Franking threat could reset portfolios

Summary: Treasury has questioned the ALP's franking calculations, while Macquarie has done the yield numbers.

Key take-out: Impacted investors may switch into unfranked stocks offering high yields.

The Australian Labor Party's plan to abolish cash refunds on excess dividend imputation credits, announced in March, has created great consternation among investors.

And a new research report by Macquarie Wealth Management points to a likely major shift in Australian equity asset allocations by retirees and others should the ALP's contentious policy be passed at some stage in the future.

Despite the ALP's recent backflip on who its franking credits crackdown would apply to, screening out those on the Age Pension under a “Pensioner Guarantee”, the investment group notes that those in the firing line, including self-managed superannuation fund trustees in retirement receiving dividend tax credits, will likely shift capital into higher-yielding stocks paying unfranked dividends.

A Treasury review of the proposal, conducted over the last two months, has found that the expected $10.7 billion in additional tax revenue the ALP had calculated it would receive from the policy over the first two years would not eventuate as a result of retirees moving into other assets, including foreign stocks.

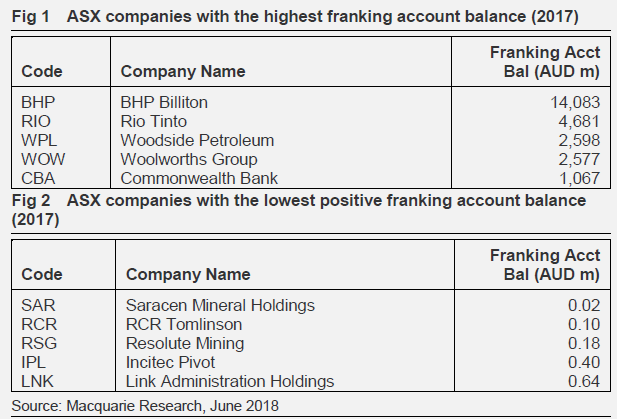

In an update based on franking credits data to the end of December last year, Macquarie says that another outcome of the ALP's plan could be an acceleration of capital management initiatives by companies with large franking account balances, including special dividend pay-outs. But Macquarie added that given the relatively small proportion of investors overall that would be impacted, it was unlikely companies would be incentivised to alter their dividend policies.

Australia's second-largest company, BHP, holds more than $14 billion in franking credits, followed by Rio Tinto ($4.7 billion), Woodside ($2.6 billion), Woolworths ($2.6 billion), and Commonwealth Bank ($1.1 billion). Westpac also holds around $1.1 billion in franking credits, followed by Caltex with $868 million.

The response, therefore, is more likely to be on the investor side, potentially with a rotation out of stocks paying 100 per cent franked dividends (where there would no longer be cash refunds available) into high-quality companies paying attractive yields.

Macquarie's research suggests there could be a rotation into companies currently paying unfranked yields of between 4 per cent and 7 per cent, from those currently paying higher grossed-up fully franked dividends. On an unfranked basis, the yields from these companies are compatible with those of companies paying unfranked returns.

.png)