Eureka's Week: the truth about money, the correction, blockchain, retail

The truth about money | Eureka's Week | The correction | China and commodities | Blockchain | Retail | Readings & viewings | Last week | Next week

Last night

Dow Jones, down 0.33%

S&P 500, down 0.33%

Nasdaq, down 0.92%

Aust. dollar, US73.9c

Paul Clitheroe

The truth about money

In my first column a few weeks ago I looked at the key principles of money and investing. Our very sophisticated financial system tends to place a shroud of complexity around investment and it is very easy to get dragged into a huge amount of chatter and noise, which can incapacitate our ability to take action. Very sensibly, we don't want to get key investment decisions wrong and the huge amount of noise about investment often obliterates the really important stuff, the simple truths about money. These have been unchanged for thousands of years, I call them the “gravity of money”. Like gravity, you can do what you like, but over any extended period it will win. Thirty five years of working in the “money” industry, communicating money issues and also worrying about my own money has certainly taught me not to ignore fundamental principles.

People do love to chat about money and over the last few decades people have chatted to me about their money concerns and asked me questions in planes, trains, walking through the city, on talk back radio, emails and so on. But they nearly always ask the wrong questions. On Wednesday I was at a charity golf day with some old University college friends in Moree. It was a great day, with a large amount of money raised for Variety, the children's charity. In the golf club bar after the game, sure enough, a few locals did want to chat about money.

As you would expect in a rural export region, the value of the Aussie dollar against the US dollar always comes up. Of course, like everyone else who bothers to take the faintest notice of “experts” predicting our exchange rate, it is bleedingly obvious that the chances of anyone getting this consistently anywhere near correct are about zero. In fact if you take the usual “start of the year” predictions by experts and check a year later, you'll realise you may as well put various exchange rates on a dart board and chuck a dart at it.

As you can imagine, Moree farmers contemplating whether to hedge this year's crop or not (it looks like being another good season) found this particularly unhelpful. But at least it is the truth. Anyway, then the questions fell into the usual pattern. Do I have a “hot” share tip?, what is the best investment property or shares?, will super be any good after the politicians finish with it?

And so on.

What is missing is a key truth about money, which you know. Firstly, wealth is created by spending less than you earn and secondly this surplus income is directed towards sensible assets. Unlike markets going up and down, which they always will and you have absolutely no control over this, spending less than you earn is totally in your control. It really makes me chuckle when in a more appropriate location than a bar, such as an office meeting, someone starts out by telling me how much they earn. This is of little interest to me. Wealth is only created by the gap between earning and spending. I am constantly astonished by people wanting to talk about investment and wealth creation who, whether working or in retirement, do not have their cash flow control as an absolute priority.

So I really don't give a twopenny toss about trying to answer questions such as “is property better than shares”, because this is a second stage question. The first stage is to control what you can control. Your cash flow. Sure, I am then happy to have a chat about property vs shares, but I don't much care which you buy. If you have surplus assets or are generating surplus cash flow, this is quite a fun conversation. The truth about property and shares is not easy to find. Most people talking about this are trying to flog you either property or shares. In a world full of expert opinion, commentary and more statistics than you can point a stick at it is pretty easy to make a case than either is better. It also easy to bring out selective statistics and show property is terrible, or shares are a disaster.

Back to the truth, and this is that both of these assets have done very well for investors over long periods of time. Personally, I hold both property and shares. Australia's population is projected by the ABS to grow to some 40 million in the next few decades, their range is 36.8 to 48.3 million in 35 years. I figure these people will prefer not to sleep in a cave, and we don't have a heap of available land with access to jobs, schools, health and so on. So despite some experts proclaiming the crash in values to come and others the next boom, my cut through is more basic. I just reckon if I own well located property in central locations with loads of public transport and decent coffee and I hang onto it for at least a decade or two, it will be fine.

I am sure you must be mightily impressed by my sophisticated analysis, but when it comes to property it seems to me the supply and demand is a pretty good principle. If you can convince me our population will drop to say 20 million, easy, I am a seller. But I can't see the evidence.

And so it goes with shares. For heaven's sake, a share is just our piece of a business. We don't need to be Albert Einstein here, our growing population and the new 90 million people (births over deaths) living on our planet each year add to demand. And the nice thing with shares is that in this modern world we can own a bunch of them in Australia and globally and give ourselves exposure to growth sectors around the planet. Take a look at the InvestSMART website – investing in shares, infrastructure and so on here or globally can be done very efficiently and cheaply.

