account for the effects of inflation -- show that over the past year-and-a-half prices in Brisbane and Adelaide have been growing at a rate that is slower than household income growth. Perth prices have also been fairly well contained over the past six months.

So why is this taking place? Well, there are a few reasons, some based on the fundamentals and others based on the statistical nature of the daily dwelling price series.

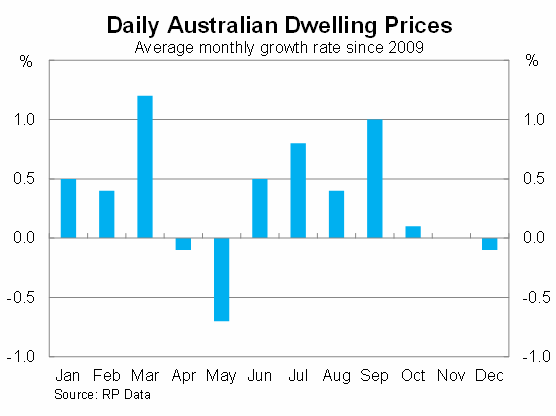

First, the decline could be seasonal. Since RP Data created their daily index in 2009, dwelling prices have fallen, on average, by around 0.7 per cent in May. In May 2013, dwelling prices fell by 1.2 per cent nationally.

Over the past five years the run from June to September has been fairly strong for dwelling prices. So that will be the period that will provide a firmer answer on whether prices have begun to deteriorate or whether the recent declines are a temporary phenomenon.

Second, it may reflect an internal adjustment to the series. Since the daily data is not revised, the series incorporates revisions via the latest outcomes. If prices have been overstated for a period then the series will be adjusted via pushing down new price data. For all practical purposes this will appear as though prices are falling.

The effect of this can be significant. When the data were released monthly they were subject to significant revisions. Between 2007 and 2010, initial monthly estimates of Melbourne price growth were typically revised downward by around 1 percentage point Perth prices on the other hand were consistently understated and revised upwards to a similar degree.

Prices in Adelaide were typically the most accurate, reflecting the more timely reporting of new settlements by their Valuer-General. Reporting in both Sydney and Brisbane was also reasonably good.

There are also some economic justifications for why prices might have slowed or even begun to tumble.

First, lending activity by owner-occupiers and investors has lost considerable momentum in recent months. On a trend basis, new loan approvals to owner-occupiers fell by 0.1 per cent in March -- the first decline since March 2012. Investor lending, on the other hand, rose by 0.4 per cent in the month, although the pace of growth has slowed rapidly in recent months.

Since prices are largely determined by the number of loan approvals -- think of it as a proxy for demand -- this suggests that the top of the market could be in sight.

Second, auction clearance rates have slowed noticeably in recent months. Last weekend the clearance rate in Melbourne was just 62 per cent, although the Sydney clearance rate remains at a fairly elevated level.

The clearance rate has traditionally been a fairly good leading indicator for house price growth which, combined with housing loan approvals data, suggests that momentum has definitely slowed in recent months.

Third, the market might be responding to soft wage growth and elevated unemployment. Speculation has driven the Sydney and Melbourne markets over the past year, but history suggests that speculation can only drive a market for so long. Eventually price gains are tied to income growth, and many Australians are feeling the pinch.

Fourth, to the extent that this daily measure incorporates new information -- most likely via auction results -- some recent weakness could reflect a loss of confidence following the May budget. Measures of consumer confidence have plummeted over the past month, and although that might reflect an overreaction, the public outcry towards the budget continues.

Momentum in the housing market has certainly slowed in recent months, of that much we can be sure, but there are a couple of statistical quirks in the data that make it unclear whether the downturn has fully begun. Certainly prices have fallen in May -- even accounting for seasonality -- but we cannot ignore the possibility that there is an internal adjustment being undertaken, particularly in Melbourne. However, even if that is the case it suggests that previous price gains have been overstated.

Nevertheless, statistical quirks will quickly give way to genuine price falls if clearance rates continue to trend down and investor activity continues to moderate. If that eventuates -- and I’m confident that it will -- then dwelling price growth will quickly follow suit.