Germany adopts new energy regime; Caribbean islands go green

Germany went through to the quarter-finals of FIFA 2014 after extra-time strikes from its players saw them edge past Algeria to win 2-1.

Last week, its renewable energy law, or EEG, also went through, with the country’s lawmakers backing an extensive revision, which curbs subsidies and slows gains in power prices that are the second-costliest in the European Union.

The legislation, which introduces limits on how much onshore wind and biomass capacity qualifies for the full subsidies and lowers existing targets for solar and offshore wind, pulls energy policy “out of the quicksand,” economy minister Sigmar Gabriel told reporters after the vote in the lower house on 27 June. “We have to expand renewables with more planning security”.

Last-minute changes included in the draft a day before the vote focused on adjusting the EEG-surcharge levels on electricity produced from renewable sources and consumed onsite. This mostly affects commercial photovoltaic projects, which are now built in Germany primarily for auto-consumption in order to offset high retail electricity prices, rather than for the benefits of the feed-in tariff. The new rules lower the EEG-surcharge on auto-consumed electricity from PV from the originally proposed 70%, to 30% in 2015, 35% in 2016 and 40% in 2017. The surcharge only applies to new projects larger than 10kW, but the rules will be revised in 2017 again, when operating projects may also be covered.

The likely impact of the new changes have been detailed in a Bloomberg New Energy Finance Analyst Reaction titled “Update on Germany’s EEG reform for PV”, and published on 30 June.

The government is trying to have the bill become law on 1 August, giving local companies time to apply for rebates. The legislation is to be debated 11 July in the upper house by state leaders, who can at most delay it by calling for an arbitration panel.

While Germany is trying to regulate investment flow into renewables, the Caribbean is looking to attract as much as $US30bn of investment to expand the sector and cut reliance on fossil fuels, partly by securing attractive payments for generators of clean power, a regional development bank said.

“Most of our countries are highly dependent on fossil fuels for power generation,” Caribbean Development Bank president Warren Smith said in an interview to Bloomberg News in London. “This vulnerability to volatile oil prices has contributed hugely to the competitiveness challenges of Caribbean industries.”

About $US20bn is needed in the next five to 10 years to replace power plants and upgrade distribution and transmission, he said.

There is potential to replace 4750MW of fossil-fuel generation with renewables through 2019, Smith said. The bank is talking with regional utilities interested in building clean energy plants to feed power into the grid.

For more on clean energy in Latin America and Caribbean, please refer to Climatescope 2013, a report and index that assesses the suitability of the environment for climate-related investments in those regions.

Feeding power into the grid is in itself a whole new problem in some countries, and this is where energy storage comes in. In a chat with Bloomberg TV, Logan Goldie-Scot of Bloomberg New Energy Finance noted how increasing levels of renewable energy penetration are resulting in grids becoming more decentralised and therefore, harder to manage. In the stationary energy storage market, there is currently about 1.2GW of commissioned capacity, he said, adding that it is likely to grow to 11.3GW by 2020.

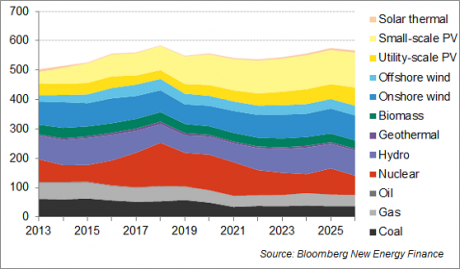

Graph of the week: Small-scale PV is set to expand later this decade, attracting 17% of cumulative investment over 2013-2026

Originally published by Bloomberg New Energy Finance. Reproduced with permission.