Fund managers find love in Rome and Madrid

The once-shunned markets of Italy and Spain are back in favour with investment managers, a timely reminder of opportunities beyond our market.

An overwhelming $US39 billion has made its way into equities over the past two weeks as investors globally have dismissed reservations over the US fiscal position.

There is plenty more to be tipped back into equities, with an estimated $94 billion still held across the money market, which was bolstered from May of this year as investors fled equities in the wake of taper talk, Syria and most recently, US government default fears.

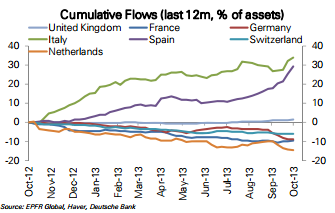

The decision not to taper has not only lifted US flows. Global flows have picked up in pace as investors have felt more comfortable about returns in markets outside of the US. In Europe, Italy (green line) and Spain (purple line) have been the favoured countries, with the most significant cumulative in-flows over the past twelve months.

Brian Singer, head of William Blair’s dynamic asset allocation strategies team, is fond of both Italy and Spain at the moment. Yes, these are two countries that make up half of the PIGS that caused so much discomfort for markets globally only two years ago. Today they are more than in favour with investors.

The flow of funds suggests Singer isn’t alone in seeking out Italy and Spain as investment destinations.

Taking a pure macro view of the economy, Singer and his team buy macroeconomic themes and sectors as opposed to individual stocks. Included in the macro view Singer takes is the political environment. Across Europe the market has priced in high political and policy uncertainty already, keeping prices lower on a valuation basis.

It is important to note much of the policy risk once saturating Europe has subsided in the wake of clearer guidance from Mario Draghi at the European Central Bank and individual countries.

All too often investors have a home-country bias when it comes to investing. There is an element of familiarity – often investors gravitate to the names and businesses they know. At the same time, investors are shutting themselves out of markets with entirely different characteristics and opportunities.

Where does the Australian market fit in? While domestically investors might be enthused by the Big Four banks and miners in light of recent stability in commodity prices, dollars have consistently abandoned the Australian market over the past year.

Singapore is the only other developed market to experience fund flows greater than Australia.

The flow of funds doesn’t explain why investment managers favour a certain direction but it does gives investors an idea of where they could look beyond their own market.

Share this article and show your support