Four hot spots on the investing radar

Robert Gottliebsen

Four hot spots on the investing radar

There is a mild chaos out there is superannuation land, but I urge Eureka Report readers not to panic. It will get sorted out.

After last week's commentary on superannuation fund structures for those in pension mode, a number of readers came back to me to check on their alternative strategies in relation to the $1.6 million tax-free segments in their fund.

Each person with superannuation in pension mode has the ability to select $1.6 million in assets and put them into a ‘tax-free fund'. On July 1 this year the assets are transferred at market value. From then on those assets are frozen and, although all capital gains are tax-free, if the value of a share or any other asset transferred value falls then there is no relief.

The superannuation holder will simply have fewer funds in the tax-free zone, but conversely if the asset value rises there will be a lot more in the tax-free zone. And so, you have a choice. Those who don't have self-managed funds and have their funds invested in most pooled funds will need to choose between various asset classes and also need to be careful if their superannuation is spread over various funds. (Some pooled funds may offer the ability to allocate specific shares to the pooled fund). Obviously, there is great danger of a mistake.

As you know, I am fortunate to have more than $1.6 million in a fund and I plan to use the second option and have an actuary allocate a portion of the income of the fund to $1.6 million of asset classification. And so, theoretically, if I had a fund of $3.2 million – half the income would be tax-free and half would be taxed at 15 per cent. The pension remains as it is now as a tax-free payment in my hands. That means I miss out on the tax-free delights of big asset gains, but I also miss out on the impact of losses in the $1.6 million fund.

One more point. Let's say in my $1.6 million fund I have BHP shares. If I sell them I can leave the money in cash or I can buy other shares or assets, but I can't inject any more money But we are in pension mode, so my sealed fund that started at $1.6 million must fund a minimum pension based on my age and the market value of assets. No change there.

Protecting BHP's oil assets pipeline

During the week you will have noticed that the Elliott Management Group wants to transfer BHP-Billiton's prime listing to London and to float off the US oil assets. Elliott is headed by the US billionaire Paul Singer, and will almost certainly launch personal attacks on BHP directors and management — that's the way they operate.

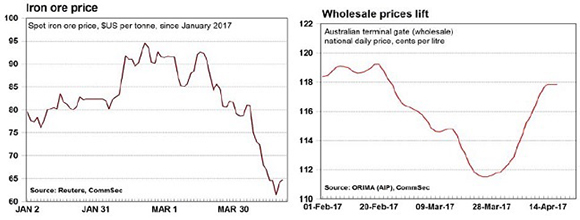

This week I simply want to focus on the Elliott idea that BHP should spin off its US oil assets. BHP recently sent a blog to its small shareholders explaining why it is enthusiastic about the long-term prospects of oil. (It is a lot less bullish about iron ore, and the recent fall has justified its view). BHP says that looking ahead to the 2020s “we see compelling fundamentals” in oil.

Global demand for liquids is expected to rise over 1 per cent per year over the next decade, fanned by rising global population, increased living standards and, in the developing world, greater car ownership. That will be offset by electrification of passenger vehicles and other developments in the developed world, but the BHP bottom-line is that demand growth and the natural decline of the existing oil fields means that the world will need 30 million new barrels a day of oil by 2025 which is equal to roughly one third of current total global supply.

BHP's view is that the world will struggle to find that oil at cheap prices, and so the price of oil will need to rise to justify the developments necessary to meet that sort of demand. And it believes that in the US, including the Gulf of Mexico, it is in an excellent position to make a lot of long-term money out of its current investment.

Accordingly, BHP says that it will be crazy to sell the oil at this point. But, of course, BHP is thinking longer term, whereas the institutions including Elliott Management want to make a ‘quick quid' and get out.

Borrowing trends and the Amazon effect

Over the Easter weekend I was yarning to a banker who explained to me he has never seen his bank's business lending portfolio performing with so few problem loans. The business community is optimistic, but is really concerned about the sluggishness in the retail sector and the brittleness of consumer confidence.

As a result, most are not investing substantial sums but instead are repaying loans. This is actually not good for banks, because they make a lot of money by lifting their business loan portfolio. It's also an alert to the nation, because the retail trend may get a lot worse given that we are facing a doubling of power prices and a substantial rises in gas prices over the next 12 to 18 months, plus the likelihood of Sydney/Melbourne blackouts next summer.

This is going to put up Australian costs and will further dint consumer confidence. In the US the digital revolution led by Amazon is much further advanced than in Australia. But Amazon is coming to Australia. We are seeing a rash of US well known retail brands get into severe problems. Atlantic Monthly says that from rural strip malls to Manhattan's avenues, it has been a disastrous two years for US retail.

There have been nine retail bankruptcies so far in 2017, which equals the total in 2016. In addition J.C. Penney, RadioShack, Macy's, and Sears have each announced more than 100 store closures. Shares in several apparel companies' stocks last month hit new multi-year lows, including Lululemon, Urban Outfitters, and American Eagle.

