Gottliebsen's Week: Good news, Banks, Virtual reality, Woolworths, Short rallies

Last Night

Dow Jones, up ~1.1%

S&P 500, up ~1.8%

Nasdaq, up ~2.3%

Aust dollar, US70c

Good news

They are coming out in dribs and drabs, but there are actually a number of good local news stories buried in our various media communications.

And these good news stories will, from time to time, override the nervousness about overseas markets and the expected profit disappointments coming from some Australian sectors.

Accordingly they will provide rallies that will allow those wanting to lower their equity exposure to do so, and give comfort to those with a big stake in the market.

One of the good news stories comes from the decisions by two of Australia's largest investment companies, Australian Foundation Investment Company (AFIC) and Milton Corp, to increase their exposure to Australian equities where they see value. These companies are not expecting the Australian stock market to bomb out. If they did they would be holding their cash back.

Banks

As I moved around holidaymakers during January, the question I was constantly asked was, “How much risk am I taking in Australian bank shares?” The low interest rates have forced Australian savers, particularly those nearing or in retirement, to use bank shares for income.

Clearly the downside is if global capital markets get into trouble, Australian banks will be adversely affected. And there is no doubt that as the mining crunch moves through the Australian corporate scene and/or unemployment rises, banks will have an increase in bad debts, which will affect their profitability and may cause some to trim their dividend.

Currently the market favourite to reduce its dividend is ANZ Bank. But bank shares have fallen in anticipation of lower dividends – that is why the yields are so high.

I can't see anything on the local horizon that is going to cause an immediate catastrophe for banks, even though there may be the odd reduction in profits/dividends in the next two years.

Their main risk exposure is residential property. In Sydney demand remains strong and certainly in apartments there remains a shortage. Rents are rising and that is likely to edge prices higher. Melbourne may be oversupplied in apartments and is particularly vulnerable to any decline in Chinese investment and/or migration. But I don't think we are about to see a collapse. Perth is tough and Brisbane is holding.

In other words, the stock market has anticipated some tough times for banks but what appears on the immediate horizon seems likely to be not as bad as the worst predictions are forecasting. Again, I am leaving out any overseas catastrophe.

In the longer term, banks will need to be a lot more nimble and innovative with their technology developments. Most of them realise that they do need to invest more in this area and so small dividend reductions should not be a surprise and are in line in what the market is signalling.

My small business owner friends tell me Commonwealth Bank took a huge lead in internet banking some years ago and the other banks have simply not been able to catch up.

Worse still, one or two of them have tried expansions that have not worked out. One small business owner tells me the bank they are dealing with made an advance in internet banking late last year but it failed and was forced to abort it.

This is a dangerous signal for our banks. They need to invest much more, including in testing products more thoroughly before they are launched. I suspect computer developers announce start dates far too early and they are forced to go ahead with untested products to ‘save face'. This is simply bad management.

But banks are not alone in being forced to adapt to rapid changes in technology. For decades now large companies, through their sheer power in the marketplace, have been able to generate very large profits, and any time they did stumble they were often taken over, usually for their market share.

That world is now beginning to change and companies are going to need to be far more nimble and end their silo mentality, which has led, in many cases, to a separate department for each corporate activity.

In the case of the banks, their systems did not allow them to fully understand customer relationships because the data is stored in different parts of the organisation.

One of the reasons the Commonwealth Bank is ahead is because it was a leader in this area. When the banks are able to make this customer data easily accessible to their staff not all of them will be innovative enough to use it to their advantage.

So assessing the performance of bank chief executives will involve much more close questioning of what the bank is doing with technology rather than what the earnings are likely to be in the next half year. Frankly, as a long-term bank shareholder I would prefer a slightly lower dividend and more investment.

This process of rapid change through innovation is going to test companies across the board.

Virtual reality

Over the holidays we had our Newfoundland grandchildren staying with us and their father (our son) was very anxious that their first viewing of the new Star Wars movie should be on an IMAX screen. So grandma and grandpa abandoned their gold seat tickets to watch Star Wars on IMAX. It was certainly an amazing experience and incredibly different to the original Star Wars movies. And that led me to realise that this is merely a forerunner of a set of new changes coming in the area of communications in the next five years.

I am not sure that IMAX fully duplicates the experience people will receive in virtual reality communication but it certainly is on the same track. Virtual reality is about to change a whole series of industries. The first will be in gaming -- virtual reality games are set to sweep the world later this year and early next year.

My guess is JB Hi-Fi will be the main beneficiary of this because they have an extremely good database. But don't write off Gerry Harvey of Harvey Norman, who understands that the key to the appliance business is to know how to market new technology developments because Australians love to buy them.

