ETFs: The hidden costs

Summary: There are a number of ETFs listed on the Australian market designed to track US benchmarks and give low-cost exposure to the sectors and companies on those markets – like healthcare and technology. However, fees mean that many of these funds don't match the returns of the benchmark, and its worth deciding which parts of the US market you want exposure to, because the objectives of each are very different. |

Key take out: When deciding between ETFs check the following: which index, or part of the index, is being tracked, what the fees are, and what specific exposure you want to the United States in your portfolio. |

Key beneficiaries: General investors. Category: Exchange-traded funds. |

If you want exposure to the US without the responsibility of picking each stock, exchange-traded funds are a simple way in – but the truth is that because of fees, the return an investor will get out of a long-only fund will likely be less than the benchmark.

What's more, you should know that while ETFs are sold as funds that perfectly mirror the indices they aim to follow - such as NASDAQ Or the FTSE - they can vary from those index returns by as much as half a percent due to fees – or more if they are designed to short the market and benefit from its decline.

Despite this obvious limitation, the past two years have seen major growth in the ETF space, and as an Australian investor this means a couple of things: not only are there more funds available across more markets, but funds under management are growing.

Stockspot's 2015 ETF sector report highlighted that in the 12 months to June 2015, funds under management increased 66 per cent, to $17.8 billion, while international share ETFs overtook Australian share ETFs for the first time. Popularity is on the rise, but as investors continue to chase US tech and health stocks not available on our markets, what are you better buying - individual shares or the whole benchmark through an ETF.

Buying an ETF is essentially buying a basket of shares that represents the benchmark an investor is trying to mimic. Rather than buying an entire market (ie, all companies domiciled in the US), investors actually buy a set of criteria based on the underlying benchmark – this means that for US shares, one should have an understanding of the sector weightings of the Nasdaq and S&P500, which parts of those sectors are performing well, and which parts of the benchmark they want exposure to.

If you decide to use an Australian-listed ETF to track the US, there are a few things that will affect returns: fees, which currency the fund is held in, and which part of which index is actually being tracked. While the end game of an ETF is to mirror the returns of an index, you'll probably get just below that in the long run.

While many ETFs are designed as long-only options to track the overall returns of the benchmark, there are also other tools to consider: funds that use gearing to amplify returns in the shorter term, those chasing a high yield return from US stocks, and ‘bear' funds that aim to give short exposure to the market and amplify returns when the market falls. With each option it's worth noting whether there is a currency hedge, because returns will be affected by fluctuations in our dollar.

Fees

A quick survey of the available Australian-listed ETFs with US exposure reveals that matching the index through an ETF is very difficult. The fees on offer range from .05 per cent to one per cent – this is different depending on the manager of the ETF and which part of the benchmark it tracks. Vanguard's Total US Shares ETF has the lowest fee we could find, at 0.05 per cent pa.

While these charges are on par with ETFs that track Australian shares, and in most cases much lower than global managed funds, it does mean that when the market is performing poorly over a short time frame it can make investors feel these losses even harder. For example, the Betashares Nasdaq-100 ETF is exposed to the tech-heavy Nasdaq – and while its benchmark delivered a loss of -1.67 per cent for the six months to March 2016, the ETF lost -1.84 per cent over the same time.

Fund managers suggest that when thinking about your ETF allocation, you should subtract around half a per cent of the benchmark's return to get an idea of the payoff.

“The benefit of an ETF is that it is a very simple structure to get exposure to well known names through the overall market,” says Shaun Parkin of SPDR ETFs Australia. “You can look back over the past 23 years [of the SPDR S&P 500 ETF] and see the track record over that time – many investors are drawn to the long term results as well as the quality and size of US stocks.”

However, it's worth noting that many Australian listed ETFs tracking the US have only come onto the market relatively recently – given the market volatility at the beginning of this year, this makes it slightly more difficult to see how a fund performs against the index in the long term and get a sense of the market's strength over that time.