So do you buy shares or property? Clearly, I don't care as long as you invest in decent quality assets. But what I really care about is that you control what you can control first. Your cash flow. Yes, if you own mainly shares, I'd be thinking about diversifying into property. If you owned mainly property, I'd be thinking about diversifying into shares. If you hate property because it is too labour intensive, buy shares. If you hate shares because you can see prices going up and down every day (property does this as well, but you can't see it!), don't buy them.

My final thought here is also a truth. Be cynical about the ”research” provided by anyone or any organisation that profits from selling either shares or property. But I do think if you take a look at any independent research you will see that over long periods both asset typeshave generated returns well above inflation.

Next week we'll have a chat about leverage and risk. There are plenty of untruths to uncover here!

- Paul Clitheroe

Eureka's Week

The correction

The Australian market has now reversed about five per cent of the 13 per cent rally that began in mid-February, thanks to a bout of risk-aversion prompted by fears of Brexit.

Let's leave to one side whether that risk aversion is justified (I don't think it is) – what it has done is return a bit of value back to the market. The price earnings ratio based on one-year forward consensus earnings estimates has dropped from 16 to 15 – slightly better but still above the long term average of 14.7.

The problem is that the already expensive defensive sectors, such as utilities and consumer durables, have done best in the past week or two, and actually become more expensive.

Most of the correction has been focused on resources and other cyclicals, so that the P/E dispersion (the gap between the highest and lowest valuation stocks) is higher than it's been since 2008.

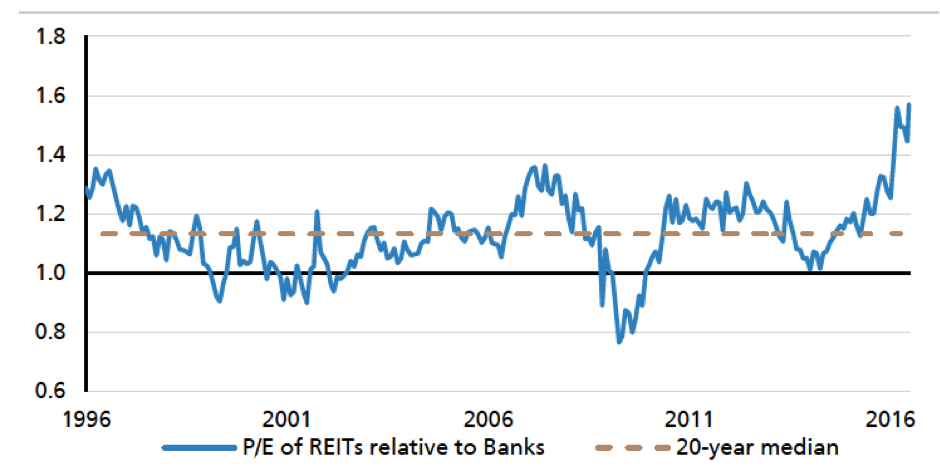

One of the more significant trends lately has been a shift by yield investors from banks to real estate investment trusts (REITs) which has seen a big rise in their relative valuation, so that it is now well above average.

Source: UBS

That doesn't mean there will be a correction the other way, either in REITs falling or banks rising, and in fact it's more likely that defensive yield investments are likely to remain well bid for a while – for as long as markets are risk averse and interest rates are super low.

On the surface, banks are starting to look decent value, but they have got their own problems, of course, and have been lagging REITs because of concerns about capital requirements and rising provisions.

Normally the fact the 10-year bond yield fell to 1.99 per cent on Thursday and is currently two per cent – a record low – would give a valuation boost to equities and property (all assets are valued by adding a risk premium to the “risk-free rate” and discounting future cash flows by the answer – the lower discount rate, the higher the valuation).

But these are not normal times, and the fact that cash and bond interest rates are so low is raising concerns about economic growth and earnings, so that the resulting reductions in profit forecasts are offsetting the impact of lower discount rates on valuations.

That's the problem with the current market: equities are not cheap and bond yields are pointing to something both weird and worrying.

As I wrote last week, I can't get my head around negative bond yields, or negative cash rates for that matter, and as an investor I don't like it one bit. It's possible that at some point the share market reacts by having another big burst of “risk-on” and possibly even a bull market, but it's also possible that Bill Gross is right and it's a supernova about to explode.

