February's flat end delivers modest super returns

|

Summary: Managed super funds delivered moderate returns for February, on the back of rises in property and share market indices. |

|

Key take-out: February's returns were relatively subdued, buoyed by property and share market highs. |

|

Key beneficiaries: General investors. Category: Superannuation. |

The Australian share market gained solid ground for half of February, but Australian super funds delivered a more moderate performance for the month.

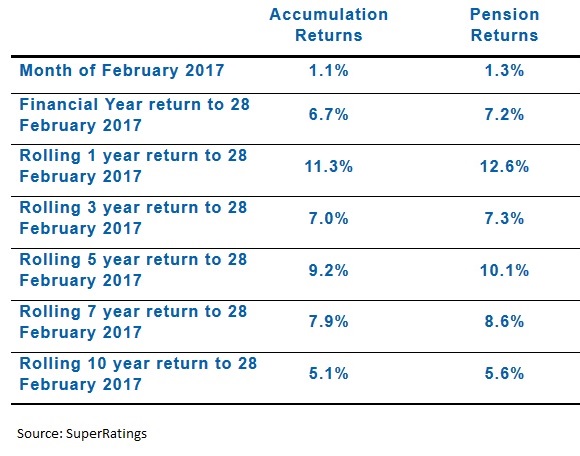

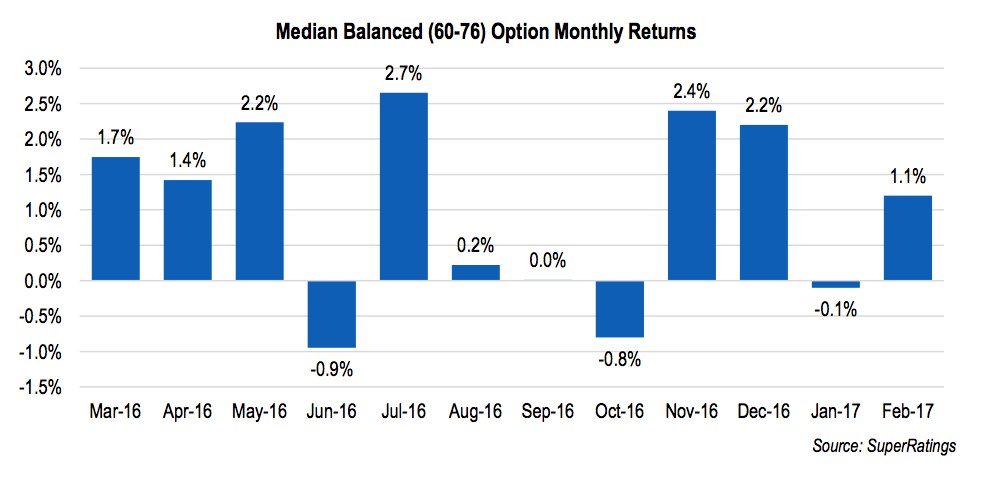

Superannuation research house SuperRatings reported this week that the median balanced return from managed super funds in February was 1.1 per cent. Meanwhile, separate data from another research firm, Chant West, reported a 1.2 per cent return, based on an allocation of 61 to 80 per cent in growth assets.

This data is up from January, where both research houses revealed super funds achieved negative monthly returns for the second time this financial year.

Commenting on the February uptick, SuperRatings chairman Jeff Bresnahan said investors should welcome the stability.

“What we have seen so far in 2017 is some stability in superannuation returns following what was potentially a bit of hype at the end of 2016,” said Bresnahan.

“Investors do not want to see markets getting too carried away, especially when there is still a fair amount of political and economic uncertainty globally.

“Looking over the past 12 months, only three months have seen negative returns, and these have been small, especially compared to the larger positive gains we saw at the end of 2016.

“Super balances seem to be in reasonable health, so investors should not panic if we do experience bumps.”

Any bumps aren't nearly evident in the 12-month return data, with SuperRatings showing the median balanced investment option rolling one-year return to the end of February reached 11.3 per cent – the highest since April 2015.

In light of overseas politics and economic uncertainty, Chant West director Warren Chant said growth funds have performed better than expected this financial year, led by property and listed shares.

Leading property indicator, the S&P/ASX 300 A-REIT Accumulation Index, gained 4.1 per cent in February, after a 4.7 per cent fall in January.

Australian shares from the consumer staples and health care sectors performed particularly well last month, rising 4.9 per cent and 3.8 per cent respectively.

“With share markets up further so far in March, we estimate that growth funds are up more than 7.5 per cent over the financial year to date,” said Chant.

“So with just over one quarter remaining, there is a good chance that they'll deliver an eighth consecutive positive financial year return. This is particularly impressive given the economic and political uncertainty that has been prevalent over the past few years.”

Longer-term returns for super continue to sit close to funds' inflation targets, with the seven-year return sitting at an estimated 7.9 per cent per annum.

SuperRatings noted signs of rising inflation in major economies, and the latest rate hike from the US Federal Reserve could herald the start of a tightening cycle.

This may create a more challenging environment for super funds, if expansion yields fail to keep pace, but steady inflation with higher rates of growth would positively impact super funds, according to SuperRatings.