Has NSW fallen for EnergyAustralia trickery?

The greed and hypocrisy in the energy debate was on full display this week at a planning hearing near Lithgow in NSW.

The NSW Planning and Assessment Commission sat in the quaint (but chilly) Cullen Bullen community hall, and considered the fate of two small coal mines owned by minor mining company Coalpac, which is now under administration. Coalpac is hoping for approval to expand the mines so they can sell them off.

Coalpac’s mines have been in mothballs for a year, but if their extensions are approved, Hong Kong-owned EnergyAustralia will buy and reopen them.

As you would expect, the commission heard from Coalpac employees pleading for an approval which might give them their jobs back.

More unusually, employees of Centennial Coal were there too. They argue that the Coalpac expansion could cost them their jobs in Centennial’s mine, which is just up the road.

Many locals and environmentalists are opposed to the mines because they are close to the Blue Mountains World Heritage Area, and are overlooked by spectacular sandstone outcrops.

You have to feel for these people whose jobs, lives and landscape are caught up in what is really a fight over money between two foreign companies.

Thai-owned Centennial want the Mount Piper power station to buy coal from them at the market price. EnergyAustralia own Mount Piper and want access to cost-price fuel. And they’ll tell NSW Planning just about anything to get it.

EnergyAustralia says that the Coalpac mines are "critical" (page 2) to them, and also to NSW electricity customers. It says that reopening these mines will drive down energy prices.

It even supplies helpful little diagrams showing that the electricity supply curve would shift to the right and the price level would fall, in case everyone at NSW Planning had forgotten 'economics 101' (see PDF page 37).

This might be correct. But if it is, then it’s surprising that EnergyAustralia recently made a submission to the Renewable Energy Target review arguing that "since 2010 it has become apparent that the wholesale energy market is grossly oversupplied and that there is insufficient demand to absorb even existing generation capacity adequately".

So do EnergyAustralia want to increase supply as it's telling NSW Planning, or decrease it as it's telling the RET review? Well, its parent company, CLP Group, boasts in its most recent interim report, "We have also taken steps to respond to the oversupply situation on the generation side by rationalising our generation portfolio".

It’s not surprising that foreign-owned 'Australian' companies would say whatever they want to make a buck. What is surprising is that we believe them.

The NSW Planning Department has swallowed this – hook, line and sinker. It recommends approval of the project, believing claims it will reduce electricity prices and bring $155 million in benefits to retail consumers (page 12).

The department was particularly influenced (page 12) by modelling EnergyAustralia had commissioned from economic modellers ACIL Allen. The modelling said the Coalpac mines could reduce retail electricity prices by 4-12 per cent.

ACIL’s key assumption in this modelling was that wholesale electricity prices were heading north, approaching $100 per megawatt-hour by 2022 (Chart A – PDF page 12):

If wholesale prices were steaming ahead, maybe the Coalpac mines really could make a difference.

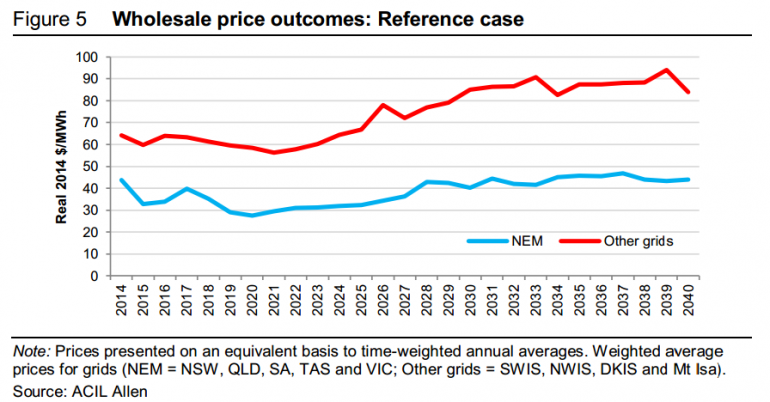

Funny, though, that ACIL’s more recent modelling for the RET review suggested nothing of the sort. In fact, it forecasted wholesale prices in the National Electricity Market would stay between $30 and $40 per megawatt-hour for decades. Watch the blue line of the NEM in the chart below (page 9):

Sure, one chart is nominal, the other is real. One is NSW, the other is the NEM. But this can’t explain a difference of $60 per megawatt-hour in 2022.

Maybe ACIL changed its outlook between these two assessments. But the NSW bureaucracy hasn’t noticed that with the current electricity market outlook, the NSW public stands to gain nothing from the Coalpac mine expansions.

Worse still, royalties from Coalpac coal would be based on a price of $50 per tonne, according to the project’s Environmental Impact Statement, rather than $70 per tonne if bought at market prices from Centennial. This would mean a present value loss of $12 million in royalties over the life of the proposal.

So there you have it. If the planning and assessment commission says the Coalpac mines are to stay closed, then EnergyAustralia will buy from Centennial, NSW will get a decent royalty, and a sensitive environmental area will be spared from considerable risk.

If the commission approves the mines, EnergyAustralia will get coal on-the-cheap. At the same time, NSW will lose royalties and wear the environmental damage, while not a single dollar will be saved by electricity customers in this ‘grossly oversupplied’ market.

Either way, not everyone will be happy in the pretty town of Cullen Bullen.

Rod Campbell is an economist with The Australia Institute.