I just don't know because these conditions are unprecedented. Then again, it's always “different this time”, so as investors we have to keep calm and carry on and try to earn a decent return.

In the current weird environment that means returning to first principles: finding well run companies in growing industries, and stick with them until something changes. It's not rocket surgery, as they say, but nor is it easy.

China and commodities

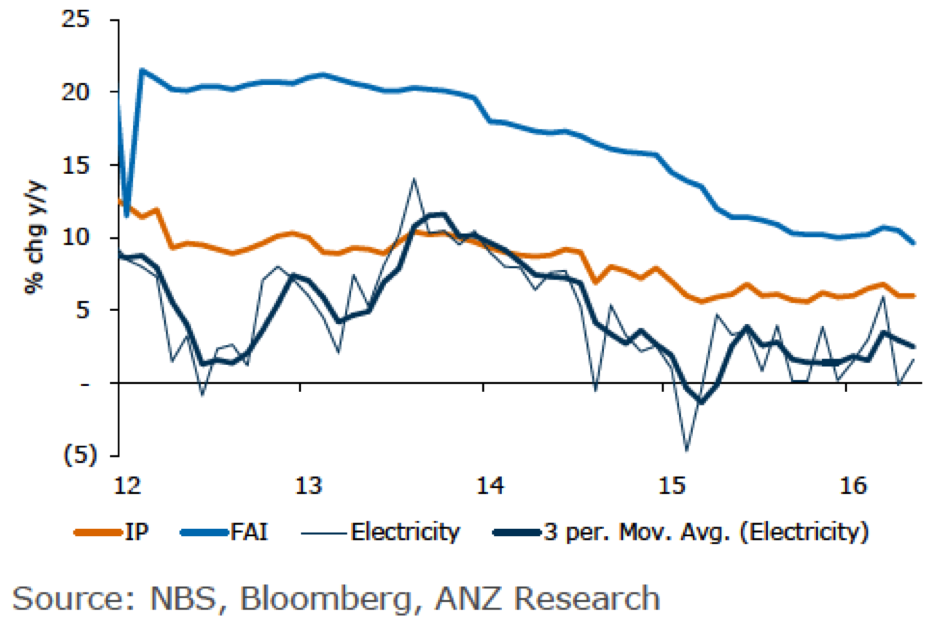

Chinese data out earlier this week has raised some questions marks around the sustainability of the rally in commodity prices this year.

Industrial production was unchanged, as was electricity production, and fixed asset investment was weak. Longer term, the picture is of an economy that just keeps grinding lower:

China's industrial production, fixed asset investment and electricity production

I suppose China and the rest of the world will take what they can get growth-wise, but with an economy as leveraged as China's is now, you're always worried when growth falls short.

At the very least, demand for iron ore and coal is likely to soften in the months ahead which should keep commodity prices subdued.

This is being exacerbated by the risk-aversion coming out next week's UK referendum (on Thursday June 23) and the fears about Brexit, which will also probably get worse before it gets better.

Blockchain

We hear a lot about disruptive technologies that is usually broad-ranging and fairly unspecific, except for those being disrupted. But here's something specific, and quite interesting.

ASX Ltd is testing the use of Blockchain to replace its CHESS settlement system, which could be very good for ASX but not very good for Computershare.

Blockchain is the technology that makes Bitcoin work and looks like being much more important in the long term than the “crypto-currency” invented in 2008 by someone hiding behind the pseudonym, Satoshi Nakamoto (an Australian named Craig Wright claims to be him, but not many believe him).

Anyway, Blockchain is what's called a distributed ledger. All parties to a transaction have the same copies of all trading records, and any changes have to be agreed upon by a majority of nodes before it is digitally encrypted and “chained” to the nodes, forming part of the transaction history.

It's a sort of a “social media”, or consensus method of conducting business. Chaining the records makes tracing ownership history very simple, and fraud is difficult because the consensus approach means all nodes have to change simultaneously.

There are two types of Blockchain: permissioned and permissionless. Bitcoin is permissionless, which means that it happens between strangers. Permissioned is where transactions are happening between parties known to each other using preset protocols. That's what ASX is looking at introducing.

According to Morgan Stanley, it's currently doing a proof-of-concept programme, and plans to make a decision either way in mid 2017. If it goes ahead, the new system will run in parallel with CHESS for 12 months, before full adoption in 2018.

