Fear factor over small cap miners

| Summary: Junior mining stocks have so far failed to fire as the broader sharemarket has rallied, but that could be about to change. Three well-positioned small caps are focused on copper, tin and iron ore. |

| Key take-out: The best strategy is to pick miners with sizeable deposits, the ability to bring new mines online, strong balance sheets and cash flows, and which are exposed to commodities with the brightest outlooks. |

| Key beneficiaries: General investors. Category: Growth. |

It’s no longer a question of “if”, but “when” investors should rotate into small mining stocks given that fear is slowly creeping back into the market.

It is this fear that will drive junior industrial metal mining stocks to outperform over the coming months, but we are not talking about the same fear that sent the stockmarket plunging last year when investors lost their stomach for risk.

This time it’s the fear of missing out on one of the strongest stockmarket rallies in a decade now that the market is up close to 10% since the start of the year.

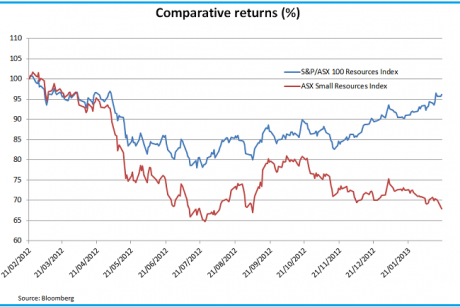

Junior mining stocks have so far failed to participate in the stellar sharemarket run-up, with the ASX Small Resources Index sliding 5% into the red.

If investor confidence stays on this current path to recovery, the next up-leg in the market will surely see smaller mining stocks lead the charge as procrastinators target this deeply discounted sector in an attempt to make up for lost time.

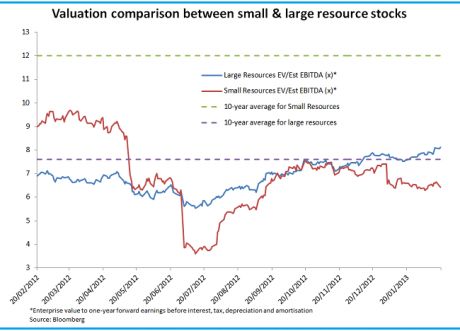

How deep is this discount? The answer stands out when you compare the enterprise value (a measure of how much a company is worth) to earnings between large and small cap miners.

The enterprise value to estimated earnings before interest, tax, depreciation and amortisation (EV/EBITDA) for junior resource companies is hovering around 6.6 times, or 44% below the sector’s 10-year average.

In contrast, those in the S&P/ASX 200 Index are trading at around 8 times, or a 4% premium to its 10-year average.

Investors have been more taken with the larger mining stocks due to their perceived quality advantage, such as healthier balance sheets and less erratic earnings. Big miners were also deep in value territory back in the second half of last year.

The fact that many small miners have a need to tap the market for additional capital to advance their projects is another reason for investors to shun them. But the risk-reward balance is changing, and the growing optimism on global markets will force investors up the risk curve.

The best way to gain leverage to this expected trend is to pick miners with sizeable deposits, the ability to bring new mines online, strong balance sheets and cash flows, and those that are exposed to commodities with the brightest outlooks.

Altona Mining (AOH)

On that last point, copper is a stand-out among commodity analysts due to robust demand and constrained supply of the red metal (see Dr Copper makes a comeback).

This puts Africa-focused Tiger Resources (TGS) in a sweet spot. However, Tiger has been well covered in the media and has already jumped close to 20% since December. While there is probably more upside left in Tiger, down-trodden Altona Mining is another worth keeping an eye on.

That may seem like a controversial call given that Altona has plunged 18% to 26 cents since Xstrata decided in January not to take up its option to buy a 51% stake in the Roseby copper project in Queensland.

There was a sense of panic from investors as Altona doesn’t appear to have the resources to develop the $320 million project, given that it has only around $19 million in cash on its balance sheet and a market capitalisation of $127 million.

But the snub from Xstrata may yet turn out to be a blessing in disguise because it now allows other interested parties to explore a partnership with Altona, or even make a takeover bid.

Chinese-owned Minmetals Group is touted as an interested party as it has a growth-by-acquisition strategy, and its Dugald River zinc mine is right beside Roseby.

Altona is considering other alternatives such as asset sales or a small-scale development of Roseby.

The small cap miner will have options to bring Roseby to life as long as the outlook for copper remains strong, with the current price for the industrial metal trading well above $US3.50 a pound and Roseby’s cash cost anticipated at $US1.73 a pound.

Further, Altona is not a one-trick pony. Its Outokumpu copper mine in Finland is in production and is delivering ahead of expectations, although it is a much smaller project compared to Roseby.

Brokers polled on Bloomberg believe the stock is worth 45 cents, a 70%-plus upside to where it is currently trading.

Metals X (MLX)

But it is not only copper that is a favorite on the hard commodities front.

Tin is a hot pick due to declining output from major producing countries such as Peru and Bolivia (see Tin soldiers on, but some miners are retreating). Poor ore grades and lack of new mine developments are the key reasons why the supply of tin is forecast to remain tight.

One big beneficiary from this is diversified miner Metals X. The company has managed to turn around its struggling Renison tin mine in Tasmania, which is turning out to be a world-class asset in terms of the quality of its grade and the size of its deposit.

Metals X is expanding Renison, and once that is complete, the mine will generate $30 million a year in EBITDA.

The $240 million market cap stock is a conviction pick by Philip Resources Fund’s chief investment officer, Chris Bain, but not only because of Renison.

“I would think we will see quite a bit of corporate action from the company over the next 12-months,” he said. “This might include divesting the gold business and perhaps the nickel projects.”

Asset sales and growing investor appreciation for tin could spark a re-rating of the stock, which has fallen 32% over the past year to around 15 cents.

If broker price targets are to be believed, the stock is tipped to double over the next 12-months.

Iron Ore Holdings (IOH)

Major iron ore producers have rallied hard since the price of the steelmaking ingredient rebounded 80% over the past five months to $157 a tonne, but smaller players such as Iron Ore Holdings have been largely left behind.

The stock is a conviction buy, in Foster Stockbroking’s opinion.

“The stock is significantly undervalued,” said Foster analyst, Haris Khaliqi. “It has a solid balance sheet, $93 million in cash, two large scale projects in the Pilbara and the potential to be a 10-15 million tonne a year [producer].”

While the stock has started to rally over the last few weeks, Khaliqi estimates that the market is only valuing Iron Ore Holdings’ deposit at 10 cents a tonne compared with the $1 per tonne ascribed to other emerging producers.

This could make the $170 million market cap miner an enticing takeover target now that the commodity is back in favour.

Final regulatory approval for its flagship Iron Valley project in central Pilbara is expected to be granted by the middle of this year, and Khaliqi has a 12-month price target of $1.30 on the stock – which implies a 20%-plus upside to its current price.

But if the iron ore price continues to hover around $US150 a tonne for the rest of the year, it could prompt an upgrade to its fair value. The same is likely true on a takeover approach given that takeover offers tend to fetch a 20% to 30% premium to fair value.

Brendon Lau is the small caps writer for Eureka Report and may have interests in some of the stocks mentioned in the article.

| Like what you’ve read from Brendon Lau? Then register your interest in an exciting new venture focused on small capitalised stock investment opportunities. CLICK HERE to register your interest now. |