Failing to foresee the electricity demand drop-off

"It is exceedingly difficult to make predictions, particularly about the future" – attributed to Niels Bohr

The drop-off in demand for electricity over the past few years has left parts of the electricity supply industry in shock and plenty of people scratching their heads.

Bar the 2008/09 GFC downturn, Australia has maintained economic growth since that time which is not all that far off the average that prevailed over the 2000s prior to the GFC. Past thinking had been growth in energy goes hand in hand with growth in the economy, so the continued drop away post the GFC, has been surprising for many.

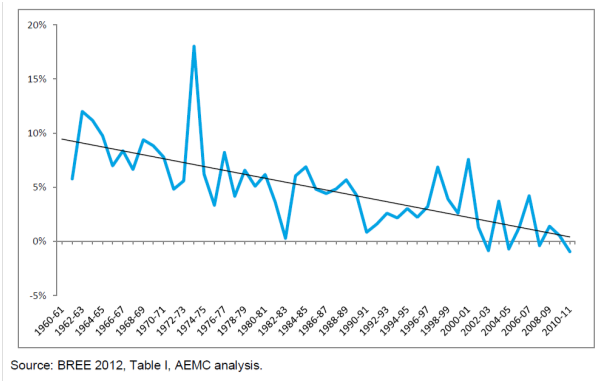

Yet the Australian Energy Market Commission, in a recent report on the regulatory implications of declining demand, provides the chart below illustrating that the recent drop-off is actually part of a far longer-term steady decline in growth rates for electrical energy. Interestingly this change is also repeated across Europe, Japan and the US.

Over time developed economies follow a pattern from being highly materials intensive as we add buildings, appliances and infrastructure (which require lots of energy to make and operate), to being more services-intensive (which is labour but not energy intensive).

Eastern states annual electricity consumption growth 1960-61 to 2010-11

In spite of this long-term trend there is an awful lot of variability at play. This makes predicting electricity demand very far from straightforward.

While the ‘80s sustained reasonably high energy demand growth, it fell well short of the Aluminium smelting boom we thought was coming. Way too much power station capacity was built, and we’re still yet to properly utilise it to this day.

Also in retrospect we appear to have over-reacted to the proliferation of cheap residential air conditioning units in the planning of network capacity, at least for NSW and Queensland. We’ve also underestimated the extent to which the mining boom would crowd out manufacturing, the boom in solar PV, and the impact of energy efficiency initiatives.

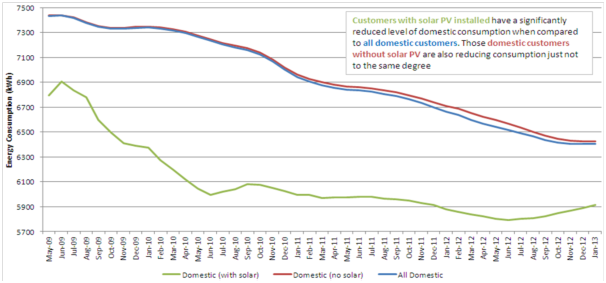

The chart below illustrates in the blue line how household electricity demand in the Energex network service area of South East Queensland has declined steadily and quite considerably between May 2009 and January 2013. This apparently represented a reversal of prior trends.

Annual average electricity consumption is now a full 1000 kWh lower than it was three and half years ago. This is a big reduction – equivalent to pulling a refrigerator and air conditioner out of every home. The green line illustrates solar PV owners consume even less.

Average household annual electricity consumption in Energex network area (kWh) – May 09 to Jan 13

Source: Energex (2013) Small grid-embedded renewables – A scorecard, Presentation to Solar 2013 by Mike Swanston - May

Looking back over the forecasts of the various state transmission system planners, all were surprised by the drop away in demand, but it seems the Queensland planner was the most of the mark and the slowest to adjust to changes in demand.

