Green lights still signalling on the ASX

Summary: Shares and bonds around the world are in a bull market stoked by a money printing experiment, which so far has inflated asset prices, not consumer prices. Pulling out of a bull market can have high opportunity costs and it's important to have an escape plan. I always advocate a trend-following system. Another momentum investing approach shows when it pays to be in shares and when it's safer to be in cash. |

Key take-out: Using this momentum strategy, the Australian share market still looks strong. |

Key beneficiaries: General investors. Category: Shares. |

Six years ago when the financial meltdown ended no one foresaw that by 2015 the world would be:

• Flooded with money first through quantitative easing (QE) by the USA, then Japan and finally Europe

• Undergoing a new cold war between Russia and the West and a vicious sectarian conflict between Sunni and Shiite militias across the Middle East that would overflow to western capitals

• Experiencing frail economies with only the US showing signs of healing, yet its middle class abandoning the American Dream because of stagnant wages, and

• Australia escaping the GFC and enjoying a resources boom, but facing slower growth because the world's strongest economy (China) might have a hard landing.

If they had, they would have thought:

• Money printing would generate hyperinflation, yet instead price deflation is the main threat

• War and terrorism would drive investors to gold and silver, yet their prices have collapsed

• Weak economic fundamentals would stymie share markets, yet they have enjoyed a boom, and

• A China slowdown would cruel Australia's share market, yet it's one of the world's best performing markets so far this year.

What this demonstrates is that forecasting is fraught with danger. Nevertheless it's always tantalising to speculate about the future. So here's a summation of two contrasting scenarios for 2015, one popularised by Mike Larson, editor of the mass circulation Safe Money Report and the other advanced by Peter Schiff, CEO and chief global strategist of Euro Pacific Asset Management.

Larson's outlook is:

• The US economy is the only one emerging from the rehabilitation ward. Italy, Russia, Brazil, Japan and China are either struggling or tumbling into recession

• It's only a matter of time before the Federal Reserve lifts US interest rates, triggering a bond crash

• Global wars and terrorism and the European debt crisis will accelerate global capital flows to America boosting the US dollar against other currencies, and

• Foreign money inflows will cause a blow-off in American asset prices in 2015 followed by a hangover in 2016.

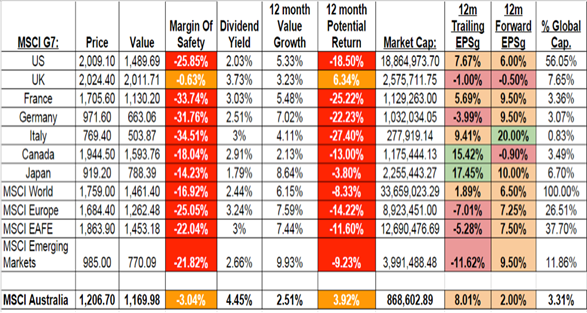

According to Clime Asset Management, only British and Australian share markets are not significantly overvalued; the rest will require a correction (10 per cent fall such as Canada and Japan) or crash (20 per cent fall such as the US, Europe and emerging markets) to get back to an even keel.

Chart: Global Equity Price & Value

Source: MSCI Price Data and Clime Asset Management

The counter view by Schiff is:

• The world has productive overcapacity which continues to put downward pressure on wage, commodity and price inflation

• As long as that is so, central banks won't raise interest rates. Indeed America's economy is faltering which will trigger a new QE program

• Easy liquidity and cheap money globally will continue to fuel debt-funded booms in bonds, property and shares until their prices become unsustainable and crash

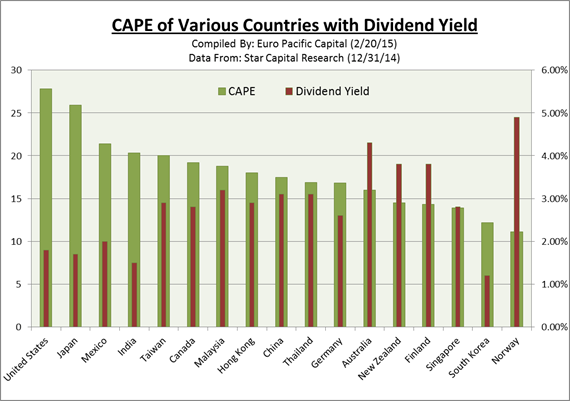

• The cyclically adjusted price-earnings ratio is much lower for share markets outside America so they have further scope to rise than the New York Stock Exchange.

According to Schiff the S&P 500 Index with a CAPE ratio of 28 is almost double the MSCI world Index CAPE of around 15. Japan, which has also engaged in QE, has a high CAPE ratio too. In Schiff's words:

“On a country by country basis, the U.S. has a CAPE that is at least 40 per cent higher than Canada, 58 per cent higher than Germany, 68 per cent higher than Australia, 90 per cent higher than New Zealand, Finland and Singapore, and well over 100 per cent higher than South Korea and Norway.

“Yet these markets, despite the strong domestic economic fundamentals that we feel exist, are rarely mentioned as priority investment targets by the mainstream asset management firms.”

The essential difference in these two outlooks is that the first expects interest rates to start climbing in the second half of 2015 triggering a financial fallout in 2016 whereas the second thinks the US economy will be too weak to raise interest rates thereby enabling European, emerging market and Australasian share makets to soar higher.

Both viewpoints recognise that:

• Global bonds and shares are in a bull market stoked by the biggest money printing experiment in human history

• To date money printing has fuelled asset price inflation and currency wars not consumer price inflation

• Close to zero cash rates means that central banks have exhausted their ammunition (other than further money printing) should there be another financial crisis

• Excessive public debt means governments won't be able to afford major stimulus spending should the world slip back into recession

• If central banks jacked up interest rates the biggest risk is sovereign debt defaults that might precipitate another GFC.

Flying an asset price hot air balloon is dangerous for investors if it encounters stormy weather or moves outside earthbound limits.

Yet pulling out of a bull market can have high opportunity costs if it keeps soaring. So it's important to have an escape plan should wars, terrorism, supply constraints or official actions precipitate a bear market.

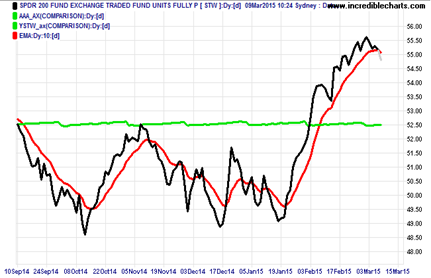

I am always of the view that an investor using a low-cost listed indexed share fund (such as the SPDR S&P/ASX 200 Fund with ASX code STW.AX or the Vanguard's Australian Share Index Fund with ASX code VAS.AX) can participate in a bull market, yet stay out of a bear market by applying a trend-following system. (See for instance Markets in 2015: Winning by not losing, January 12.)

Another approach is to monitor the smoothed six-month price momentum of a listed share fund against that of a listed cash fund (such as the BetaShares Australian High Interest Cash ETF, AAA.AX) to know when it pays to be in shares and when it's safer to be in cash.

Smoothening of the share fund's price momentum measure can be done by applying a ten day moving average trend line to its daily price. Here's how such a strategy looks at present.

Chart: Relative Price Momentum of STW Share Fund against AAA Cash Fund, Sept 2014 to March 2015

In such a chart the current position is all that matters. In other words you compare only the share fund's six-month price momentum against cash not its shorter term momentum scores in the chart. A simple brief on the advantages of momentum investing can be found here.

On that basis the Australian share market still looks strong so hang in for now.

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.