February enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

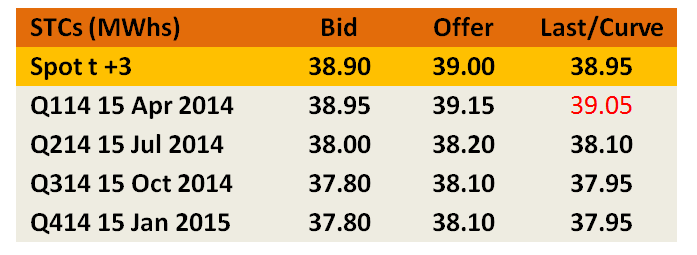

Range-bound trading in the spot, along with growing backwardation in the forward curve beyond the first quarter (a reflection of perceived regulatory risk) were among the developments in the STC market in February along with the final surrender numbers for the 2013 compliance year which again reveal a electricity demand led under-surrender. The release of the 2014 Small-scale Technology Percentage (STP) – which many expected would come in February – failed to materialise.

The last month has seen the spot STC market trading within a fairly tight trading range, with activity occurring exclusively between $38.35 and $38.90 across the month. Regular swings within the month were seen as buyers regularly paid the market higher as it approached the bottom of the range before sellers came out to weigh the market down once it reached the top.

Spot trade volumes in February were down on January’s peak, yet were still well above those seen in November and December.

Interestingly, the impact of the uncertainty created by the Renewable Energy Target review has only really been manifest in the forward market beyond the first quarter, with prices for the second quarter at levels considerably below the spot market. This 'backwardation' is a reflection of concerns held by many in the market that the way in which the Abbott Government established its review is a clear indication of its intention to ensure it recommends changes to the RET (see LGC section for more detail). With the spot price currently very close to the $40 cap, buyers are asking for a regulatory risk discount in order to lock in forwards.

With the passing of the final compliance date for the fourth quarter and 2013 (as a whole) surrenders on February 14, it is once again clear that electricity demand has once again fallen short of the Australian Energy Market office predictions used in the setting of the Small-scale Technology Percentage. This has resulted in the number of STCs surrendered in 2013 being 770,000 below that which was originally expected, with surrender down across all quarters including the fourth quarter, where many expected the take-up of exemptions to have outweighed any drop in demand.

To the 2014 Small-scale Technology Percentage, and the wait continues. Anticipation grew for the release of the STP in late February given the relevant meeting of the executive committee which needs to ultimately approve the schedule. It appears the STP was not dealt with at that meeting and now the wait must continue until some stage after the next meeting (Thursday).

It appears the official figure to be used for the surplus which will be added to the 2014 ‘base’ target is 1.9 million, consisting of the 1.5 million under surrender of STCs which occurred in 2012 along with the surplus for 400,000 STCs that were registered in 2013 above that year’s base target (20.7 million).

In terms of the 2014 base, a figure of somewhere around 18 million appears to be a middle ground, a number which would require roughly 350,000 STCs to be produced in each week across 2014. A number dramatically higher than that would be considered bullish, something clearly below that bearish.

Large-scale Generation Certificate (LGCs)

Suspicions surrounding the approach the Abbott Government would take in its Renewable Energy Target review were confirmed in February and the results for the LGC market were both indisputable and severe with the spot market down 15 per cent across the month.

The LGC market began February with a sufficient catalogue of negative Abbott Government Minister’s comments and leaked media reports surrounding the likely nature of the RET Review that many in the industry almost felt a sense of déjà vu when the actual terms of reference for the review were released.

That the panel which would conduct the review and prepare its final report was stacked with climate change sceptics in some cases and those with little history of supporting the renewables sector was fairly telling. That the support function for this panel was removed from the control of either Greg Hunt or Ian Macfarlane’s (the only true supporters of the RET in the Abbott Cabinet) departments and instead assigned to the Department of Prime Minister and Cabinet only added further weight. Yet it was hard to ignore the fact that the review is essentially a rehash of one undertaken less than 18 months ago by an eminently better resourced and qualified organisation (the Climate Change Authority). This perhaps proved the most telling of all the developments because despite the Coalition attempting to justify the review’s rerun on the basis of an absence of information, the fact that such information was extensive outlined as part of the last review has led most onlookers to one conclusion; it is not the hunt for elusive information that the Coalition seeks, but instead a review with a different set of recommendations.

Hence the explanation for the sharp fall has been a fairly simple one; many in the market believe the Abbott Government is intent on the RET review recommending major changes to the Large-scale market. Most believe that a change in the target’s calculation methodology is guaranteed, however there are now also those who are convinced there may be more extreme alternatives being considered. And in a market which is so completely subject to political whim, the prospect of such an outcome is enough to give even the most strident of optimists the jitters.

The spot market opened the month in the low $31s and softened gradually across its first half. Yet a series of dramatic falls on modest trade volumes across on a handful of trading days saw the market plummet to just below the $26 mark, plumbing a low not seen since March 2007 when details of both the Howard government and Rudd-led opposition’s respective plans for the expansion of the RET were being discussed.

Spot LGC trading volumes were healthy across February despite appearing thin at times when the market was in freefall. As can be seen below January and February were both relatively busy months when compared to the latter part of 2013.

The activity however was generally focused in the spot with forward vintages being particularly under represented with Cal 14 the exception.

By the latter part of the month a small increase in prices ($26.25) was reported along with the first trades in any volume, however these modest gains were undone early in March.

The review panel is set to hand down a final report by ‘midyear’ following some form of consultation process, though whether or not its findings will immediately be made public remains unclear. For the LGC market this means a minimum of three to four months in which speculation and rumour will continue to run wild.

Marco Stella is senior broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.