Eyeing off the term-deposits war

Summary: The banks and other institutions are competing aggressively for customer deposits by offering term deposits well above the cash rate. |

Key take-out: Term deposits may have surprised to the upside in the last month, but there's no guarantee that will continue. |

Key beneficiaries: General investors. Category: Fixed interest. |

It's been well documented that term deposits have been doing a strange thing. They've been going up against a falling official cash rate.

When the Reserve Bank last month cut the official cash rate, all four major banks and other financial institutions actually lifted some of their term deposits. The official cash rate is now at a lowly 1.5 per cent and Australian 10-year bond yields are around 2.5 per cent. But you can now deposit your money in the bank for 3 per cent or more at many institutions and enjoy the safety of a government guarantee on that deposit up to $250,000. (By comparison, Australian shares are offering an average grossed-up dividend yield of around 6 per cent, according to AMP Capital's investment head, Shane Oliver.)

So, is this “deposit war” an investment opportunity – should we be moving more money into term deposits? And, secondly, how long will the rates divergence last?

| Provider | Advertised rate (%) | Interest paid |

| 1-year products | 3.11 | Annually |

| Gateway Credit Union | 3.05 | Annually |

| BOQ | 3.05 | Annually |

| ING DIRECT | 3.05 | Annually |

| QT Mutual Bank | 3.05 | Annually |

| Big Sky | 3.01 | Annually |

| (host of providers offering 3%) | ||

| 3-year products | ||

| BOQ | 3.25 | End of term |

| QT Mutual Bank | 3.25 | Annually |

| Bank of Melbourne, Bank SA, Big Sky, CBA, NAB, Qudos Bank, St George, The Mutual, Westpac | 3.2 | Annually |

| 5-year products | ||

| QT Mutual | 3.25 | Annually |

| Police Bank | 3.15 | Semi-annually |

| Arab Bank, Bank of Melb, Bank SA, Bendigo Bank, G&C Mutual Bank, QBank*, St George, Service One Alliance, Westpac. | 3.1 | Annually (*QBank 3.05%, end of term) |

Source: CANSTAR. As at August 30, 2016.

A lot of what is going on has to do with the new worldwide rules for banks, Basel III, which requires they hold a higher portion of capital against their loans. Thus, banks are searching for new funding, and with wholesale funding markets drying up they are turning to savers.

Justine Davies, of rates comparison group CANSTAR, said competition was hottest in the one-year to three-year term deposit space.

“The big four, naturally, are making a strategic move to increase their share of local deposits to help meet their Basel III requirements,” she said.

“It will be interesting to see if their market share of term deposits can, indeed, increase given that a number of smaller institutions are matching or bettering their rates.

“Holding their market share of domestic deposits will be crucial to these smaller institutions.”

Avoiding the chase for higher returns

The unusual situation has seen flow-through to annuities stocks, with Challenger shares losing ground last month in the wake of the term deposits lifts, which are an indirect form of competition to its term annuities.

"While ... management has talked down impacts of increasing term deposits pricing, there will be some lingering concern that product margin contraction is occurring," brokers Morgans said on Challenger, as they downgraded their outlook for the stock, contributing to a 5 per cent share-price fall.

But Theo Marinis, financial strategist and founder of Adelaide-based Marinis Financial Group, who advocates a passive – i.e. long-term – approach to investing, says investors should only be moving money into term deposits if the balance of their portfolio has become "out of kilter".

“You don't go chasing returns. A few years ago, term deposit rates were 2.5 or 3 per cent while equity returns were 7 per cent. These days it's the inverse, term deposit rates are higher. So sure, cash is getting a good run at the moment but there's endless stories of people getting into the market just before a correction, and bailing out before a rise. We advise sitting tight."

But Mr Marinis said there was an exception. If an investor had enjoyed a good run in their equities selections, then it was likely that their portfolio balance was out of whack, overweight in equities as a portion of the portfolio and underweight in fixed interest.

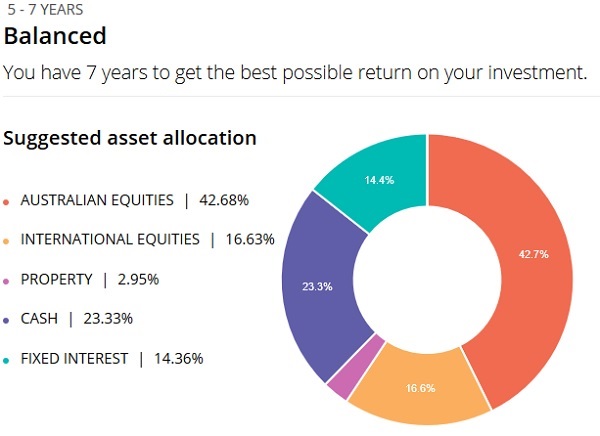

“For most investors a balanced portfolio means having half of their assets allocated to defensive assets, such as cash and bonds, and half in growth assets. If you've shot the lights out with, say, investment in property trusts (the sector has doubled in the past five years), then you may want to rebalance, so you put some of that money into term deposits.

“It's about playing the percentages. It's not sexy. We think you should only rebalance in line with your risk profile. Anything else is gambling, speculating; where rates are at the moment it's insignificant, and who knows where they'll be in six months' time.”

Source: InvestSMART

There is, of course, one other exception. In the case of an investor who wants a known amount from an investment after a certain period of time, putting that money in a term deposit – should it meet that yield objective – is obviously a good choice.

But the cycle already appears to have turned again. Analysts at Deutsche Bank – while acknowledging term deposit rate spreads spreads remained “elevated relative to early 2016 levels” – has reported a lowering of short-term rates spreads after they initially peaked following the August RBA rate cut.

Short-term deposit rates fell by 10 basis points from a peak of 0.42 percentage points over the bank rate in early August. Meanwhile, Challenger's share price has rebounded from its August low.

Maybe it was all just a ruse by the banks for some positive rates publicity, after all?