Greece, interest rates and your portfolio

Summary: Greece's decision to hold a referendum on whether to back creditors' terms for a bailout has dramatically lifted the possibility for further rate cuts back here in Australia. If they vote no, then watch the probability of the RBA slashing rates increase. If they vote yes, however, the chances become much more opaque given the uncertainty of data and RBA's rhetoric. |

Key take-out: There are three things investors need to look at to determine if the RBA will cut again: Greece, the terms of trade and the exchange rate. If Greece votes no on Sunday, the chance of a rate cut from the RBA rises to 60 per cent or more in coming months. A ‘Grexit' guarantees a rate cut or two. |

Key beneficiaries: General investors. Category: Economics and investment strategy. |

The crisis in Greece has dramatically opened the possibility of further rate cuts in Australia in the months ahead.

In one week, the Reserve Bank of Australia (RBA) board meets again at a time when very large question marks hang over the outlook for policy.

Especially as the outlook can change so quickly. On paper, a Greek default is already done. The planned referendum is to be held five days after the government is due to make a €1.6 billion payment to the International Monetary Fund tomorrow (Tuesday June 29) – and at this point they don't have the money to meet that obligation.

Interestingly, despite the risk of a default, the market doesn't have an elevated chance of an RBA rate cut priced in for next week's meeting – at 10 per cent only.

Yet the risk for market volatility is high if Greece defaults and exits the euro zone. We'll know a day before the RBA's meeting if that's the case, and it's something that we increasingly have to take seriously.

Worryingly, only 57 per cent of Greek citizens favour a deal to be reached with creditors, according to polling conducted on the weekend. This percentage is just not enough of a majority to give confidence that Greece will remain in the eurozone.

Either way, the referendum is basically a vote on whether Greece wants to exit the eurozone and it's down to the wire.

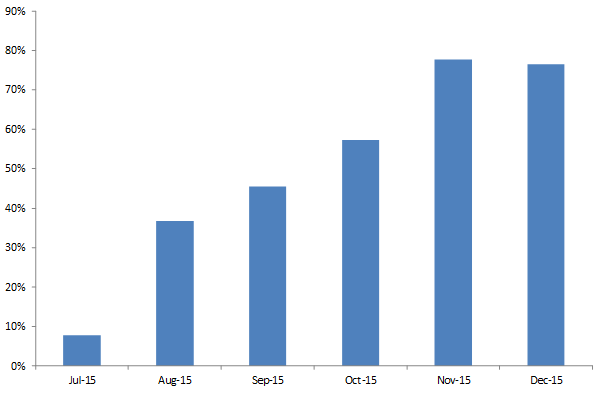

Chart 1: Probability of an RBA rate cut

Back in Australia, the pricing for an August and September cut looks more reasonable at between 35 per cent and 45 per cent, but again, that's probably a bit low.

The problem is that a Grexit is a binary event; they will or they won't. If referendum shows a no vote, watch that probability shoot up. Certainly we'd see the ECB take further action, and the Fed delay its own cycle. The Bank of Japan may even print more money which would see those currencies weaken against the Aussie dollar unless the RBA took action. So the RBA would likely take action.

But what if the Greeks vote yes – effectively accepting its creditors demands - and the ‘crisis' ends well again? Would the RBA still cut? That's a much harder question to answer.

The reason for the uncertainty is the mixed nature, not only of the data flow, but also of RBA rhetoric. It's very difficult to get a sense of what the RBA is trying to communicate. Officially, the RBA state they “remain open to the possibility of further policy easing” should that prove necessary. The difficulty markets are having is determining whether the RBA thinks it will prove necessary. There are no signposts on the economy.

On a pure economic read, it's hard to make the case that another rate cut will come. Now admittedly I had expected growth to be stronger by now, that it isn't has only to do with confidence in some sectors. Even noting that though – take a look at how the RBA described the economy at the last meeting. Overall they expect growth to “remain a little below trend in the period ahead before picking up to around trend in the latter part of 2016.”

A little below trend? That's not suggestive of lower rates. Nor is the expectation that growth will pick up in the latter part of 2016. That puts an acceleration only one year away which isn't long in the grand scheme of things, especially for an economy that's only ‘a little' below trend anyways.

Of particular interest is the RBA's view that:

“After picking up late last year, growth of household expenditure was expected to have remained strong, supported by low interest rates and strong population growth. Conditions in the housing market in Sydney and parts of Melbourne had remained very strong, though trends were more mixed in other cities. Survey-based measures of business conditions had remained around average levels.”

As you can see, the RBA is quite upbeat and those comments would serve equally as an assessment of why the bank should hike rates. Things become even muddier when you consider this commentary from the RBA governor in a recent speech:

“Monetary policy alone can't deliver everything we need and expecting too much from it can lead, in time, to much bigger problems. Much of the effect of monetary policy comes through the spending, borrowing and saving decisions of households. There isn't much cause from research, or from current data, to expect a direct impact on business investment.”

What's interesting about that is the RBA already thinks that consumer spending is as strong is it can safely get. The Governor made that abundantly clear when he said that its “households that probably have the least scope to expand their balance sheets to drive spending. That's because they already did that a decade or more ago. Their debt burden, while being well serviced and with low arrears rates, is already high. It is for this reason that I have previously noted some reservations about how much monetary policy can be expected to do to boost growth with lower and lower interest rates.”

You can see the market's confusion right? They've said clearly that they stand ready to cut again – having only cut rates in May. At the same time though, they have a reasonable assessment on the economy and it's a pretty decent picture really. A goldilocks economy even – not too hot and not too cold. Further, they think it will accelerate from here. Even if it didn't, they don't think lower rates will help much anyway given household expenditure is already strong and at a growth limit – and not something that would boost investment.

Noting this, there are three things investors need to look at to determine if the RBA will cut again. Greece, the terms of trade and the exchange rate.

If Greece votes no on Sunday, the chance of a rate cut from the RBA rises to 60 per cent or more in coming months. A Grexit guarantees a rate cut or two.

If the Greek crisis dies down, then we look to the terms of trade. If it falls further and the Aussie dollar doesn't follow, then the RBA will likely cut again in order to help push the dollar down. If, conversely, the dollar does fall independently, then they won't cut again. Obviously the Federal Reserve features heavily in any discussion because if they hike, the RBA will be much more confident that the Aussie dollar will fall if the terms of trade continues to decline.

I don't think the RBA would be overly concerned if the Aussie dollar went up as long as the terms of trade did too – they don't want to see a divergence. If the dollar does rise while the terms of trade falls, then more rate cuts will come.