Grainy Ukraine prospects give traders food for thought

Since the end of February, trading in the commodities markets appears to be largely unaffected by the Crimean crisis – at least at first glance. Oil prices are 1 per cent lower, based on Brent crude oil futures, despite Russia being the largest oil producer in the world.

Even in European natural gas, where roughly 30 per cent of supplies have come from Russia, prices have actually moved substantially lower despite some initial spikes in early March as warm weather sapped demand.

We see several potential reasons for this, but the bigger picture is that commodities traders haven’t been very concerned about supply disruptions from Russia. However, the same is not true for traders in commodities that depend on Ukraine for a large share of supply. Those commodities are wheat and corn.

The link between Russian credit risk and wheat prices

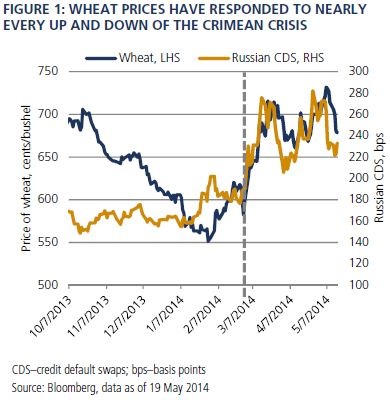

If you want an outside gauge of whether the market is more or less concerned about events in Russia and Ukraine, you can look at wheat prices. Ukraine is a major supplier of grains, particularly wheat and corn: The country represents roughly 7 per cent of global wheat exports and 17 per cent of global corn exports on average. Since the end of February, when the Crimean crisis started to escalate, grain prices have responded to nearly every up and down of the crisis (Figure 1). Wheat is up 21 per cent and corn is up 10 per cent.

So why are market participants more concerned about supply disruptions from Ukraine?

Part of this is likely related to the disruption of shipping through Ukraine ports like Odessa, which is an important source of global grain exports. Another reason may be the difficulties that both exporters and farmers have faced obtaining financing to conduct their normal operations. In addition, in the event of a Russian invasion, it would seem reasonable for Ukrainian farmers or local governments to hoard grain and food supplies.

What this means for future prices

Absent the events in Crimea, we see the wheat and corn markets as well supplied globally, and we see little evidence that this will change over the coming several months. High grain prices over the past year have led to large crops and a rebuilding of global inventories.

There is no doubt that this year’s winter wheat crop in the US suffered some damage as it came out of winter dormancy into an excessively hot and dry spring across the Southern Plains. However, crop conditions in Europe are much more normal. In corn, the current pace of planting is relatively slow, but we expect a large crop and limited downside to yields given the developing El Niño weather pattern. (Typically El Niño years are associated with cooler, wetter summers, and this reduces the tail risk of a materially smaller corn crop like last year’s.)

The combined impact of current conditions in the US and uncertainty in the Black Sea region has resulted in a large premium being placed on US grain prices. For example, compare the current free-on-board market (the cash offer at port for global wheat). Australian offers for high-grade wheat are approximately $US60 per metric ton, or 20 per cent cheaper than the same grade of US wheat. This shows how uncompetitive the US offer has become to global buyers. We expect that over the coming months the risk premium embedded in US as well as global grain prices is likely to recede as the size of the US wheat and corn crops becomes more certain.

Investment implications

Our forecast for falling grain prices over the next few months assumes that the Russia-Ukraine situation doesn’t escalate further. How do we reflect this fundamental view in our portfolios? Implied volatility from the wheat and corn options market is below 30 per cent, which is well below the average of the past five or 10 years. Since the end of February, volatility has risen by roughly 3 percentage points, far less than the impact on the outright price of the commodity.

Therefore, we believe that investors looking to take a view on the future price of wheat or corn should do so through the options market. In this case, we think that being long puts on wheat is an attractive way to implement our short wheat view.

© Pacific Investment Management Company LLC. Republished with permission. All rights reserved.