Finding the path to value in stocks

Investors are understandably apprehensive about equity valuations. On a total return basis, the MSCI World Index has nearly doubled and the S&P 500 Index has more than doubled since the financial crisis. The equity rally, from March 9 2009 through August 29 2014, has been the fourth-biggest since the Great Depression.

Many ask: 'Can value still be found in equity markets?'

The short answer is yes.

In our view, the big returns from beta may be over, but today’s higher valuations may be sustainable nonetheless. Going forward, earnings growth and stock selection -- more than multiple expansion and beta -- will likely play a bigger role in driving positive returns.

In this environment we believe investors should consider an unconstrained equity strategy that is grounded in fundamental research and seeks to deliver excess returns while limiting downside risk and volatility.

Indeed, our research has uncovered numerous examples of stocks trading below our estimate of intrinsic value. Many of these companies are in Europe, where European Central Bank accommodation and market valuations have lagged those in the US and Japan; in emerging markets, which were hit hard by the onset of tapering; or in special situations, such as mergers and acquisitions, that require expertise to evaluate.

Our generally sanguine view on valuations stems from our 'new neutral' outlook for the next three to five years. Despite stable (albeit subdued) economic growth, we believe central banks will keep policy rates close to zero in real terms, far below historical norms. In our view, the combination of record-high leverage relative to GDP, comparatively elevated output gaps and aging populations in developed countries will constrain the ability of central bankers to normalize monetary policy.

On balance, this environment should be supportive of stocks, provided inflation stays low and earnings are delivered. Among other potential benefits, low interest rates allow healthy companies to take advantage of inexpensive financing. We also expect periods of short-term volatility because the capacity of economies to absorb shocks may be diminished amid slow growth or unanticipated geopolitical events; shocks can create 'air pockets' in equity prices that provide buying opportunities for investors with a long-term horizon.

Although we believe the beta wave has crested, PIMCO’s fundamental and company-specific approach, augmented by our macroeconomic insights and global credit analysis, has the potential to uncover opportunities even amid today’s valuations.

Here are some of the areas we’ve identified:

Constructive ECB policy action and appealing European valuations

The US and Japan have benefited from highly accommodative central banks, giving support to stock markets in both regions. In Europe, however, the ECB until this year had been very quiescent, and European stock markets trailed their US and Japanese counterparts markedly.

Valuations of many European companies have been cheaper than their global counterparts, and have provided higher dividend yields; many of Europe’s multinationals also have greater exposure to the faster-growing emerging markets.

A more accommodative ECB and modest economic recovery in Europe this year have lifted European equities, which have outperformed both Japanese equities and the MSCI World Index, while tracking the S&P 500 closely.

Nonetheless, European valuations generally remain lower, and current dividend yields tend to be higher, than those in the US or the world market. Moreover, we believe the improving economic outlook in Europe will continue to support rising aggregate demand, better earnings and higher valuations -- especially for the companies we own.

Consumer (and portfolio) staples

High quality consumer European staples, including food, beverages and tobacco, looked attractive to us at the beginning of the year. In general, consumer staples companies tend to exhibit stable and consistent earnings and dividend growth profiles: people tend to eat, drink and consume basic necessities no matter the economic environment.

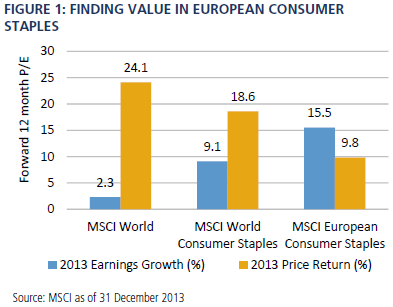

The earnings per share growth of European consumer staples last year was substantially better than their global counterparts or the MSCI World Index, yet share prices have appreciated less. In our view, European high quality staples remain underpriced in general, often even more so in specific companies (see Figure 1).

Finding opportunities in long-term demand/supply imbalances

Fish farming is an industry where demand is expected to exceed supply over the long term, increasing pricing power, according to the UN, the World Bank and others.

Yet so far this sector has not attracted a lot of investors’ attention. The world’s population, just over 2 billion people around 1950, is expected to be 9 billion by 2050, the bank says, noting that global population growth and increased consumption of protein, particularly in emerging markets, should drive a significant increase in demand, with global protein consumption projected to rise 55 per cent by 2030 -- roughly 5 per cent annually.