In the case of virtual reality games, in the initial stage I think there'll need to be areas set aside for instruction and virtual reality products will not be as easy to market as large TV screens.

With Dick Smith and a number of other retail chains out of the way it is going to be all about generating profits for the remaining groups. But virtual reality in gaming is merely the beginning and the technology will spread to many other forms of entertainment and then enter the corporate world in a way that substantially reduces the need for personal contact.

Airline business travel will be greatly reduced, although by no means eliminated. Education and many other industries will also be impacted. And so we need to keep an eye on that development and again watch the ways CEOs embrace the technology as it applies to their business.

Woolworths

In this new environment a dangerous virus is spreading large corporations – it occurs where you have committees handing out self-praise to mask mistakes.

So many in the corporate world praise each other and don't recognise mistakes. The best recent illustration is Woolworths and Masters.

Australian supermarket chains have prospered because of their size and ability to mobilise stock and more recently to reduce prices. The game will become much more complex as customers use their mobile phones and other means to change their relationship with supermarkets.

Five years ago Woolworths was in the box seat to mince Coles and other supermarket chains. The real cost of the Masters debacle was that the company did not update its supermarkets to save cash and Masters used up far more of Woolworths' planning time than was healthy for the supermarket chain.

Whoever becomes the next CEO of Woolworths will first need to complete the closure of Masters but also then end the myriad committees and useless head office bureaucracy that grew in the shadow of Masters.

There are some big writedowns and costs involved in both Masters and the required sharpening of the Woolworths organisation. The new CEO must then take the cleansed company into the new world of customer communication to match Coles, Aldi and Costco. No easy task.

It would have been far better had Woolworths pulled the plug on Masters two years ago so that the slate would now be clean to embrace new technologies.

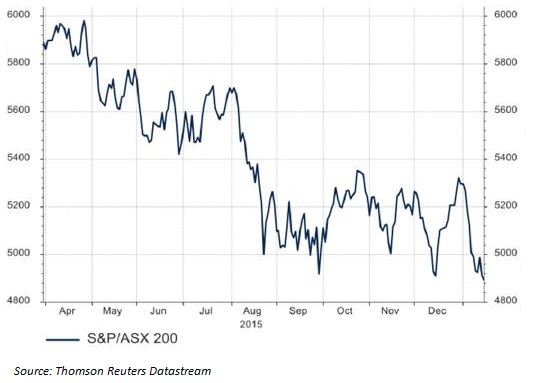

Short rallies

Finally to the market – nothing has changed from last week's warning except that panic has subsided and we are starting to see worthwhile rallies from time to time, usually sparked by short covering.

The greatest danger, in my view, is the overexposure of US non-bank institutions to energy companies and emerging countries. During the week the Saudi foreign minister made it very clear that he was not planning to reduce his market share but was going to let the marketplace eliminate the high-cost oil producers.

The US has maintained its production because the level of loan loss that will erupt if production is ceased is so high that lenders are prepared to ride it out. Nevertheless, now the oil price has gone below $US30 a barrel we are entering a very dangerous period for many oil producers.

And of course on the local market the fact that non-public servant incomes are stagnant is going to test the abilities of managers selling to consumers, so we will see quite a few profit shocks in 2016.

Provided you don't get caught with deeply troubled stocks, sudden falls in good companies on a temporary decline can be a buying opportunity.

Readings & Viewings

The Davos Summit is on in Switzerland and Mr Roubini is…well...ubiquitous. This interview snippet with the equally colourful Henry Blodget is short, but it's worth knowing that Roubini is relatively sanguine about this current bout of market volatility

Peter Cai of Business Spectator has quickly emerged as one of the nation's top China commentators. Here he is on the oversupply rampant in China's industrial sector.

The world could drown in oil, the IEA says.

China's stockmarket red herring.

Nearly half of Australia's CEOs say they'll be cutting staff in 2016.

NSW Liberals play Game of Thrones.

The new Penrith Masters store picked an unfortunate opening weekend.

China's Xi Jinping's new source of economic inspiration: Ronald Reagan and Margaret Thatcher.

Hedge fund that predicted the subprime crisis expects massive yuan devaluation in 2016.

The world is facing a wave of epic debt defaults.

US students are claiming colleges defrauded them.

People trust Google for their news more than the actual news.

Islam's path to modernity.

Building ethics into clothing supply chains.

If you don't know what has been happening to certain Hong Kong booksellers who sell books critical of China you must check out this piece ... this story may become much bigger in the coming months.

The trouble with predicting Chinese share market moves: we don't know what they're worth.

Christopher Hitchens really did die too soon…here's a new look at this exceptionally talented…relentlessly controversial journalist.