Computershare's registry business is based on the existing settlement systems for global stock markets, and 36 per cent of its total revenue comes from this division.

About seven per cent of this comes from Australia, which is most immediately at risk. The US, which contributes 40 per cent of Computershare's registry revenue, is also experimenting with Blockchain, so if it works that's only a matter of time as well.

And what's not well known is how important the registry business is to the rest of Computershare's other revenue streams, such as business services and employee share plans.

As for ASX, Blockchain should defend its clearing monopoly and reduce costs, and possibly create some opportunities, like growing data & analytic services and expanding services provided to the equity markets – as well as go beyond equities.

Retail

Two interesting things happened this week: I went into a Uniqlo store and I sat next to a Wesfarmers executive at a dinner.

Uniqlo is a Japanese-owned chain and it's an extraordinary store: packed with stock, well-laid out and cheap, and the clothes are pretty good. I'd previously been in an H&M store, which is also very good, and although I haven't been inside a Zara shop yet, apparently it's pretty good too.

The Wesfarmers executive confirmed to me that those three chains are squeezing the life out of Target in much the same way as Aldi and Costco are squeezing Coles (and Woolies).

As a direct result of the competition from Uniqlo, H&M and Zara, the head of K-Mart, Guy Russo, as well as some self-inflicted miseries, has been put in charge of Target with the task of cutting the size of the business down by about half. That is, its retail floor space and revenue will be halved, and the hope is that the business will be profitable at that point (it's losing money now).

According to a recent report from Macquarie Wealth Management, Uniqlo, H&M ad Zara reported $460 million in sales in 2015, from a standing start three years before. Actually H&M and Uniqlo didn't exist in Australian 2013, only Zara did.

They now have 36 stores between them and plans to continue rapidly rolling new stores out.

They are also taking market share off Myer and David Jones, which is ironic since the fear about those has always been that online retailers would drain their revenue. Turns out it's other, better, shops.

Readings & viewings

Stephen Colbert discusses Donald Trump's reaction to Orlando shootings. Funny, devastating.

The message of the terrorist is, “I matter. My cause matters. My hatred matters. My ability to act matters.” We respond by saying, “Yes, you matter.”

The NRA's slippery slope in gun control ends in paradise.

Fantastic interview on Radio national's Religion and Ethics Report with Raheel Raza, Pakistani Canadian writer, about the Orlando shooting.

Container ships doubled in size between 1955 and 1975, then quadrupled again by 1995. The latest mega-carriers are too big for most ports, and shipowners are building ever bigger ships in a sort of arms race, hoping to drive rivals out of business. A crash looms.

The golden rule of investing, with Roger Montgomery and Steve Johnson.

Globalisation is fraying. Look under the Elephant Trunk.

Stunning piece from Ambrose Evans-Pritchard: why I'll be voting for Brexit.

Brexit will be a gentle process.

Unlike life and the universe, Europe has no simple answer.

This is remarkable: an entire spoof issue of the New Yorker magazine.

How do you hedge against a Trump Presidency (traders are asking themselves).

LinkedIn, which was bought by Microsoft this week, is “an Escher staircase masquerading as a career ladder”.

What's going on in an animal's mind?

Why humans sing.

Barrie Cassidy on the hoax of pork barrelling.

The problem with reinforced concrete (it doesn't last long).

Last week

Shane Oliver, AMP

Investment markets and key developments over the past week

The past week has been dominated by Brexit worries which pushed down most share markets and combined with a very dovish US Federal Reserve pushed bond yields down as well. Japanese shares were also hit by the absence of further Bank of Japan monetary easing. The fall in bond yields saw German 10 year yields fall below zero for the first time and Australian 10 year bond yields fall briefly below two per cent to a new record low. Commodity prices were mixed with oil down but metals up a bit. Despite the volatility in share markets currencies were little changed including the $A.