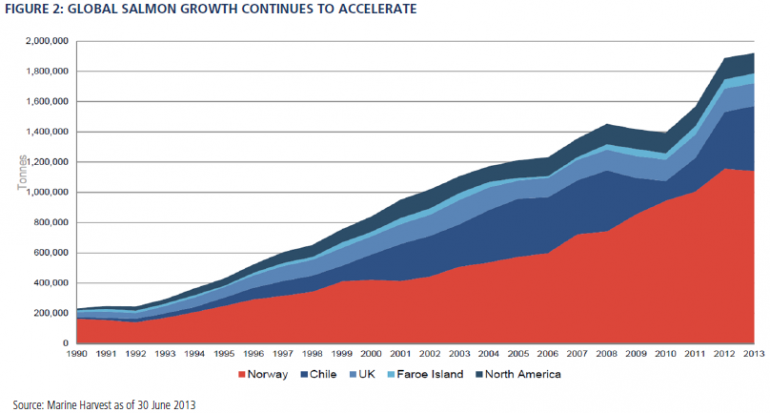

Sustainable aquaculture is one of the most efficient ways to source protein and has great potential to feed the world’s growing population. On the supply side, Norway and Chile account for over 80 per cent of production, although capacity expansion is constrained in both countries (see Figure 2).

The Norwegian government announced earlier this year that some farmers will be allowed to increase capacity by 5 per cent. Chile could increase production in the south, but a lack of infrastructure there means that an upturn would likely be limited and expensive to realise.

Although the aquaculture industry faces its own challenges, mainly biological ones, it trades at single-digit price-to-earnings ratios on 2015 market-cap-weighted earnings with dividend yields in excess of 5 per cent, according to Bloomberg.

As with other stocks in our portfolio, we look to specific companies that are generating increased sales and earnings, have attractive operating margins and good balance sheets, and are available at attractive valuation levels -- or roughly two-thirds the price-to-earnings ratio of the market as a whole at 9–10 times estimated earnings, with 2 per cent to 7 per cent dividend yields. We anticipate holding them for the long term.

Finding opportunities in special situations

Capital and corporate restructurings such as initial public offerings, mergers and acquisitions, asset sales, spin-offs and split-offs, and share buybacks may also provide pockets of opportunity.

These unique and special situations may offer not only the opportunity to earn attractive rates of return (see Figure 3), but less risk in many cases due to either the structure of a merger or acquisition or the discount at which they can be purchased. Many investors shun these opportunities because they lack the expertise to properly analyse and evaluate restructurings.

As an example, last June, a postal operator in Europe announced plans to go public at what appeared to be an attractive price. The business of collecting, sorting, transporting and delivering mail, parcels and packages, although somewhat cyclical, is also one for which there is relatively steady demand -- a trait we find appealing because it has the potential to reduce downside risk. The company’s shares rose recently after better-than-expected earnings results due to better volumes and management-led cost reductions.

Another special situation that provided an attractive opportunity was an Irish-domiciled biotech that a US-based specialty pharma company sought to acquire. The acquirer announced a stock-and-cash deal after the target had become the subject of an unsolicited approach from a financial buyer. The fully hedged merger-arbitrage spread was a fairly unattractive annualised return of about 3 per cent, but analysis suggested that investors misunderstood the transaction because the acquirer’s shares had underperformed its peers by more than 10 per cent following the deal announcement.

The deal, however, allowed the acquirer to 'invert' to a lower-cost tax jurisdiction (Ireland), which could drive better internal rates of return from additional product offerings via tuck-in mergers and acquisitions. We expected that this, plus operational savings, could potentially drive significant earnings accretion in future years.

The possibility of asset sales after the deal closed, which could generate significant cash to pay down debt and/or return capital to shareholders, also made this special situation more attractive than market valuations suggested. Digging deep into the details of the transaction is often the key to identifying hidden future potential.

A focus on value'

As much as the macroeconomic environment has changed, we believe the fundamental premises of value investing still apply. Stocks will often be mispriced relative to intrinsic value because of investor behavior, short-term thinking and overreaction to news. Investors with the capacity for deep, fundamental research and a long-term perspective may be positioned to find these opportunities.

This article was originally published in Pimco. Republished with permission.