Eureka's Week: Monetary movements, deposits, property, risk hurdles abroad

Robert Gottliebsen

On rates, property and political ructions

It's been a fascinating week so let me share with you some of my experiences.

We will cover:

- US-China-Europe;

- a different way of looking at investment strategy;

- bank deposits and the implications of the CBA term deposit interest rate rise;

- and the new apartment game.

I spent some time with a top Australian securities analyst who works in his own business and sells his material to the big institutions - so he has to be good.

He has recently spent time in the United States and tells me that he believes the big feature of the next 12 months will be a revival in the US as the momentum of low unemployment, consumer spending and their strong banking system comes to the fore.

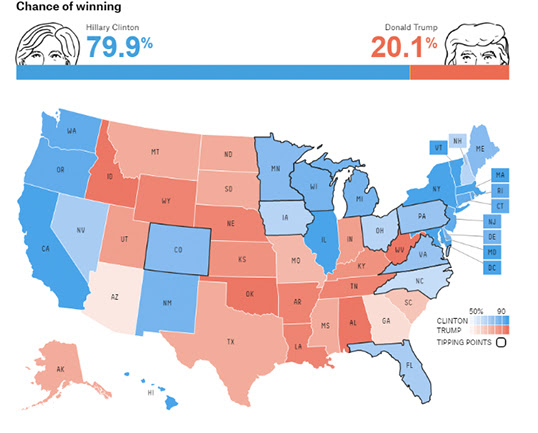

It will require a victory by Hillary Clinton in the presidential race to ignite the forward momentum because she is planning a major thrust to boost consumer spending via higher minimum wages and other social service benefits.

It is true she will try and tax the rich to pay for it but usually the rich are too clever. So it will be a question of spending only partly covered by tax.

If Donald Trump wins, the associated uncertainty will hold the US back. If my man is correct then the American dollar will rise as their interest rates edge up, which is what most markets were plotting for 2016. It now becomes the prospect for 2017 which means that it makes sense to have a portion of your portfolio exposed to the US dollar, particularly as it looks as though Clinton is going to win. (But don't go overboard because forecasts can be wrong.)

Source : FiveThirtyEight.com

Having said that, the American market is priced at high levels so if anything goes wrong with a particular company or the economy the market will be savaged because it is not priced for failure.

In Europe and in China they have weak banking systems because - unlike the US -they didn't tackle their underlying banking weaknesses during the global financial crisis. That is going to hold both China and Europe back, and with that comes risk for Australia if China gets into trouble. I will return to China when I discuss apartments.

A different investment strategy

I was yarning with the Parametric Group who are based in Seattle. They have come up with an investment strategy which unfortunately is too complex for small investors to use but it is worth understanding because in the next year or so one of the big institutions might think of offering it to self-managed funds and smaller investors.

Parametric's scheme starts with the understanding that our big institutions have a high-cost method of protecting their portfolios against sudden reversals.

In particular they use derivatives to achieve their objectives. The securities they use are very expensive. And so Parametric came up with this solution: they would provide a global portfolio service in which half the funds were in cash and half were in indexed share securities. They would set up 30-day put options of indexed securities pitching the put options just below the market. The main buyers of these put options were the major institutions. That way if the portfolio fell below a certain level they would exercise their put option but, of course, they would pocket the premium.

If their shares rose then the put option premium was pure profit. On the other side of the portfolio similarly, they underwrite call options which again are sold to institutions -naturally if the shares rise then the call options are exercised and the portfolio gain is of course reduced. It limits your participation in both rises and falls in the market. And with two sets of fees it seems the returns will be likely in the 10 per cent vicinity and sometimes higher.

As I listened to them I couldn't help thinking that such a portfolio might be useful in the $1.6 million tax free fund that self-managed super funds have to set up to comply with the government's plan. If the service becomes available I will let you know.

Deposit rates

As I mentioned during the week I had a five-year deposit maturing at the Bendigo Bank. I do much of my business through the Bendigo Bank as, in my small "island" suburban community, the big banks disappeared and the Bendigo Bank opened and has supported a number of my community activities. So there is a lot of goodwill.

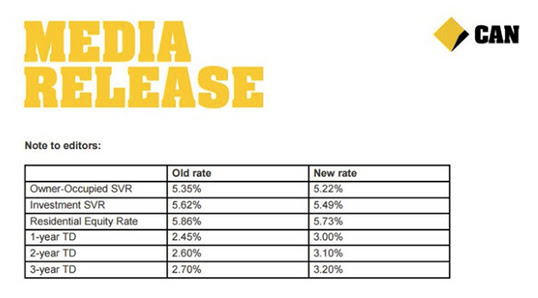

I have been a great fan of corporate bonds but it is getting harder in that area because as the rates fall the amount of risk you take is greater ... I am prepared to carry a small portion of my portfolio in no-risk term deposits with the bank which carry a government guarantee for less than $250,000. The 3.2 per cent rate is a healthy 1.7 per cent above the inflation rate. I think I could have secured 3.3 per cent for five years however, despite the inflation margin, 3.3 per cent is not a high rate and events can change. Accordingly, I preferred the three-year term at these rates. Five years ago the maturing deposit was offered at 6.7 per cent so at that level I committed to five years. When my deposit came due the official Bendigo Bank three-year rate was 2.9 per cent but I pointed out to them that on August 19 the Commonwealth Bank would be offering 3.2 per cent rate and the agreed to match the CBA offer.

