Getting a handle on corporate bond ETFs

|

Summary: ETFs covering Australian investment-grade corporate bonds are few and far between. But they do exist, and can be an option for self-directed investors wanting easy exposure to fixed income securities. |

|

Key take-out: Low-cost access through the ASX, and low fees, are some of the key attractions of using exchange-traded fund products. But a cautionary note for investors looking into fixed income securities now is that fixed-rate bonds may be in for a sustained period of falling prices. |

|

Key beneficiaries: General investors. Category: Fixed interest. |

For self-directed investors who are determined to make their own investment decisions and not pay a fund manager, opportunities in the fixed income space are limited.

There is the ASX-listed debt securities market, but this is becoming almost entirely dominated by bank or insurance company hybrid notes issues because senior and subordinated notes issues from non-financial corporates are rapidly reaching their call or maturity dates, and in most cases, are not being replaced.

This sector of the market did very well in the first few years following the GFC, when banks were less willing to lend, and for some issuers there was the motivation of obtaining easily available ‘equity credit' from credit rating agencies.

This is no longer so easily obtained (see A hybrids game changer, November 2012).

Then there is the wholesale corporate bond market – the domain of institutional investors and sometimes those who qualify as sophisticated investors. In this market, bonds trade in parcels of $500,000 at a time, at least initially.

However, this is a very deep and liquid market in comparison to the ASX-listed debt securities market, and comes with much greater opportunities for risk diversification among industry sectors and issuers, and credit quality is investment grade. Credit quality in the ASX-listed debt securities market is mixed between investment grade and sub-investment grade (otherwise known as junk bonds).

Corporate bond opportunities for investors

In between these two options available to self-directed investors are smaller packages of wholesale bonds which can be bought and sold through specialist fixed income brokers, a range of individual wholesale corporate bonds listed on the ASX in the form of XTBs (exchange-traded bonds), and two Australian corporate bond exchange-traded funds (ETFs).

Some specialist fixed income brokers will break down $500,000 parcels of corporate bonds into smaller lots of $50,000 or even $10,000. But this has drawbacks with a lack of visibility around the true price being paid for the bond, which could be some way from the price being achieved in the wholesale market, and liquidity, should an investor wish to sell the bonds before maturity – there will be only one buyer for your bonds.

XTBs overcome this problem by being listed on the ASX, but with each XTB being an ETF in its own right with a dedicated market maker, management expenses need to be covered. These are built into the cost of acquiring the underlying corporate bonds and are reflected in the yield to maturity offered on the XTB (see At last … corporate bonds for everyone, July 2015).

Rate sheets from brokers such as Morgans clearly highlight the difference between the yield to maturity available from an XTB and that available on the underlying corporate bond. For example, the yield to maturity recently quoted for the BHP Billiton, March 2020, XTB was 2.25 per cent per annum, while the yield to maturity on the bond itself was 2.8 per cent per annum.

The other drawback with buying smaller parcels of bonds through specialist brokers or buying XTBs listed on the ASX is the difficulty involved in achieving sufficient diversification within a bond portfolio to eliminate non-systemic risk. (This problem also exists with ASX-listed debt securities.)

Without getting too technical, non-systemic risk can be diversified away in portfolio of as few as ten well-chosen shares. This is because shares can go both up and down in value, and overtime the increases should more than offset the decreases.

However, in a bond portfolio where bonds are held to maturity, the best that can happen is that the face value of a bond is repaid and coupon payments are made on time. The worst that can happen is that a bond issuer goes broke and both the capital value of the bond and the coupons that would have otherwise been paid are lost.

The distribution of possible returns from a bond portfolio is asymmetrical, and therefore elimination of non-systemic risk requires a portfolio of 100 bonds (100 different issuers) or more. Many institutional investors would not achieve a portfolio of such size.

However, a corporate bond ETF may get closer to this objective than many others.

Australia's corporate bond ETFs

There are two Australian corporate bond ETFs listed on the ASX. One is the Vanguard Australian Corporate Fixed Interest Index Fund (ticker code: VACF), the other is the Russell Australian Select Corporate Bond ETF (ticker code: RCB).

The former will be used as an example for no other reason than the information on the fund is readily available.

This ETF has a portfolio of 278 individual bond issues, but issuer duplication would reduce the number of individual issuers substantially. The portfolio has assets under management of $27 million, and is based on an underlying portfolio with total assets under management of $103.5 million.

The aim of the ETF is to replicate returns from the Bloomberg AusBond Credit 0 Yr Index and provide investors with low-cost, diversified exposure to Australian corporate bonds. The ETF invests in investment grade bonds issued by corporations including Australia's four largest banks, offshore banks, other lending institutions and property trusts.

Investors in the ETF are charged a management fee of just 0.26 per cent per annum, which is considerably lower than the 2 per cent plus per annum that might be charged by other fixed income managers seeking to generate higher returns than the index.

Investing in a corporate bond ETF may be anathema to self-directed investors, but in the fixed income space it may well be the best option for all the reasons outlined above.

However, right at the moment, taking on a large fixed income exposure may not be the best thing to do.

With global interest rates rising and the 30-year bond rally at an end (see Ringing the bell after a 30-year rally, February 2017) fixed-rate bonds may be in for a sustained period of falling prices.

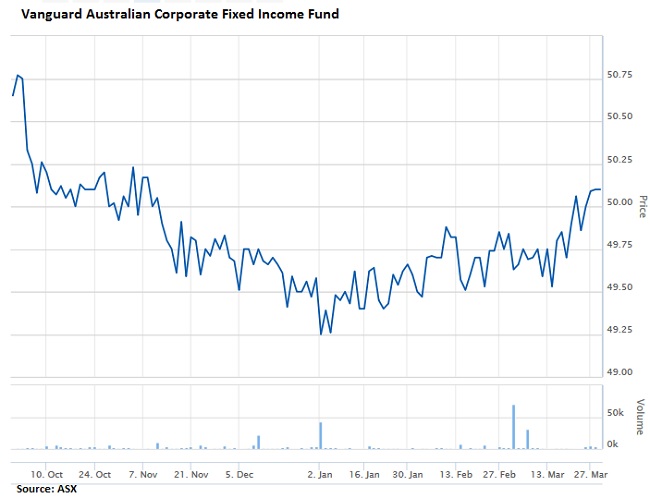

Indeed, the recent price performance of this particular ETF is telling, but in no way unique.