Has the Aussie entered the A-list?

The International Monetary Fund just published data for the first time in its history on the importance of the Australian and the Canadian dollar in global foreign exchange reserves. The new data were strikingly clear. Both currencies already play a non-negligible role as reserve currencies, alongside well-established reserve units, such as the dollar, the euro, the yen and sterling, which are used to calculate the special drawing right.

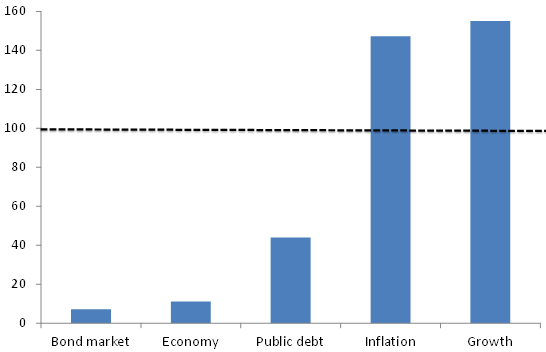

Admittedly, the importance of the Australian and Canadian dollar, together with that of other non-traditional reserve currencies, is still limited. The Australian and Canadian dollar account for three percent of global foreign exchange reserves whose currency composition is known. But non-traditional currencies as a whole (i.e. the Australian dollar, the Canadian dollar and all ‘other currencies’ that are not typically used as reserve currencies) saw their share in global reserves virtually tripled between 2007 and 2012, to around 6 per cent (see Figure 1). This share stands now at a 14-year peak. And its increase is noticeably steep after the autumn of 2009, which marked the onset of the intensification of the sovereign debt crisis in advanced economies, particularly in Europe.

Figure 1. Share of non-traditional currencies in global reserves

Source: IMF COFER data and ECB staff calculations. Note: EMEs = Emerging-market economies.

What explains this increase in demand for non-traditional reserve currencies?

At first glance, several explanations are possible:

– A first possible explanation is that this increase simply reflects the status of the Australian and Canadian dollar as ‘commodity currencies’.

Both Australia and Canada are large commodity exporters and their currencies are known to have surprisingly robust power in predicting global commodity prices. In turn, some reserve managers might invest in the Australian and Canadian dollar to seek indirect exposure to commodity prices. Admittedly, from a portfolio-management perspective, a close correlation with oil prices does not necessarily make a currency attractive as a reserve asset. This depends, among other factors, on whether such a currency is expected to deliver positive risk-adjusted excess returns as well as on its hedging properties against financial or macroeconomic risks.

– A related explanation is return, to the extent that reserves are not purely held for precautionary reasons.

Assets denominated in non-traditional reserve currencies might be believed to offer higher yields to investors, given that the economies issuing these currencies were less affected by the crisis. Their interest rates and bond yields have remained above those in major reserve-currency issuers, in line with this view.

– A third possible explanation is the growing role played by non-traditional reserve-currency issuers in the global economy.

In other words, increasing trade and financial linkages with these economies might have contributed to the growing popularity of their currencies, to the extent that the fraction of reserves held for precautionary reasons mainly reflects trade and financial linkages.

– Finally, the rise in non-traditional currencies in global reserve portfolios could be related to sovereign risk in advanced economies typically considered as safe, consistently with concerns as to an alleged ‘shortage of global safe assets’.

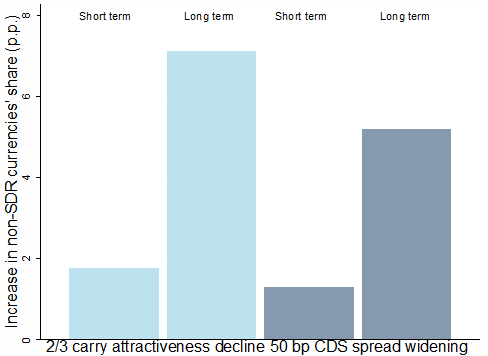

After all, Australian and Canada are among the few remaining AAA-rated countries, while some of the major reserve currency issuers lost their AAA-rating at the same time when their public debt levels increased markedly (see Figure 2).

