Geopolitics: What investors need to know in 2015

Summary: The collapse in oil prices is problematic for many Middle Eastern countries, which rely on crude exports for substantial portions of budget revenue. Any recession in these economies could inflame civil unrest, which could be an ongoing source of angst for financial markets. In Russia, the economic outlook is dire and the rouble has fallen steeply, with default now a high risk. |

Key take-out: I think any financial crisis in Russia could spread to the west. But I'm not worried about the prospects of a Greek exit from the Eurozone. |

Key beneficiaries: General investors. Category: Economy. |

One of the big surprises of 2014 is just how seriously geopolitics has weighed. I mentioned at the start of 2014 that, in terms of the macro environment, it would be one of the most benign years for nearly a decade – and it was. I'll get on to the macro and market outlook early in the New Year. This week I wanted to take a look at the current geopolitical backdrop and how that might continue to affect the market in 2015.

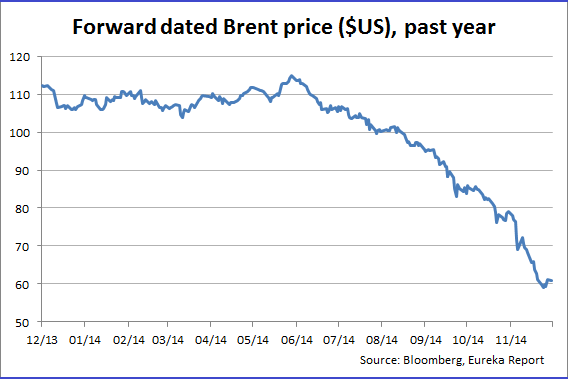

What has taken me – and the rest of the market – by surprise has been the complete collapse of crude oil prices and commodity prices generally. At the time of writing, Brent was at $US59.6 – a fall of 49% from the 2014 peak in late June of about $US115. It should be noted that big moves aren't unusual by any means - we've seen two other large downside moves (circa 30%) over the last three years alone. Then of course we saw a 76% drop in the wake of the GFC. Even in 2006 crude slumped by over 30%.

But I'll be honest: outside of the rally in US dollars, which would only explain maybe 20% of the move, I really don't know what has caused such a sharp drop. Two things I do know as fact though:

1. The slump has nothing to do with a supply glut, because there isn't one; and

2. Nor has demand faltered.

You can see this very clearly in the data, so there is nothing to sort out on that front. Regardless of the drivers, this event will have – already is having – major repercussions throughout the world. Firstly it's a huge economic stimulus to the advanced economies, not to mention a sizeable disinflationary pulse. It's all good news for the developed world.

That is, up to a point. Because for Russia and the Middle East, it's a little more serious and what is problematic for the Middle East and Russia could soon become a problem for the West.

We all know crude is critical to the Middle East. But to give a sense as to just how critical: For Saudi Arabia, crude accounts for 90% of exports, 80% of budget revenue and nearly half its GDP. It's the same elsewhere in the region to varying degrees – Libya, Iran, Iraq, Kuwait etc – crude is vital to them all.

Now while countries like Kuwait and Saud Arabia, with their vast national savings and low public debt, may be able to withstand a period of low oil prices, they couldn't hold out indefinitely and at some point a recession would ensue. This could obviously come more quickly for less robust economies like Libya or Iraq and it's not implausible that some of those economies could face a fairly grim and protracted recession.

This could matter a lot to western economies. At a basic level, it's not going to be a good look if much of the Islamic world is suffering economic hardship while the US - the great Satan - booms. I can't help but think this economic hardship would simply inflame civil unrest and what is already red-hot anti-American sentiment.

Unfortunately it may even get to the point where affected national governments welcome the distraction. Don't forget it was only recently that the Arab Spring saw major civil unrest throughout the region. Large scale protests were commonplace in most countries, while at its worst, four governments were removed from power. Unfortunately the effects of that period are still being felt. The Syrian civil war still rages and of course, it catalysed the birth of ISIS.

Now none of this is to say that the oil slump will exacerbate these problems, but it's certainly not going to help. For investors, the heightened risk of civil uprising in the Middle East or increased tensions with the US and Israel etc could be an ongoing source of angst for financial markets and bears close watching.

For Russia, the situation is equally serious. The Energy Information Administration suggests that energy exports such as oil and gas account for nearly 70% of total Russian exports, about 50% of government revenues and 17% of total GDP. On top of existing sanctions, the economic outlook for Russia is dire.

The rouble has collapsed more than 80% against the US dollar, prompting the Russian central bank to hike rates by 17%. The latest move of 6.5% is the biggest since the Russian crisis of 1998 and rates are up from 5.5% at the beginning of the year.

The talk now is of default and with foreign debts of over $US700bn (one third of GDP or more) this is a high risk. The question is, could financial and economic crisis in Russia, spread to the west? The answer, I think, is yes. If a country as tiny as Greece can have this effect, then Russia most certainly can. Indeed during the Russian debt crisis, the S&P500 fell nearly 20% – although, admittedly, that correction was very short-lived, a couple of months maybe, and stocks ended the year 30% higher. Who knows how it would play out this time. With crisis elsewhere around the world and an already fragile Europe, this time around a debt or currency crisis in Russia could have a greater impact on Western markets than in 1998.

As for Europe itself, I'm not worried by its growth prospects – they are weak but that is the norm – or the prospect of a Grexit or anything. However, it could flare up again as a major problem. At this point Greek stocks are down nearly 40% from a peak in March but there isn't much of a wider contagion.

(Indeed, we are seeing something close to the opposite of contagion in mainstream European markets: the Italian 10 year bond yield is down nearly 2% this year, and is almost 1% lower than the Australian equivalent.)

In Greece, assuming the favoured presidential candidate can't muster enough votes – a final ballot is to be held on December 29, when Greece's left-wing Syriza party is widely tipped to win the primary vote. However, even in that instance, Syriza does not want or plan for Greece to leave the Eurozone and nor can they be forced out. The worst case scenario would be another debt restructure. That's not to say that we wouldn't see wild financial market ructions as a result – indeed, this is a high probability, especially in Europe. I still look back in surprise at what occurred throughout 2010-12, when investment banks attached a 95% probability that Greece would leave the Eurozone and the EU within a year. Two years later they're still there. Investors should keep that in mind as the above issues play out.