Ralph Lauren announced that it is closing its flagship Polo store on Fifth Avenue, one of several brands to abandon that iconic thoroughfare. All this is happening in a US economy that has been growing for eight straight years, petrol prices are low, unemployment is under 5 per cent, and in the last 18 months wages have grown.

While overall retail spending continues to grow steadily, albeit slow, the rise of e-commerce, the oversupply of malls, and the surprising effects of a restaurant renaissance have conspired to change the face of American shopping.

Clearly the Australian situation is different to the US but similar forces will affect us, so the retail world is on edge assuming difficult times.

North Korea and the share market

I have no clear vision as to how the North Korean military stand-off will end but just at the moment the US share market is not anticipating war, because investors believe that the US will not attack. The risks are simply too great.

Paradoxically, North Korean leader Kim Jong-un has the same view. I hope the market is right, but I am not sure it is.

A war in Korea will slash share prices and the refugees into China will be a major setback for our largest customer.

Please note, AMP Capital head of investment strategy and chief economist Shane Oliver is on leave this week, so our usual This Week column will not run. In his place, we have some insightful economic charts from CommSec.

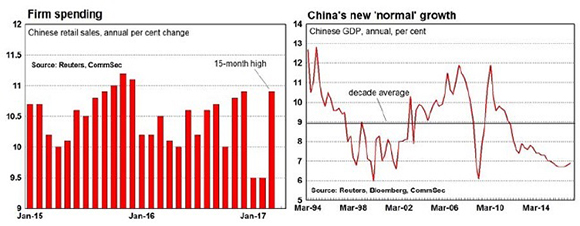

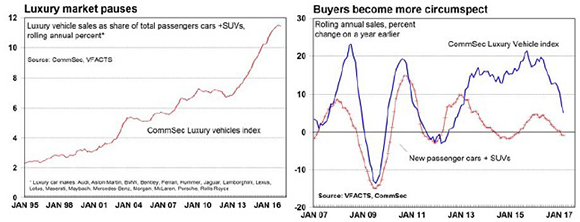

Economic Six Pack from CommSec

Next Week

Craig James, CommSec

Inflation week

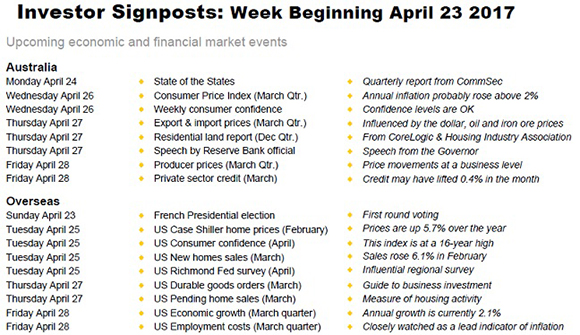

- Inflation dominates the coming week's schedule of economic statistics. Meanwhile in the US, there is a raft of data releases including home prices and economic growth.

- The week begins in Australia on Monday with the release of the quarterly State of the States report from CommSec. The report analyses the relative economic performance of state and territory economies.

- On Wednesday in Australia, the Australian Bureau of Statistics releases the quarterly Consumer Price Index – the main measure of inflation used in Australia. In fact the CPI is regarded globally as one of the best measures of price movements or inflation.

- And for the first time in 2½ years the annual headline rate of inflation is expected to be back in the Reserve Bank's 2-3 per cent target zone. We expect that prices rose by around 0.6 per cent in the March quarter, lifting the annual rate of inflation from 1.5 per cent to 2.3 per cent.

- One of the biggest drivers of the result is likely to be petrol, up around 6 per cent and adding almost 0.2 percentage points to the quarterly lift in the CPI. Seasonal increases in education fees and pharmaceuticals are offset by seasonal declines in holiday travel & accommodation, alcohol & tobacco and clothing.

- Stripping out the volatile elements, the “underlying” CPI is expected to lift by around 0.5 per cent in the quarter and 1.8 per cent over the year – getting closer to the 2-3 per cent band. The results for the CPI probably won't have any direct impact on interest rates. But higher-than-expected readings could cause some analysts to bring forward expectations of rate hikes from 2018.

- The weekly consumer sentiment reading is expected to be released on the same day (on Tuesday). Confidence at the moment is merely OK.

- On Thursday, the ABS will release the international trade price data (data on export and import prices). Export prices are tipped to have lifted 3 per cent in the quarter and import prices may have lifted 0.5 per cent. Gold, base metals, wool and wheat prices rose in the quarter while the Aussie dollar rose by 5.6 per cent.

- Also on Thursday the Reserve Bank Governor delivers a speech at the Renminbi Global Cities Dialogue Dinner. Governor Lowe will have the first chance to comment on the inflation data.

