Flight Centre's blue sky trajectory

| Summary: After a severe price plunge during the GFC, the travel agency group Flight Centre has not only recovered all its lost ground, but reached new heights. The company continues to build market share, in Australia and overseas, with little standing in the way of further growth. |

| Key take-out: The market is largely anticipating an earnings upgrade will be forthcoming at some stage during the year. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Outperform (under review). |

Flight Centre (FLT) is one of Australia’s best corporate success stories.

The business was started in 1980 and listed on the ASX in 1995 at 95c per share. It has operations in 11 countries, with approximately 2,500 stores combined with a strong online presence.

FLT has managed to navigate through intense competition, structural industry changes and the cyclicality of consumer travel associated with economic conditions and global political tensions, to become Australia’s leading travel agent while successfully expanding globally.

FLT has a solid track record of profit delivery. Since 2006, earnings per share has grown from 85c to 238c, an increase of 280%. The only major blemish was during the global financial crisis, when profits fell significantly in 2009 assisted by write-downs and operational losses on a US acquisition.

Profits quickly rebounded over the subsequent years, and earnings are now forecast to be approximately 265c in 2014. If history is a guide, there is every chance that FLT management have been conservative in their 2014 guidance to the market. During the past two years FLT has delivered final profit figures in excess of initial guidance, which has seen the stock in “upgrade” mode with sell-side analysts repeatedly upgrading earnings.

These earnings upgrades have been one of the main reasons for the strong stock price move over the past 18 months, during which time the price to earnings ratio has expanded from 12 times to 18 times earnings today. 18 times earnings may seem high for a cyclical stock like FLT, however for a company forecast by sell-side analysts to grow earnings over the next three years at around 10% per annum it seems a reasonable valuation. FLT has traded in the past (pre-GFC) on price to earnings multiples higher than this, in the mid-20s, when earnings have been growing strongly.

What I liked about the most recent 2013 result:

- Delivered a profit before tax of $349.2, a 20% increase on the previous year, which compared to initial guidance at the start of FY13 of $305 to $315 million.

- Revenue increased 8.7% to approximately $1.98 billion (total transaction value increased 7.7% to a record $14.3 billion).

- Ended the year with a strong balance sheet, with a net cash position of $388 million and a $200 million franking credit balance.

- Significant margin expansion – EBIT margins expanded by approximately 200 basis points.

- Strong growth in both the domestic business and international subsidiaries – Australian EBIT grew by 21%, UK EBIT grew by 30% , and US EBIT by 11%. FLT’s international earnings now represent 22% of total earnings.

- Online transaction growth of 20% during the year, cementing FLT’s dual channel offering of bricks and mortar and online.

- Management guided to 8-12% profit before tax growth in 2013-14.

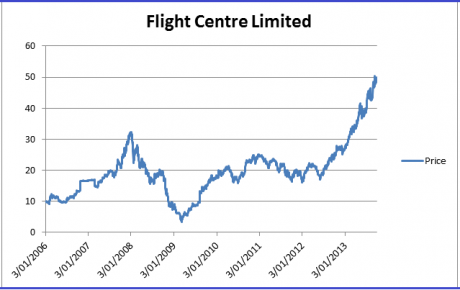

From a technical perspective I can see that FLT’s share price is in “blue sky” territory, making new all-time highs in a strong uptrend that began in mid-2012. After reaching $32.48 in 2007, FLT fell to a low of $3.39 during the GFC. The FLT share price subsequently moved higher to trade in a consolidation range of between $16 and $25 during mid-2010 to mid-2012. Towards the end of 2012 a break-out of this consolidation occurred, and in February 2013 FLT overcame the 2007 high of $32.48 to reach blue sky – a strong technical signal.

The two-year consolidation between 2010 and 2012 and more broader consolidation since 2008 has set a solid foundation for the strong uptrend being currently witnessed in FLT. Until I see a breakdown of the price from the current uptrend there is every expectation that the stock will continue to move higher.

I would also expect that in order for the share price to move higher FLT’s earnings will have to continue to grow at a reasonable pace, at least double-digit growth. There may be some further valuation (price to earnings ratio) expansion in the stock if management upgrades their initial FY14 profit guidance, even though the market is largely anticipating an upgrade will be forthcoming at some stage during the year. It will most likely be the degree of any future upgrade that will determine the fate of the trend in stock price.

Simon Bonouvrie is Investment Manager of Cadence Asset Management.