French will fight for Alstom's 'strategic turbines'

Against the backdrop of General Electric's $US17 billion bid for Alstom, and Siemens' plan to make a counter-offer, the French government gave itself the power last week to block foreign takeovers in industries it considers strategic.

A decree signed on May 14 by economy and industry minister Arnaud Montebourg broadened a 2005 law to make government approval mandatory for foreign investment in areas such as energy, equipment, plants and transportation critical for national security.

The new French decree puts pressure on GE to improve its offer, which Montebourg characterised as an "absorption" of Alstom rather than an alliance like the one that he said Siemens is proposing. "There are talks with Siemens that are very constructive, which is not the case with GE. We want alliances that give our companies a global scale. We don’t want dismantling," he said.

Bloomberg New Energy Finance published its 'First look at sides of the GE-Alstom-Siemens triangle' at the beginning of the month. This Analyst Reaction looks at the main bones of the two proposals and the implications for the grid, storage, nuclear, fossil-fuel, wind, hydro-electric and transport businesses.

Staying with France, earlier this month the government announced the GDF Suez led consortium as the sole winner of its second offshore wind tender: it bagged the 500MW Le Tréport and the 500MW Iles d’Yeu et de Noirmoutier sites, where it will deploy 125 Areva 8MW turbines. In the first tender, developers for four projects with total capacity of 1.9GW were selected in 2012.

This raises Areva's total European offshore wind pipeline to 3.3GW and cements its second position after Siemens' 6.3GW, according to Bloomberg New Energy Finance. The latter figure includes the order that Siemens signed last week for the 600MW Gemini wind offshore wind park in Netherlands. The €1.5 billion contract also includes services. Alstom, at 1.4GW, is in third position in the market.

The French government is targeting 6GW of marine renewable energy by 2020 comprising tidal and offshore wind. Bloomberg New Energy Finance expects only around 2GW of offshore wind capacity to come online by 2020, according to our latest analysis captured in the note: "One set all" after second French offshore tender.

The other main news in Europe was from the UK, where the Department of Energy and Climate Change proposed that solar projects bigger than 5MW would not receive renewable obligation certificates from next April instead of the previously planned 2017 cutoff. Also, under the new system of contracts-for-difference, solar and onshore wind plants will have to compete with other technologies from October.

The UK government's ReStats database shows 1.4GW of PV applications pending, with 92 per cent of the capacity coming from applications greater than 5MW. Bloomberg New Energy Finance therefore expects another boom this year in the UK, with 800-1100MW utility-scale projects coming online before the changes are implemented.

In Asia, China announced very aggressive targets for renewables for 2017: it aims to more-than-triple solar capacity to 70GW, have 150GW of wind power, 330GW of hydro power and 11GW of biomass power. The world's largest investor in clean energy also aims to operate 40GW of nuclear plants by 2015 and 50GW by 2017.

In India, Blackstone-backed Hindustan Powerprojects said it plans an initial public offer of shares in its solar unit. Goldman Sachs, UBS and Credit Suisse have been appointed managers to the offering.

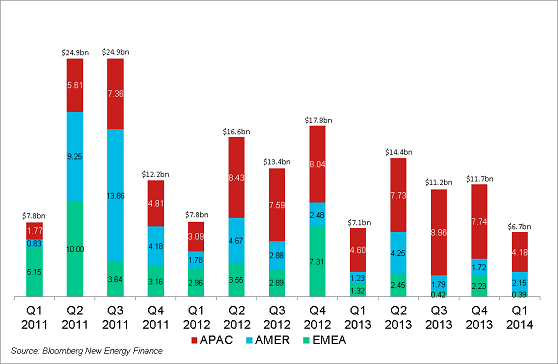

Global asset finance for large-scale solar projects hit another historical low in Q1 2014 at $US6.7 billion

Originally published by Bloomberg New Energy Finance. Reproduced with permission.