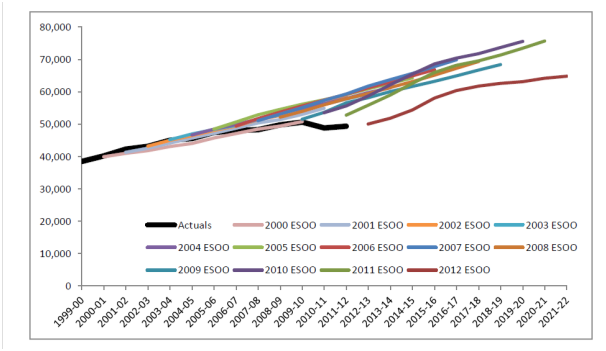

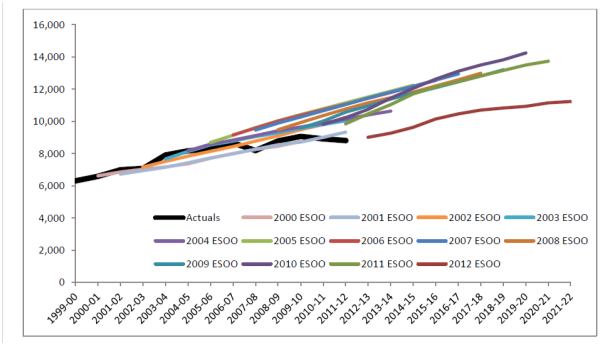

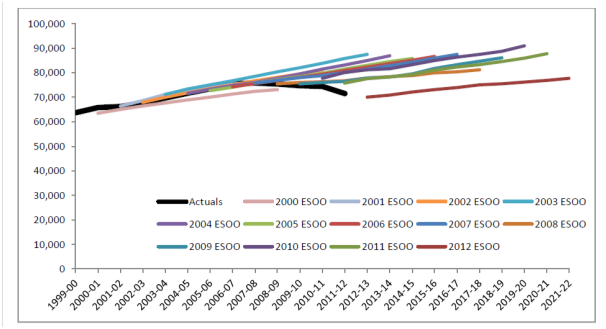

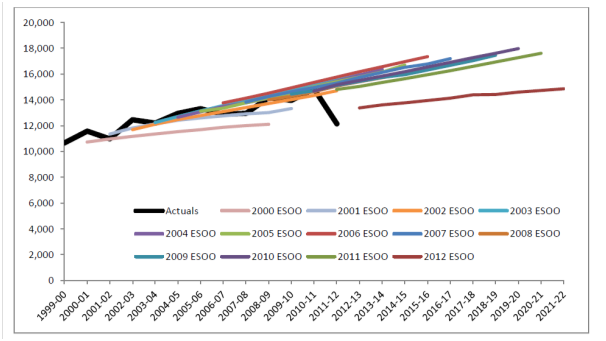

Below are two charts illustrating in the black line actual annual energy consumption and peak demand for Queensland, and the transmission planner’s forecasts. Forecasts made in 2000, 2001 and 2002 were reasonably good. But then the forecasts steadily afterward expect a level of growth that hasn’t materialised. What’s more, Queensland planners persisted with forecasts similar to the prior year in spite of demand repeatedly falling short. Worth noting is the major revision downwards in the 2012 forecast (dark red line), which was when AEMO took over the forecast from the Queensland transmission company.

Queensland annual electricity consumption forecasts and actual data (GWh)

Queensland summer peak demand forecasts and actual data (MW)

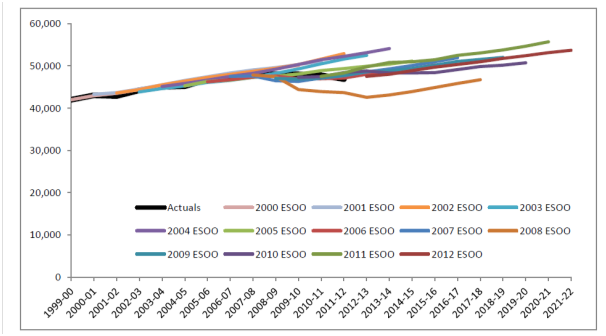

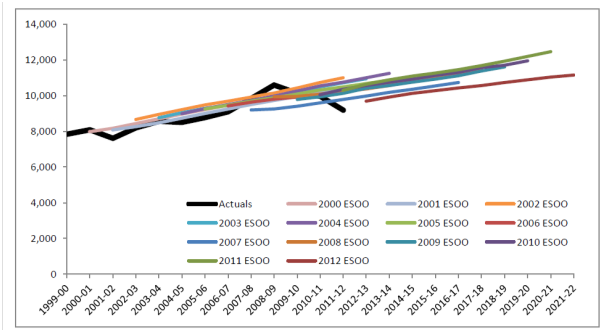

In NSW things only appear to have gone wrong from 2007 onwards when demand started to decline, although their track-record on peak demand had been reasonably good until the abrupt decline in 2011/12.

NSW annual electricity consumption forecasts and actual data (GWh)

NSW summer peak demand forecasts and actual data (MW)

AEMO, and its predecessor Vencorp, have been less prone to overestimate demand, but also failed to anticipate the drop away in demand that occurred around 2008. However, unlike Queensland, and to a lesser extent NSW, AEMO/Vencorp’s planners were much quicker to adjust forecasts downwards as they saw demand drop away.

Victorian annual electricity consumption forecasts and actual data (GWh)

Victorian summer peak demand forecasts and actual data (MW)

Predicting the future of electricity demand is far from easy, but it seems those in Queensland have been the most surprised. Interestingly Queensland has been a major beneficiary of the mining boom and is less exposed to manufacturing than Victoria or NSW. So one can’t simply write this off as a product of structural change in the economy driven by the mining boom.

It seems we can no longer take it for granted that electricity demand will grow inexorably as our economy grows. And that is a good thing.