From Napster to Spotify: The next step in streaming culture

From CD burners to Napster and beyond, the digital era has done a number on the music industry’s traditional revenue streams. The promise of commercialised digital downloads, with Apple’s ubiquitous iTunes at the forefront, has largely failed to offset record companies’ shrinking sales.

But digital music is on the cusp of a new era, and something spectacular is happening.

The anytime, anywhere appeal of streaming music in real time through subscription and advertising-based services is growing at an exponential rate. And in mature markets such as Britain, Norway and Sweden -- home of Spotify -- streaming culture is driving fan engagement and seeing overall music sales rise again.

Bumpy transition

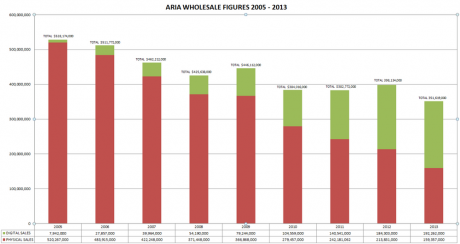

In Australia, recorded music industry revenue is at its lowest point in 24 years. That’s right -- the worst result for nearly a quarter of a century, despite Australians’ rising incomes and population. Australian Record Industry Association figures released last week show wholesale revenue in the sector contracted 11.6 per cent in 2013 to $351.62 million, a disappointing slip after the four per cent lift seen in 2011.

Yet revenue from streaming doubled to 5.9 per cent of total recorded music revenue in 2013. And while it’s growing fast, the streaming sector is still very much in its infancy. In the mature Swedish market, a staggering 70 per cent of all music purchases are made via streaming platforms.

ARIA chief executive Dan Rosen is confident that as streaming matures in Australia, overall recorded music sales will “absolutely” strengthen too -- but not without a few bumps along the way.

Rosen says overseas markets have taken similar non-linear paths as Australia is seeing now, but over time the trend is positive.

“We’re expecting it to be a little bumpy,” says Rosen. “[Australia is] in transition in the digital market between the download market and subscriptions, and even overseas we’ve seen it’s not necessarily a straight line.”

Streaming creates “better music fans”

For Colin Blake, who heads up the Australian arm of Skype’s music streaming brainchild, Rdio, this distinction between digital downloads and streaming is key. Streaming platforms, he says, “create better music fans” by fostering a culture of sharing and promoting content among users -- hence boosting the industry more broadly.

“People might just download one song, but when you’re streaming you’re more engaged with an artist and their back catalogue,” Blake adds.

But while these figures look promising for record company execs, the disruptive technology is causing headaches elsewhere. High-profile musicians like Radiohead’s Thom Yorke have been quick to vocalise the raw deal content makers are given, and certainly the maths do little to counteract the ‘starving artist’ cliché (The music industry may be streaming towards a cliff, October 9 2013).

Efforts to maximise performer profits in Australia have so far resulted in turmoil as hundreds of commercial radio stations opted to cease streaming altogether rather than pay additional licensing fees introduced earlier this year.

Australian Songwriters Association chairman Denny Burgess says it’s impossible to tell how the “dogs breakfast” of an industry will sort itself out, but that paying artists “a pittance” isn’t sustainable.

“It can’t go on like this but it’s going to be a long, slow and involved process,” he says.

While Burgess says that overall it’s much harder for artists to earn their keep via the streaming model, he does concede that the trade-off provides a far greater potential for international exposure -- and the obvious benefits that could bring to an artist’s career.

“It’s a vexing question,” says Burgess. “I think as time proceeds we will get more of a handle on it and be able to have a bit more control over things, but at the moment it’s anyone’s guess where it’s headed.”

Survival of the fittest?

Music streaming providers themselves are likely to face a tough test as the Australian market matures. Despite the relatively small size of the industry, there are 16 streaming platforms available to Australian consumers.

These include big international players like Spotify, iTunes radio, YouTube, Pandora, Google, Rara, Rdio, Vevo, Grooveshark, Samsung, Sony and Nokia, as well as smaller local services such as JB Hi-Fi and Guvera.

While ARIA’s Rosen believes the vast number of players is a sign of how innovative the Australian market is, some consolidation in the sector is inevitable, and the exit of French-based service Deezer last month may herald the beginning of such a shake-up.

Rdio’s Blake predicts around half the current music streaming service providers in Australia will eventually disappear. And he says the ones that survive will be those with enough resources to keep developing their technological capabilities and keep their platform relevant in the ever-changing digital media landscape.

That’s a lot harder for smaller, local players, and as they fight to carve a niche, their ability to forge partnerships with other industries to maximise marketing and distribution capabilities will also prove vital. To this end, successful players both at home and abroad are teaming up with telcos and internet service providers to offer bundling deals to customers.

But the flexibility of streaming technology lends it to broader opportunities. Rdio, for example, teamed up with Australian music festival Big Day Out to offer exclusive live streaming content, and also has a deal with music identifying app Shazam.

Device manufacturers are also emerging as a fresh battleground, with homegrown platform Guvera this week announcing a deal under which it will come pre-installed onto all Lenovo tablets and smartphones. In the smart car space, British-based platform rara is now readily built into most new BMW cars, while Pandora has various arrangements with auto makers in the US.

And while the domestic music streaming market is crowded, there are opportunities for service providers offshore. Guvera has a relatively small profile in Australia but that hasn’t stopped it launching into the massive Indonesian market, inking a distribution deal with global cloud provider Omnifone and Indonesian IT company Skybee.

The potential for other local players to tap emerging Asian markets is enormous.