Normally I would expect a higher rate from the Bendigo Bank to the Commonwealth Bank but as it was a rollover and a relatively small exposure I was prepared to take it as goodwill. But for those who are not Eureka readers and who don't know that all the big bank term deposit rates will go up with the Commonwealth Bank on August 19, they could be tricked to take much lower rates.

During the week the banks put out an unofficial noise that in due course they may lower their deposit rates. Banks are simply going to have to attract local deposits if they are to meet the regulatory requirements for 2018 and they need to start now.

Aussie apartments

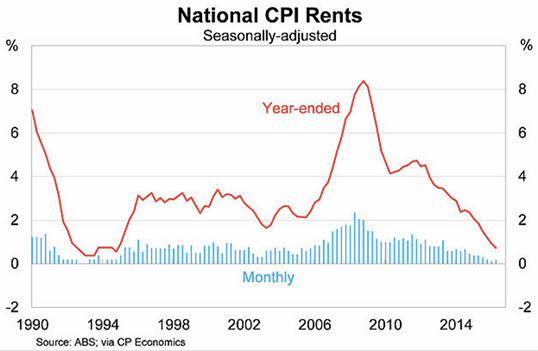

Unless you are a reader of The Australian you would not know that in Sydney the Chinese have been rescinding off-the-plan apartment contracts and forfeiting their 10 per cent deposits. They have never done this before. The industry leader in the New South Wales apartment industry is Harry Triguboff. He tells me that other Asian investors are taking the place of those that are exiting.

The most crucial aspect of this development is what happens in Melbourne where the emerging supply of small apartments is enormous because the Chinese bought vast numbers on 10 per cent deposits. It will take a lot of new Asian and Australian investors to replace any mass exodus.

The reason Chinese are rescinding their contracts is that our local banks, having given encouragement to the Chinese that they would fund their purchases, have closed the door. And so when the off-the-plan deals came due banks told the Chinese that they will not receive any funding. At the same time the Chinese Government has cracked down on money leaving the country for property investments. So the Chinese have no other choice but to walk away.

We don't know where this new Asian purchasing is coming from but the likelihood is that it is from Hong Kong or from those Chinese that have already shipped money out of the country. The greatest market for Chinese real estate purchasing is Vancouver, Canada, but they have turned against the Chinese with a new tax of 15 per cent on new purchases and the prospect of a tax on empty houses. Our state governments are moving in that direction but so far have not gone over the top. So we may get some money out of Vancouver. There is also increasing Australian investment in housing.

This is a very important issue because if a vast number of Melbourne apartments can't be sold then developers, builders and sub-contractors will be sent to the wall. Banks will lose a lot of money. It is one of the most critical areas for the nation in the next two years so we will need to follow it very closely.

Readings & viewings

Are analysts' earnings forecasts a waste of time? Nir Kaissar of Bloomberg looked into it and found that two simple measures were usually more successful at predicting future earnings than complicated forecasting models.

Why are so many people turning away from experts? Julia Shaw of the UK Independent thinks it's because they love using words non-experts don't understand.

A debate is opening about re-purposing inner city golf courses in Sydney and, maybe, Melbourne. Urban forests, anyone?

Speaking of golf, this piece looks at Obama the athlete - the 55-year-old president has reluctantly ditched basketball for golf.

Malcolm Turnbull's decision for a Royal Commission into NT abuses was flawed on two fronts.

A few years ago, along with the rest of the Middle East, Israel was running out of water. Now it has more than it needs. Water technologist Edo Bar-Zeev thinks high tech desalinated plants can bring harmony to the region.

The term 'maximize shareholder value' has been hijacked, says Michael Mauboussin and Alfred Rappaport in HBR. But Amazon's Jeff Bezos gets it right.

The most anticipated comic-movie release in years - Suicide Squad - should have been kept locked away.

Take a look at this SBS Dateline video about a unique nursing home in Holland with old and young living together.

Feel like doing something for charity? This Melbourne dinner to help underprivileged kids features a terrible line up of chefs for a charity dinner: Ben Shewry, Neil Perry, Maggie Beer, Peter Gilmore etc. The things we do for others...

The Simpsons' take on the '3am call to the White House' for election 2016.

Honourable men may still exist. We were never in doubt.

Mitchell Sneddon's recipe of the week.