Gas demand plummets in NSW and SA, flat in VIC - the death spiral is on

The Australian Energy Market Operator (AEMO) has just released its 2014 National Gas Forecasting Report. This report is being released at a critical time for the energy industry as demand from new LNG plants pushes domestic prices up to international levels.

Meanwhile, rather illogically, gas pipeline networks servicing domestic consumers are being expanded with massive capex budgets which dwarf the NBN in terms of cost per premises past, and past Victorian governments (and, potentially, NSW) paying exorbitant subsidies to extend networks into smaller and smaller country towns at higher costs in spite of very little take up.

The key bit of analysis of its own data that AEMO curiously make little of is the dramatic 8% drop in demand in NSW and 12% in South Australia its estimates between 2013 and 2014. Meanwhile, demand in Victoria will also decline slightly.

So despite a compliant regulator, state government subsidies and marketing that still misleads the public that gas is cheaper than other heating options, customers are reducing demand for the energy.

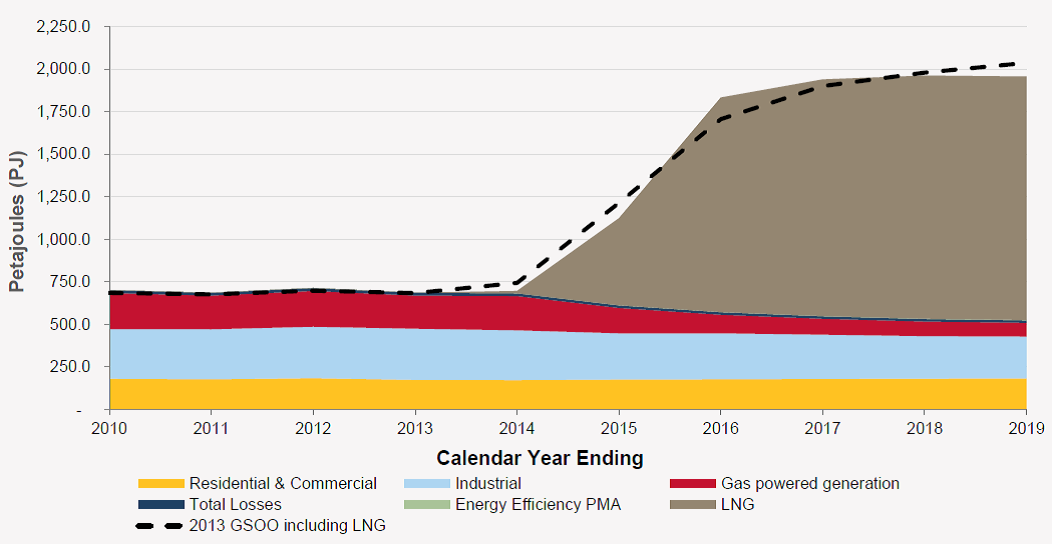

What's interesting is that much of the drop-off in demand to 2014 will have been in industrial usage and power generation with residential and commercial demand the only thing not plummeting like a stone. AEMO expects demand in power generation to really plummet in the coming years and a moderate decline in industrial usage.

Figure: Total NEM-wide annual gas consumption (including LNG exports) over the short term (to 2019)

But the situation is much worse than this.

AEMO is still forecasting that residential and commercial sector usage of gas will continue to grow because, even though they foresee that usage per capita will decline, it will be more than offset by growth in new customer pipeline connections.

What AEMO fails to recognise is that the small initial number of residential gas grid defections happening today are a repeat of the shift to solar energy that began a few years ago.

However the threat to the gas industry is far greater.

Reverse-cycle air conditioning is to gas industry what solar PV systems have been to electricity companies, except you don't need batteries to get off the gas grid. The renewable ambient heat that helps power an air conditioner heat-pump is available 24 hours a day at a cost that is much cheaper than solar and people are already conditioned to buy these units for comfort in summer. Now they are coming to the realisation about how cheap they are for heating in winter.

Once, the historical legacy memory of gas being a cheaper fuel is broken, and given air conditioners are installed in new premises almost as a default, why on earth are customers going to be willing to sign-up for several hundred dollars per annum in fixed costs to be connected to the gas network?

With declining per capita usage, and people refusing to connect to new pipelines built past their homes, the death spiral will inevitably set in. Gas companies will raise prices to recover their fixed costs, which will only further discourage customers being connected to the network.

AEMO is deluding itself if it thinks that gas is on solid ground with ongoing growth in residential and commercial due to increasing connections in the future. Unfortunately they're deluding policymakers and regulators also.

Matthew Wright is executive director of Zero Emissions Australia, technical director at Efficiency Matrix and resident columnist at Climate Spectator.