Why the Brexit frenzy and is it justified? The Brexit vote (Thursday) is fast approaching and nervousness in financial markets has been building up over the last few weeks, particularly as the Leave campaign – focussing on the more emotive topic of immigration - has been showing a lead over Remain. The agitation in financial markets reflects two things. First, concern about the impact of Brexit on the UK economy via reduced trade access to the EU, its financial sector and labour mobility (which has been estimated at somewhere around -2 per cent of UK GDP) and this has been weighing on UK assets notably the British pound. But Britain ain't what it used to be (eg it only takes 2.7 per cent of Australia's exports). The real concern globally is that a Brexit could lead to renewed worries about the durability of the Euro to the extent that it may encourage moves by Eurozone countries to exit the EU and Eurozone which in turn could reignite concerns about the credit worthiness of debt issued by peripheral countries and lead to a flight to safety out of the Euro into the $US which could in turn put renewed pressure on emerging market currencies, the Renminbi and commodity prices. And then we are back in the turmoil we saw earlier this year!

However, with Eurozone shares down 8% in the last few weeks it could be getting overdone. If Remain wins then recent market moves should reverse with the British pound and Eurozone shares likely to bounce particularly sharply. If Brexit wins there could be more to go in the short term (ie shares down, bond yields down, British pound and Euro down and $US, Yen and gold up) but this will likely prove to be a buying opportunity in relation to European and global shares as Europe is likely to hang together as it did through its sovereign debt crisis. The hurdle for a Spain, an Italy or a France to leave the Eurozone is much higher than for the UK to leave as they would end up with a depreciated currency and much higher debt costs. Just think of Greece which despite all its woes consistently wants to stay in the Eurozone. In fact, support generally remains high for the Euro. It would probably also be the case that Europe would ultimately be better off without Britain as it would remove a brake on greater integration.

Will Brexit happen? While the polls have been moving in favour of a victory for the Leave campaign, I still lean to a Remain outcome: undecided voters assuming they actually vote are likely to favour the status quo, telephone polls which were more accurate during the UK election last year still favour Remain and the murder of a British politician who supported Remain by a mad Brexiter may swing support back to Remain.

Meanwhile the Fed remains on hold and very dovish. It revised growth forecasts down fractionally to two per cent for this year and next and slightly upgraded its inflation forecasts but it was a bit less positive on the US jobs market. More significantly the so-called "dot plot" showing expectations of the 17 Fed meeting participants for the Fed Funds rate still sees 2 hikes this year but 6 members now see only one hike this year (up from just one in March). The "dot plot" also lowered the profile for interest rates in the years ahead once again in the direction of already lower market expectations. See the next chart. While Fed Chair Yellen said every meeting was "live" for a hike she is no longer comfortable talking about a hike in the next meeting or two. Short of a big rebound in June payroll employment I can't see the Fed moving before September at the earliest. The key is that the Fed remains cautious and is allowing for global risks. It's not going to knowingly do anything that threatens the US or global growth outlook.

As if there isn't enough to worry about the terror threat loomed its head again with a horrible attack in Orlando. This appears to have more in common with the Sydney Lindt Café attack with another nutcase, but it doesn't annul the horrible loss of life. Investment markets appear to be getting desensitised to terror attacks because if they don't damage economic infrastructure they are unlikely to have much financial impact. The Orlando attack has played into the hands of Donald Trump though.

Major global economic events and implications

US economic data was mixed but remains consistent with a modest rebound in June quarter GDP growth. Industrial production was soft in May but manufacturing conditions in the New York and Philadelphia regions bounced back, the NAHB home builders' conditions index rose, US retail sales rose strongly in May for the second month in a row and jobless claims remain low. The Atlanta Fed's GDPNow growth tracker is pointing to GDP growth of 2.8 per cent annualised this quarter. Meanwhile, core CPI inflation was 2.2 per cent year on year in May which is all consistent with the Fed's preferred measure of inflation gradually heading back to its two per cent target.

The Bank of Japan disappointed yet again, but with inflation well below target, shaky growth and the Yen now rising to a 12 month high pressure remains for additional quantitative easing which we still see being delivered, perhaps in July.

Chinese data for May was mixed with slowing growth in investment but stable growth in retail sales and industrialist production. Combined with stronger exports and stable business conditions PMIs growth looks to be tracking sideways at 6.5-7 per cent but policy looks like it will have to remain stimulatory.

Australian economic events and implications

Australian data remains consistent with okay economic growth with business conditions remaining solid in May, consumer sentiment holding onto most of the rate cut related bounce in May and employment up solidly in May with unemployment remaining unchanged at 5.7 per cent. However, there are some concerns with business confidence down in May, full time employment growth remaining weak and labour market underutilisation as measured by unemployment and underemployment rising to a high 14.2 per cent which will maintain downwards pressure on wages growth. So while growth looks okay there is nothing here to prevent further monetary easing.