Glenn Frey of The Eagles died this week. When they were good, they were very, very good. Here they are doing Lyin Eyes from 1977 ... an obituary this week on Frey, who sings the lead here, told how the musician was anything but laid back. When recording Lying Eyes Frey spent three days getting the opening phrase 'City girls' just right in a California studio, according to guitarist Don Felder

How the Eagles' 'Greatest Hits' invented a new kind of Blockbuster.

Rivalling last week's Hubei ice festival clip this week's snowy wonder comes from Poland.

Chart of the Week (thanks to Clime Asset Management's John Abernethy).

Last Week

By Shane Oliver, AMP Capital

It's been another volatile week in financial markets as investors continue to fret about the global growth outlook. Share markets remained under pressure but managed to rally off their lows helped by strong signs of further monetary easing from the ECB, with Australian shares actually seeing a small gain for the week despite most other markets being down slightly.

The oil price plunged to a new low of $US26.6c but also managed to rally from its lows and metal prices managed to rise. The ECB inspired bounce in risk assets latter in the week also helped push the Australian dollar back up to around US70c, and saw bond yields little changed for the week.

From their highs last year many global share markets have already fallen into bear market territory (defined as a 20 per cent decline from the high – which this time around was last year). Asian shares (down 28 per cent from last year's high) and emerging market shares (down 27 per cent) entered bear market territory last year. Japanese shares have had a fall of 23 per cent and Eurozone shares have lost 22 per cent. Australian shares came close in the past week falling to a 19 per cent decline from the high in April last year but US shares have only lost 13 per cent from last year's high.

With global growth worries likely to linger and US shares having only at a 13 per cent fall despite having more valuation concerns than other markets it's too early to say that we have seen the low. So the Australian share market could yet be tipped into bear market territory.

However, there were some more positives over the last week.

First, Chinese economic data for December was much better than feared and the Chinese Renminbi has remained relatively stable.

Second, share markets have become very oversold with some technical indicators (RSI's for example) at levels often associated with at least short term lows.

Third, signs of extreme pessimism and investor capitulation are continuing to build, with our investor sentiment index on US shares nearing levels associated with bounces.

Finally, central banks are turning dovish. This started with the Fed's Bullard last week and now the ECB is signalling more easing at its March 10 meeting if things don't improve. This is likely to take the form of a €10bn/month increase to the ECB's quantitative easing program and another deposit rate cut.

In the week ahead the Fed is likely to signal a pause in raising interest rates to allow it to reassess the outlook and the Bank of Japan is expected to either ease further or be more dovish.

Our high level view remains that if there is to be a US/global recession then share markets have much further to fall (eg another 20 per cent plus), but if recession is avoided and global growth continues to muddle along around 3 per cent pa then further downside in markets is likely to be limited and they are likely to stage a decent recovery by year end.

We see a recession as being unlikely because we have not seen the normal excesses – massive debt growth, over investment or inflation – along with aggressive monetary tightening that invariably precede them.

While on global growth, the IMF downgraded its global growth forecasts for 2016 to 3.4 per cent (from 3.6 per cent) and for 2017 to 3.6 per cent (from 3.8 per cent). This was largely due to growth downgrades in the emerging world and the US. It's worth noting that though that IMF growth downgrades have been pretty much the norm for the last five years now with the IMF typically starting off with a growth forecast of close to 4 per cent for each year and then having to downgrade it to usually end up around 3 per cent.

On one level it's negative as it highlights the fragile and constrained nature of global growth since the GFC. But it should also mean that the days of rising inflation and much higher interest rates leading to a sharp economic downturn is a still long way off.

Major global economic events and implications

In the US, home builder conditions and housing starts were a bit weaker than expected but remain solid and should be supported by rising household formation, manufacturing conditions in the Philadelphia region improved in January but jobless claims rose again. Meanwhile headline and core inflation was weaker than expected in December. So far only 67 S&P 500 companies have reported December quarter earnings with 79 per cent beatings on earnings but only 51 per cent beating on sales.

Chinese December quarter GDP growth at 6.8 per cent year on year and December activity data were fractionally weaker than expected but not dramatically so. It tells us that growth is still soft but it's not collapsing. Policy stimulus measures are helping but more is needed to help the economy as it transitions from a reliance on manufacturing and investment to services and consumption.

This transition is evident in industrial production growth of 5.9 per cent over the year to December (which is down from 10 per cent plus up until about four years ago) in contrast to retail sales growth of 11.1 per cent year on year. That Chinese shares were able to rally on the news tells us that a much worse outcome had been “feared”. This year I expect Chinese growth to edge down to a 6.5 per cent pace with policy stimulus measures continuing to help avoid a sharper slowing. Continued gains in Chinese property prices for December highlight that the risks from a property collapse in China are continuing to recede.