Figure 2. Salient features of the Australian and the Canadian dollar (Traditional reserve currencies = 100)

Note: bond market = amount outstanding of domestic and international bonds in USD billion in the issuing economies (2012 Q4); economy = nominal GDP in USD billion in the issuing economies (2011); public debt = general government debt in per cent of GDP in the issuing economies (2011); inflation: average CPI inflation between 1999 and 2012 in per cent in the issuing economies; growth = average real GDP growth between 1999 and 2011 in per cent in the issuing economies. 'Traditional reserve currency issuers' are defined as a weighted average of the US, the eurozone, Japan and the UK.

In Beck and Mehl (2013), we take a closer look at the data and find that only the last of these explanations might help convincingly explain the growing importance of non-traditional reserve currencies in global reserve portfolios, especially since 2009.

Higher oil and commodity prices are unlikely to offer a good explanation. The share of the Australian and Canadian dollar started to increase markedly in 2009 – i.e. immediately after the correction in commodity prices that followed the collapse of Lehman brothers. Return or carry trade-related considerations are unlikely to provide a reasonable explanation either. Interest rate differentials across advanced economies have narrowed since the outbreak of the crisis, while volatility in foreign exchange markets has markedly increased. This makes the Australian and Canadian dollar less attractive as investment vehicles for carry trade strategies than they used to be before the crisis, especially in the ‘hunt for yield’ period of 2003-07. Moreover, international trade relations with Australia and Canada have not increased much since the outbreak of the crisis. In particular, the share of Australia and Canada in global imports has remained steadily at roughly 4 per cent.

The last possible explanation that hence remains is that the rise in non-traditional reserve currencies is associated with concerns about a possible rise in sovereign default risk among traditional reserve currency issuers. Consistent with this explanation, credit default swap spreads for non-traditional reserve currency issuers have become lower than those for traditional issuers since 2009. Empirical estimates based on a panel of 47 countries publishing data on their holdings of reserves denominated in currencies other than the special drawing right units between 1999 and 2012 substantiate the point further. These estimates are based on simple linear lagged-dependent variable models, which control for fixed effects. They explain reasonably well the heterogeneity of the share of non-traditional currencies in reserve holdings over time and across countries, fitting about 80 per cent of the latter’s variance.

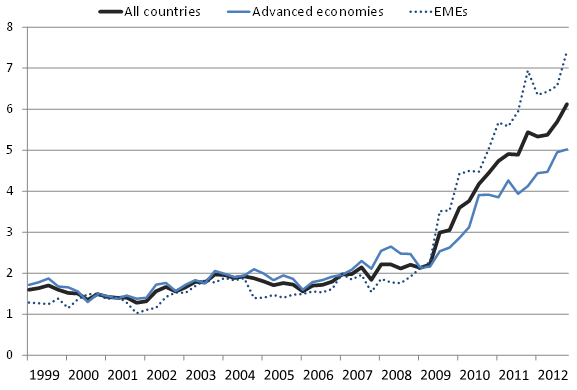

In addition to persistence effects, which are known to be important determinants of the currency composition of reserve holdings, the estimates suggest that only changes in the differential credit default swap spread (defined as the average credit default swap sovereign spread of the major reserve currency issuers relative to those of Australia and Canada) and risk aversion in foreign exchange markets have been associated with a rise in the share of non-special-drawing-right currencies. In terms of economic magnitude, the model estimates are plausible. For instance, a 50-basis-point widening in the differential credit default swap spread (i.e. one close to the actual widening after 2009) is found to be associated with a full percentage point increase in the share of non-standard currencies in the short term and with a five-percentage-point increase in the long term (see Figure 3). The latter is broadly comparable with the actual increase in the share of non-traditional reserve currencies in our sample between 2007 and 2012, i.e. a similar five-percentage-point increase.

Figure 3. Impact of sovereign default risk and risk aversion in FX markets

Whether this increase will be long-lasting remains an open question, admittedly. The lack of large, deep and liquid financial markets may still limit the potential of non-traditional reserve currencies to become truly major reserve units, going forward. In addition, the growing use of such currencies might decelerate to the extent that market conditions normalise and all major advanced economy sovereigns introduce and implement ambitious and credible medium-term fiscal consolidation plans. In the case of the euro, the removal of financial-market fragmentation in the eurozone remains essential to underpin its role as second most important currency internationally.

Roland Beck is principal economist at the European Central Bank. Arnaud Mehl is principal economist at Directorate General International, ECB.

Originally published on www.VoxEU.org. Reproduced with permission.