Fighting off a gas price spike

New economic modelling analysis by one of Australia’s leading energy market modellers, ROAM Consulting, suggests that abolishing the Renewable Energy Target would actually increase electricity bills for consumers rather than reducing them.

According to the study, average residential electricity bills would be $51 a year higher in 2020 and an average of $100 per year higher post 2020 if the Renewable Energy Target is repealed. This is the case even without a carbon price in place.

What the?!

How can a policy that induces supply from a power source about twice the cost of current wholesale electricity prices result in lower costs for consumers? It doesn’t seem to make sense.

To help explain, there are two points you need to keep in mind.

- Prices across the entire electricity market would need to rise considerably in the future to bring on new power supply from gas (or coal or any other fuel) without supply induced from the RET.

While current average wholesale electricity generation prices are low relative to the cost of newly built wind (will be about $35 -$45 per MWh once the carbon price goes versus about $85 to $100 for wind), these prices would need to rise considerably to make it attractive to bring on an extra increment of power supply in the future. That’s because new supply would most likely come from gas, and the cost of gas is now very high and linked to the price of oil. For a new baseload gas power station to be viable, it would require wholesale prices of about $80 to $100 per MWh, according to analysis from the Bureau of Resource and Energy Economics.

The important thing to note is that this doesn’t mean all the existing old coal plant will still be happy to take $35 to $45 per MWh while the extra gas plant takes $80. Rather, the coal generators can price their output at a level just under the gas generator and not lose any market share while making a heck of a lot more profit. Hence prices for every unit of megawatt-hour you buy from wholesale generators would rise to $80 or possibly as much as $100.

- The extra cost of the new supply from wind (or solar or other renewables) supported by the RET doesn’t set the price for the entire wholesale electricity market, only that small proportion of your power supply dictated by the RET.

Instead of getting new extra incremental supply from gas, the RET will ensure you get extra supply from wind, solar or some other source of renewable generation. This also costs more than what existing generators currently require to be viable. But this new supply is induced into the market not by an increase in the overall wholesale market price, but through a subsidy. You pay for this subsidy in your electricity bill, but here’s the twist: it only influences that proportion of your electricity supply that its dictated by the RET. This will be roughly about 15-20 per cent of your bill, but much lower for heavy, energy-intensive industry who get exemptions from the RET subsidy.

So you pay extra for about 15-20 per cent of your power supply coming from renewables. However, in return, you continue to pay the coal generators a price that allows them to stay in business but not the windfall price they would have otherwise received, which is dictated by what a gas generator needs to stay in business.

This principle would apply even in a situation where wind power was cheaper than gas, which is conceivable in the near future. That’s because the RET would stop overall electricity prices rising to the level needed to bring on new supply from wind, because it would be paid for via the RET subsidy.

Is ROAM’s analysis an anomaly?

In short, no. Two other leading Australian energy market modellers in SKM-MMA and Intelligent Energy Systems have come to similar conclusions. They’ve found that the extra cost consumers pay for the RET subsidy is largely offset by savings in purchase costs from the wholesale electricity market.

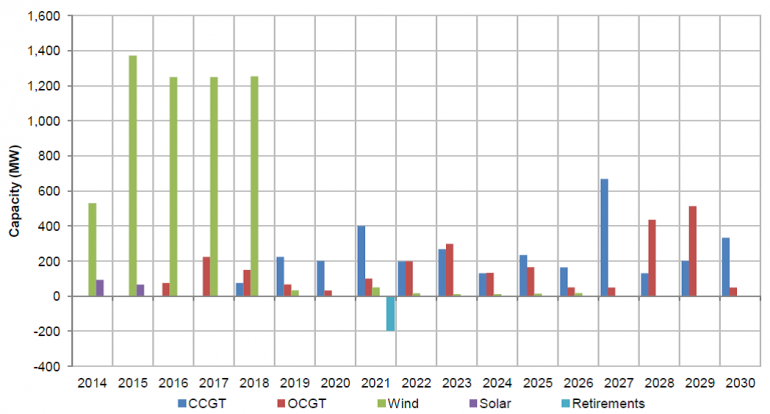

But another modeller and the one commissioned by the government in its current review, ACIL Allen (previously called ACIL Tasman), came to a different conclusion in its 2012 report. That study concluded that the RET wouldn’t do much to reduce prices in the wholesale electricity market because we’d still need quite a lot of new gas power stations to meet growth in demand under the existing RET policy. The chart below illustrates in the blue and red bars that they foresaw additions of new gas power capacity in every year from 2016 onwards.

ACIL 2012 forecast of additions and retirements in power supply capacity in the NEM with current RET policy

Source: ACIL-Tasman (2012) Achieving a 20 per cent RET

Since that study was published, it has become apparent that electricity demand isn’t growing as fast as many thought and there’s not much need for any new generation even into the mid 2020s.

This was acknowledged at a stakeholder meeting held by the RET Review panel last week where the review team said there wasn’t much need for new conventional generation even out to 2030.

This suggests that ACIL-Allen should probably come to similar conclusions as ROAM Consulting when they update their model to reflect reductions in electricity demand growth.