- On Friday the ABS releases the Producer Price Indexes for the March quarter while the Reserve Bank releases data on private sector credit or loans outstanding. Credit may have lifted 0.4 per cent in March.

Overseas: US economic growth and housing data

- US economic data dominates in the week ahead. The next Chinese data is released on April 30 (Sunday). The first round of the French Presidential elections is held on Sunday (April 23).

- On Monday the week kicks off in the US, with the national activity index and Dallas Federal Reserve manufacturing index.

- On Tuesday, both the FHFA and Case Shiller measures of home prices are issued in the US. Annual growth of home prices stands at 5.7 per cent. The April consumer confidence data is also released with new home sales, the Richmond, Texas and Dallas Federal Reserve survey indicators and weekly data on chain store sales.

- On Wednesday, the usual US weekly data on home purchase and refinancing is issued with revised figures on building permits.

- On Thursday in the US the usual weekly data on claims for unemployment insurance is released together with durable goods orders (measure of business investment), pending home sales, advance data on international trade and inventories and the Kansas City Federal Reserve survey.

- On Friday, investors will get the first look at economic growth data for the March quarter. There are three estimates of GDP – advance, preliminary and final estimates. On the same day the quarterly employment cost index is issued – a key gauge of wages (or compensation). When wages start lifting at a faster rate, interest rates won't be far behind. The next Federal Reserve meeting is May 2-3.

- Also on Friday is the Chicago purchasing managers index and the consumer sentiment measure from the University of Michigan.

Financial markets

- The US profit reporting (earnings) season is in full swing in the coming week.

- Amongst stocks reporting on Monday are Halliburton, Kimberly-Clark, Alcoa, Barrick Gold and Newmont Mining.

- On Tuesday, reporting firms include 3M, Baker Hughes, Caterpillar, Coca Cola, DuPont, Eli Lilly, Lockheed Martin, McDonald's, Office Depot, AT&T and US Steel.

- On Wednesday, profit results include those from Fiat Chrysler, PepsiCo, Twitter, T-Mobile and Procter & Gamble.

- On Thursday, earnings will come from American Airlines, Domino's Pizza, Ford Motor, UPS, Under Amour, Amazon, Microsoft, Intel and ResMed.

- And on Friday, financial updates will come from Chevron, Colgate Palmolive, Exxon Mobil and General Motors.

Craig James is chief economist at CommSec.

Readings & Viewings

It seems not even the rising threat of nuclear war is enough to upset the US stock market. It finished up higher once again on Friday morning, thanks to a spate of higher US earnings results. What can we small investors make out of all this? Well, the share market largely thinks from day to day. And, if war does erupt, head for the shelters – gold bullion and gold stocks.

Markets might be building, but physics could be unravelling.

Australian resources investors should be keeping a close eye on iron ore prices, and the potential of lower demand from China. Now US President Donald Trump has weighed in, launching a national security investigation into Chinese steel dumping. So watch the iron ore space.

And it's not only the steel industry that's hurting in the US. So is Barbie.

Are we all destined to become bloodsuckers? This sounds like something out of Twilight.

In a same but different vein, Google parent company Alphabet doesn't want your blood; but your spit, tears and stools for a massive medical study.

Non-GMO ketchup looks a little like blood, and Unilever wants it. The household products giant is banking on condiments to reenergise its business.

Bad PR went to new heights this month when a United Airlines passenger was dragged off a plane, bleeding and screaming. This week CEO Oscar Munoz said the airline was reviewing its policies, and vowed the airline will learn and grow.

But this bride and groom aren't that convinced, after being booted off another United flight this week.

Meanwhile, staying on airlines, Emirates has cut its US flights schedule as a result of recent changes by the Trump administration.

This one is nothing to do with planes, but it does concern autopilots. Tesla is being sued in the US over allegedly “dangerous and non-functioning” software in its electric cars.

Then there's flying cars, from a Slovakian start-up.

If you're a tech investor, something isn't computing at IBM.

Does a leaked report point to the next wave of product development for Apple?

Changing pace, the corks are popping over at Morgan Stanley. A Bloomberg report says the firm has trounced Goldman on bond trading for first time since 2011.

Then there's the other end of the spectrum, with the troubles at Wells Fargo still fresh in the minds of US regulators. They missed the red flags, it seems.

But that's not bothering Wells Fargo's biggest investor, Warren Buffett, who remains a big fan.

It's definitely not all gloom in the banking sector. Brexit or not, now could be a good time to look for a job in the UK.

How rich is rich in the UK, anyway? The answer may surprise you.

Do you have a Playstation 4? Please watch out.

This is even more weird. Like the journalist said, it makes zero sense – for now.

But could the VR piñata herald an AR dystopia? Just a thought.

Lastly, a flustered barista this week got Starbucks into a frappuccino flap. What are the chances they misspelt names on those cups?