Exit the king: McNamee's mastery

Who has been the best Australian chief executive over the last quarter of a century?

Traditionally the men who built BHP – Essington Lewis and Ian McLennan – plus Rupert Murdoch have been seen as clearly our best.

The BHP leaders came from a different era and Rupert Murdoch’s total shareholder returns since the millennium have not ranked with the leaders.

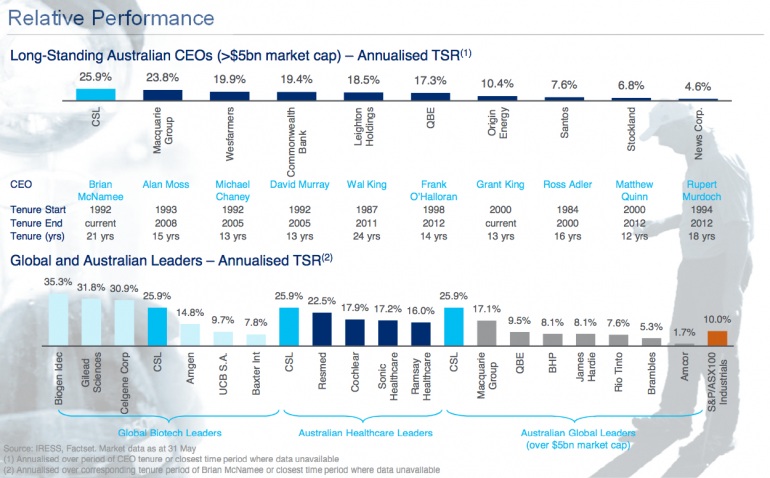

Citibank, to mark the imminent retirement of CSL chief Brian McNamee, have ranked Australia’s recent long serving chief executives by the increase they achieved in total shareholder return.

On that basis Brian McNamee achieved a stunning 25.9 per cent annual total shareholder return over his 23 years as chief executive and becomes the best of Australia’s CEOs over the last quarter century.

Not far behind him is Macquarie’s Allan Moss who retired in 2008 after achieving a massive 23.8 per cent annual return in his 15 years at the top.

Third ranker is Michael Chaney who chalked up a 19.9 per cent return during his 13 years as chief of Wesfarmers.

Then come CBA’s David Murray (19.4 per cent); Leighton’s Wal King (18.5 per cent); QBE’s Frank O’Halloran (17.3 per cent); and Origin’s Grant King (10.4 per cent and still going).

On the Citibank figures the McNamee achievement not only makes him the best CEO in Australia in the last quarter of a century but he has world ranking.

Among global biotech leaders he ranks fourth behind Biogen Idec, Glead Sciences, Celgene Corp.

In post-war Australian corporate history the great achievement of Rupert Murdoch was that he became a world leader. Frank O’Halloran made QBE a global player in reinsurance and much of Allan Moss’ achievements came on the world stage.

The key to McNamee’s success was that he realised that when CSL was privatised that it would have to be global to prosper.

McNamee’s great skill was to be able to execute global takeovers that brought great value to the company because he made the acquisitions at what turned out to be low prices. The two big ones, ZLB in Switzerland (2000) and Aventis Behring (2004) involved extremely complex acquisition strategies to beat rivals.

And then McNamee was able to integrate both operations within CSL.

The only other Australian CEO who has been able to do that has been Rupert Murdoch but he almost lost the company around 1990.

McNamee’s successor Paul Perreault came from Aventis Behring.

Most of the global big drug companies believed that the secret of success was achieving global size. It was the wrong strategy and they lost heavily. By contrast, McNamee having achieved world leadership in the specialised field of blood plasma products, he did not try to diversify.

Instead he used the surplus cash generated to buy back CSL shares. The shares turned out to be a fantastic investment and added billions to CSL prosperity because the company continued to grow at 10 per cent plus. Accordingly total shareholder returns were compounded.

The management schools will study the McNamee performance for many years. It is a model for others to follow.