Europe: Four charts you need to see

Summary: The economic situation in Europe can largely be judged by looking at just four charts, but one tells a very different story to the others. |

| Key take-out: Total government debt, the deficit, the unemployment rate and the borrowing rate are four key measures that can be used to evaluate Europe's recovery. But while the first three point to a negative outlook, the borrowing rate tells another story. |

| Key beneficiaries: General investors. Category: Economics and strategy. |

Europe has largely skipped the headlines lately, somehow… But to keep a balanced opinion, this article points out the ongoing problems and trends in Europe and attempts to draw some conclusions for investors.

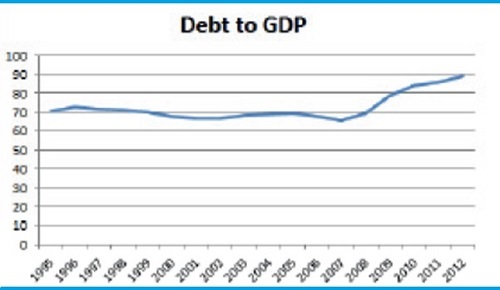

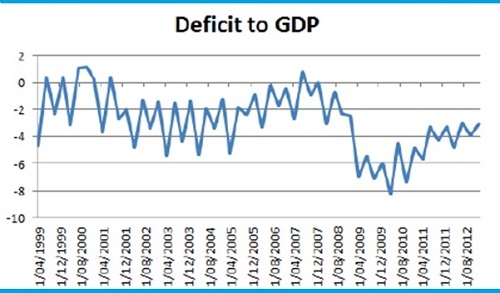

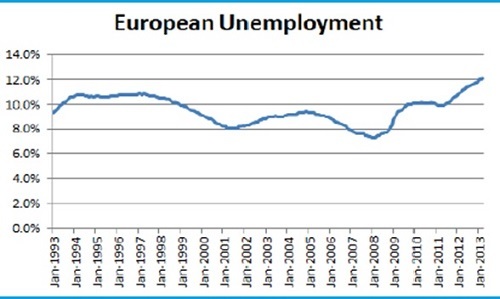

It is said that only four charts are required to assess the economic situation in Europe: total Government debt, the deficit, the unemployment rate and the borrowing rate (bond yield). In a simplistic way, this makes a lot of sense.

For the majority of the population, the first three charts are well known. However, it is very clear that all three measures continue to wane despite the best efforts of the European Governments’ so-called austerity measures; government debt continues to rise, the deficit remains negative (albeit slowly improving) and unemployment is at an all-time high at 12.2%. All this overlaps as the worst recession in Europe for over 20 years.

Source: The Investing Times

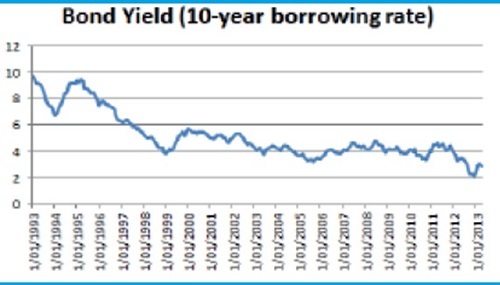

However, all is not lost. The chart that arguably matters most – yet is probably the least understood by investors – is the borrowing rate, otherwise referred to as the bond yield. This is where the positive news lies.

Source: The Investing Times

Borrowing rate well below danger levels

It is typically understood that the true breaking point for Europe is if borrowing costs exceed 7%. This is evidenced by the fact that Ireland, Greece and Portugal all reached the 7% figure before needing a bail-out.

However, as a collective whole for Europe, the rate is currently 2.9% and is not in danger.

How does Europe borrow so cheaply?

It may surprise you that Europe can borrow at a cheaper rate than it ever has. Explaining how and why is an essay in itself, but it mostly revolves around the historical low interest rates which are now just 0.5%. Just be satisfied that it is a good thing for the sustainability of Europe.

However the effect this has on investors is more debatable.

A low borrowing rate can be good for shares

What happens in times of low borrowing yields is that people are forced to move away from “safe” assets such as cash /bonds and invest into “higher risk” assets such as shares/property that offer a greater return. We have also seen this in Australia and the USA, as cash rates fall people are forced to consider the blue-chip dividend stocks in the great hunt for yield.

Any investor that anticipated this “transfer of wealth effect” has been handsomely rewarded and it remains an incredibly successful investing strategy.

This might actually provide the answer to why the European sharemarket has been able to deliver returns that have outstripped the rest of the world. After all, over the past year Germany is up 33%, France 30%, UK 24%, Spain 36% and even Greece is up 93%. At the same time, China has fallen 2%. Go figure, right?

However, the counter-argument from critics is that Europe’s recent rally won’t last and they inevitably face a Japanese event (two decades of no growth). Some have even gone on to nickname Europe’s woes “the lost generation”. In this case, shares are unlikely to deliver long-term growth in line with historical figures.

Major lessons

With more than 330 million people and an economy that is nine times bigger than Australia’s, it is vitally important to all investors that Europe remains stable. At the current time, the low borrowing costs are the best news we have. The much debated austerity (attempting to cut spending and save) is a common-sense approach, but double-digit unemployment is making the locals question its viability. Worse still, the unemployment problem is almost guaranteed to deteriorate further before any turnaround occurs.

However, much of this European mess can possibly be seen as a blessing in disguise for investors. The sharemarket has arguably factored in a “no-growth scenario” so healthy dividends and low P/E ratios are available to investors. It is then just a question whether investors can handle the ups and downs along the way.

In summary, will volatility continue? Yes. Will Europe continue to battle economically? Yes. Are shares dead as a result? No.

Scott Dixon is a senior advisor at Lachlan Partners.

This is an article which first appeared in “The Investing Times” newsletter which is published by Lachlan Partners and to which Scott Dixon is a regular contributor.