Next week

Craig James, CommSec

Reserve Bank, population and jobs data

There are no ‘top shelf' indicators in Australia in the coming week.

The week kicks off on Monday with the Business Sales Index from Commonwealth Bank – a measure of economy-wide spending.

On Tuesday minutes of the last Reserve Bank Board meeting are released. While the Reserve Bank seems happy with the current state of the economy and interest rate settings, investors are looking for further insights.

Also on Tuesday the House Price Index is released by the Bureau of Statistics (ABS) while Reserve Bank Assistant Governor Guy Debelle delivers a speech together with Alex Heath, Head of the Economic Analysis Department.

On Wednesday, the Department of Employment releases the Vacancy Report. Just like job advertisements and broader job vacancies, the data acts as a leading indicator of the job market. In April the internet vacancy index rose by 2.8 per cent to be up 6 per cent on a year ago.

On Thursday, the December quarter population data is released by the ABS together with the detailed job market data for May.

In the September quarter Australia's population expanded by 313,200 people to 23,860,100 people. Overall, Australia's population growth rate fell from 1.35 per cent to 1.33 per cent - a 10-year low

In terms of the industry jobs data, employment fell by 3,200 over the three months to February after a gain of 71,900 in the previous three months.

Also on Thursday, Reserve Bank Assistant Governor Guy Debelle delivers a speech as does Luci Ellis, Head of the Financial Stability Department.

US Fed chair takes the stand

In the coming week, Federal Reserve chair, Janet Yellen, testifies on the economy. And all eyes will be focussed on Thursday's “Brexit” vote in the UK.

The week kicks off on Tuesday in the US with the Federal Reserve chair, Janet Yellen, delivering the "Semi- annual Monetary Policy Report" to the Senate Banking Committee. The hope is that the report and testimony from the Federal Reserve chair will clear up a lot of issues related to how the Fed believes the economy is faring, where rates are headed and even on issues like the “Brexit” vote.

On Wednesday, two of the week's housing market indicators are released in the US – data on existing home sales and a measure of home prices by the Federal Housing Finance Agency (FHFA).

Economists tip a near 1 per cent lift in existing home sales to a 5.5 million annual rate in May after a 1.7 per cent gain in April. Some believe a housing shortage exists with only 4.7 months of stock on hand, below the 6-month figure regarded as balanced between demand and supply.The FHFA data will provide further insights on the state of the housing market. In March, home prices were up 6.1 per cent on a year ago, led by California.

On Thursday, the spotlight is shone on the UK. After months of speculation on the outcome, UK voters will finally get their chance to decide whether the country should stay in the European Union. The referendum could go either way. And no one knows what the broader implications will be. So investors will walk of eggshells awaiting the verdict.

In the US on Thursday data on new home sales is released together with the leading index. New home sales soared by over 16 per cent in April but the outsized increase is expected to be followed by an outsized fall of around 11 per cent in May.

Also on Thursday, “flash” readings on manufacturing activity are released is the US, Europe and Japan.

And on Friday US data on durable goods orders (a key gauge of business investment) is released with consumer confidence. Durable goods orders are tipped to have eased by 0.8 per cent in May after a healthy 3.4 per cent gain in April.

Share market, interest rates, currencies & commodities

Last week we looked at how global share markets and currencies have performed so far in 2015/16. This week it is the turn of commodity or raw material prices.

One closely-watched commodity price index is the Thomson Reuters CRB futures index. So far in 2015/16 the CRB futures index is down by just over 15 per cent after being down almost 32 per cent in mid-February.

At face value, the decline in the CRB futures index suggests general weakness in commodity prices. But that actually hasn't been the case. In fact the sugar price has soared by 55 per cent with rice up 16 per cent and gold up around 10 per cent. Zinc, cotton and wool prices have been largely unchanged since June 30 last year.

On the downside, nickel has recorded one of the biggest declines, down around 26 per cent, with copper down 22 per cent, wheat down 21 per cent and beef down around 11 per cent. Other base metals have been better-behaved with aluminium and lead down 3-4 per cent.

The high profile commodities – oil and iron ore – have had a volatile twelve months. Oil fell from US$57 a barrel to US$26 before recovering to around $48. Iron ore fell from near US$59 a tonne to US$37, before also recovering to around $50. But overall oil is still down around 18 per cent over the year with iron ore down around 14 per cent.