Fixed Income ETFs: Can bonds beat cash?

The Reserve Bank’s attempt to encourage the economy along by dropping the cash rate to 1.75% is more bad news for savers who rely on already lousy returns from bank deposits.

Inflation has sunk to 1.3% and a term deposit paying around 3% is really only returning 1.7% a year.

Trustees of self-managed super funds have about 28% of their wealth in bank deposits, so what looks like a minor adjustment to interest rates may actually translate to a significant adjustment to income for many of them. No-one should hold out much hope that rates are going to spring back upwards any time soon.

Cash is the most defensive asset class of all, but those who are prepared to live with a little more risk may find fixed income investments deserve a place in their portfolios. A simple way to do that is with an exchange-traded fund that tracks a bond index, such as the Bloomberg AusBond Composite index. The AusBond index is made up of more than 500 bonds, about 90% of which are issued by the Australian federal or state governments.

(The InvestSMART model portfolios hold fixed income using an iShares ETF and an active fund run by Macquarie, which can invest in riskier offshore markets. Vanguard and Russell Investments also run Australian fixed income ETFs.)

CHOOSE YOUR YIELD

A bond index never stays still. At one end you have new bonds being issued and at the other end you have existing bonds reaching maturity and being paid out. The new bonds will be issued at current market yields, being a level of income that satisfies the market, but all the others will pay income determined in the past. The price of those bonds will have risen or fallen as interest rates fell or went up. The income from some bonds is pegged to the cash rate, so their prices don’t move around as much.

It all gets very complicated, and investors at home can never hope to trade bonds like the professionals.

THE LONG RUN

Investors weighing the benefits of bonds against cash are interested in “yield to maturity”, which is the total return, income and price change included, from holding a bond until the day it is paid out. The yield to maturity for the iShares and Vanguard bond ETFs mentioned is around 2.5%.

But hang on — a term deposit will pay about 3%, so why bother with anything that pays less? Because when interest rates go down, the price of fixed-rate bonds goes up.

THE BOND SEESAW

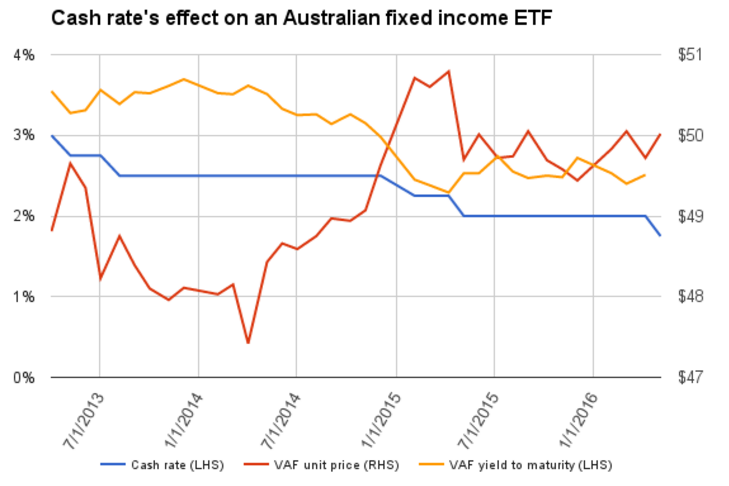

The chart below shows how the price of the Vanguard ETF has performed over the past three years as the cash rate has fallen from 3% to 1.75%. Data for yield to maturity for May wasn’t available at time of writing, so the yellow line pulls up short.

As rates drop, the price of a bond with a fixed rate coupon will be bid upwards as the income it pays becomes more attractive relative to other alternatives. Yield to maturity and price are at opposite ends of a seesaw, however, so as the unit price of a bond ETF rises its yield to maturity falls.

NO GUARANTEES

It’s impossible to say this is a good time to flip from cash to bonds. If the Reserve Bank keeps cutting rates to spur the economy then a decision to hold bonds today will have been a good one. If inflation picks up and the cash rate is adjusted upwards, however, the prices of fixed rate bonds will fall.

For those who don’t already hold bonds or don’t “get” them, the case for fixed income is more about adding another layer of diversification. Over the long term bonds are said to have a negative correlation to shares, meaning they perform well when shares do badly and vice versa. The relationship doesn’t always hold, however. There are times when shares and bonds are struck down in unison.

With central banks around the world holding interest rates at frigidly low levels intuition would tell investors now is not a good time to buy bonds, or to rely on an active manager to seek outperformance in more exotic parts of the bond universe. The Australian market is a little different, as interest rates here are still relatively high. In fact, about 63% of our government’s debt is held by foreign investors.

With returns on bank deposits this low it’s time to at least consider bonds — to look under the bonnet.

The InvestSMART Balanced model portfolio is 15.5% invested in the AusBond index, using the iShares Core Composite Bond ETF, and 10% invested in a Macquarie bond fund with a mandate to hold offshore debt.

Australia’s SMSFs are about 1.1% invested in bonds.

Maybe they’re missing out on something?

Frequently Asked Questions about this Article…

Fixed income ETFs are gaining attention because they offer a way to diversify portfolios with bonds, especially as cash rates remain low. With interest rates dropping, the price of fixed-rate bonds increases, making them a potentially attractive investment compared to traditional bank deposits.

While term deposits might offer around 3% returns, bond ETFs like those from iShares and Vanguard have a yield to maturity of about 2.5%. However, bond prices can rise when interest rates fall, potentially offering capital gains that term deposits do not.

Yield to maturity is the total return expected from a bond if held until it matures, including both income and price changes. It's crucial for investors as it provides a comprehensive view of potential returns from bond investments.

Investing in fixed income ETFs carries risks such as interest rate fluctuations. If rates rise, the prices of fixed-rate bonds may fall. Additionally, bonds may not always perform inversely to shares, which can affect diversification benefits.

Bond prices and interest rates have an inverse relationship. When interest rates fall, the price of existing bonds with fixed rates tends to rise, as their income becomes more attractive compared to new bonds issued at lower rates.

Self-managed super funds might consider bonds to diversify their portfolios and potentially enhance returns, especially in a low-interest-rate environment where traditional bank deposits offer limited income.

Central banks influence bond attractiveness by setting interest rates. Low rates can make bonds more appealing as their prices rise, but if rates increase, bond prices may fall, impacting returns.

Yes, Australian bonds can be different due to relatively higher interest rates compared to other countries. This can make them more attractive to foreign investors, with about 63% of Australia's government debt held by overseas investors.