Australian economic events and implications

Australian economic data releases were but generally on the soft side. Consumer confidence fell in January, presumably in response to news of market turmoil, leaving it a bit below average and new home sales fell in again in November. While housing starts rose to a record high in the September quarter, the softening trend in building approvals and new home sales suggest they are likely to have peaked. Meanwhile the TD Securities Inflation Gauge for December points to continued low inflation.

Next Week

By Craig James, CommSec

All about inflation

In the coming week, inflation dominates the Australian economic calendar. In the US a raft of indicators is released, including those covering economic growth, consumer confidence and home sales.

It is a quiet start to proceedings in Australia in the coming week. Many would have sought an extra day of leave on Monday to lock in an extra-long weekend given that the Australia Day holiday will be held on Tuesday.

On Monday, National Australia Bank releases its December business survey and investors will look for a continuation of improving conditions.

On Wednesday, CommSec will release the quarterly State of the States report — an assessment of the economic performance of state and territory economies.

Also on Wednesday, the main measure of inflation in Australia — the Consumer Price Index (CPI) -- is scheduled for release. And the indications are that another low reading of inflation is on the cards.

We are tipping a modest 0.3 per cent lift in the headline rate of inflation, leaving the annual inflation rate locked near 1.5-1.6 per cent.

One factor constraining overall price growth is the falling cost of petrol. Pump prices probably fell by 6.3 per cent in the December quarter, slicing around 0.2 percentage points off the quarterly CPI.

During the quarter there are generally seasonal price increases in tobacco prices and the cost of domestic holidays and accommodation. Offsetting these price changes, lower prices are likely for pharmaceutical goods reflecting changes to the Pharmaceutical Benefit Scheme (PBS) safety net. Higher prices are likely for dwelling purchase while rents may have been flat or lower in the quarter.

The Reserve Bank attempts to keep inflation between 2-3 per cent over time. But when prices of goods like petrol prices are slumping, the Bank tends to focus more on measures of “underlying” prices. We suspect that underlying price measures probably grew around 0.5 per cent in the quarter will annual growth around 2.0 per cent.

Should prices move in line with forecasts, that is, inflation stays low, the Reserve Bank will retain its conditional ‘easing bias'. In other words, the Reserve Bank has indicated that — should the economy need it — the Reserve Bank won't hesitate to cut interest rates again.

On Thursday the Bureau of Statistics (ABS) will release more data on prices, this time figures on import and export prices. These international price measures tend to be dominated by changes in the Australian dollar and iron ore, coal and oil prices.

On Friday, the Producer Price Indexes (PPI) is released by the ABS. While the CPI covers retail prices, the PPI are focused on business prices or inflation.

Also on Friday the Reserve Bank releases data on loans outstanding — or Private Sector Credit. New loan commitments are rising — now at 7.5-year highs — and this is reflected in higher credit growth. We expect that credit grew around 0.6 per cent in December to stand around 6.6 per cent higher over the year.

Raft of US economic indicators due for release

There are no key indicators to watch in China in the coming week, so the US hogs the limelight. Economic growth data and the Federal Reserve decision are the highlights.

The week kicks off on Monday with the release of the Dallas Federal Reserve index. On Tuesday, two measures of home prices are released with consumer confidence, the influential Richmond Federal Reserve index and weekly chain store sales. The two price measures are from the Federal Housing Finance Agency index and the Case-Shiller index of home prices.

On Wednesday, the Federal Reserve begins a two-day policy meeting with the decision announced on Thursday morning at 6am AEDT. New home sales data is also released on Wednesday together with the weekly housing finance data.

Also on Thursday data on durable goods orders (a measure of business investment) is released together with pending home sales, the Kansas City Federal Reserve index and the weekly data on claims for unemployment (jobless claims).

On Friday, the ‘flash' or advance measure of economic growth (GDP) is released in the US. Economists expect that the economy slowed to a 1.3 per cent annual pace in the December quarter, down from 2.0 per cent in the September quarter. The Federal Reserve believes this slowdown is temporary, thus its decision to lift rates in December.

Also released on Friday is quarterly data on employment (wage) costs, consumer sentiment and the Chicago purchasing manager's index. The wage data is important in its link with inflation and, in turn, interest rates.

Sharemarkets, interest rates, exchange rates and commodities

The US earnings season continues. On Monday, 28 companies are to report including McDonalds.

On Tuesday, earnings from 68 companies are expected, including Apple.

On Wednesday, 102 companies are scheduled to report their results including eBay, Facebook and Boeing.

On Thursday, as many as 175 companies are to report. Included are Microsoft, Amazon and Ford Motor.

And on Friday, 29 companies are to report including Chevron.