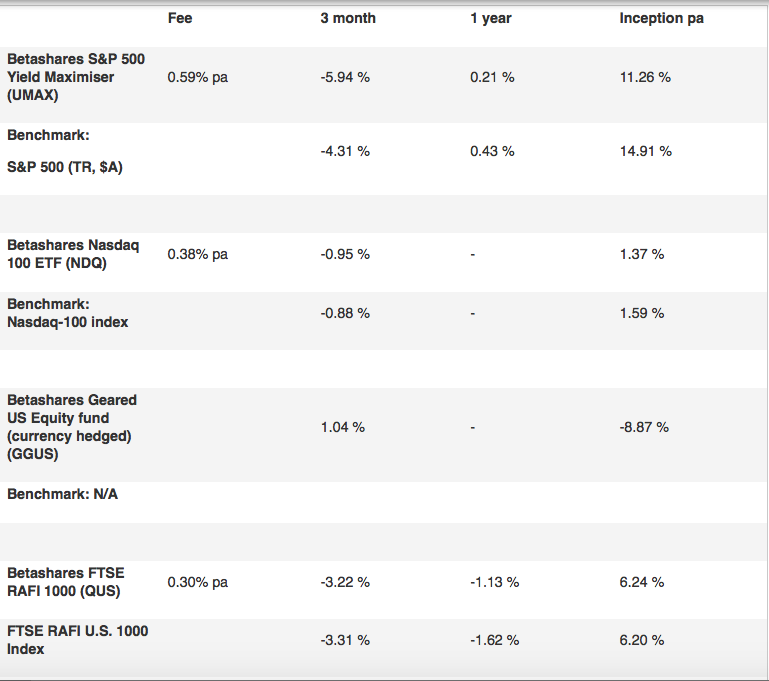

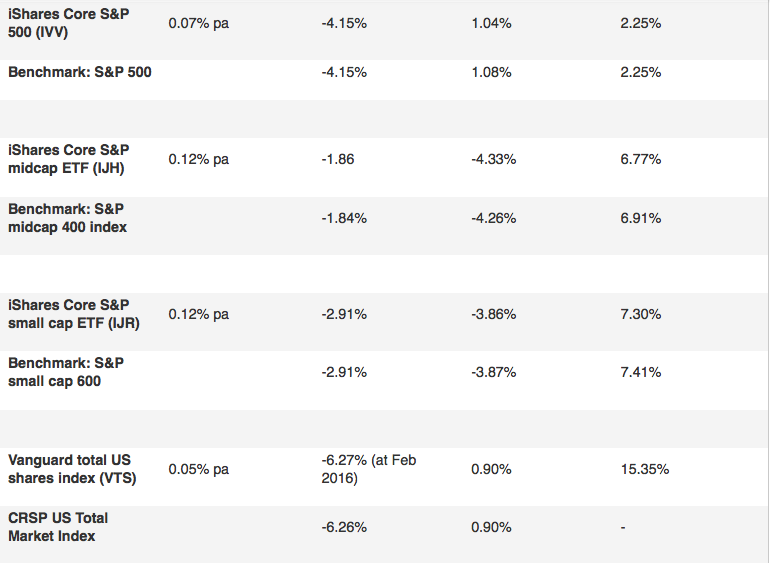

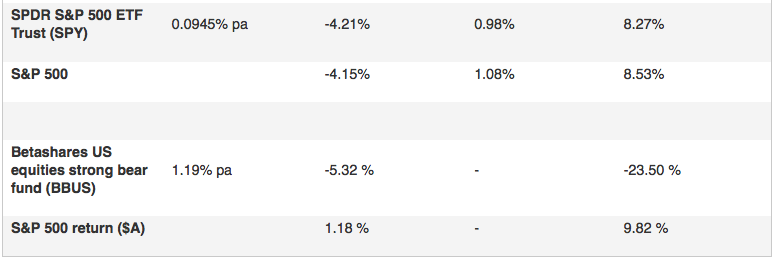

A snapshot of returns

Here's a look at the returns of major US-tracking ETFs listed on the ASX:

The returns vary depending on the specific index tracked and strategy employed by each fund – making it important for investors to know the exact make up of the market they are buying in the first place.

You might be surprised at the variations - these exist in part because of the different fees on offer, as well as the different approaches and tools used by the ETF. While the SPDR S&P 500 ETF, which has been in operation since 1993, has returned 8.27 per cent per annum since inception, the Betashares US Equities strong bear fund is designed to perform well when the underlying index sinks - and to date the return has been -23.50 per cent.

Know the benchmark – and why you want to track it

Much like the ASX200's heavy weighting towards financials, the Nasdaq and S&P 500 are the product of the companies sectors within them, and each has vulnerabilities. “The S&P is quite a broad index, and the Nasdaq is a very different set up,” says Betashares managing director Alex Vynokur. “Tracking the Nasdaq is getting exposure to the kinds of companies working to change the way we live our lives [as it is so technology heavy] – a different kind of choice entirely.”

There is also variation in the mandates of funds – for example, the Betashares S&P500 Yield Maximiser aims specifically to take stocks from the S&P500 to deliver a yield higher than the stocks alone, using a covered call strategy – selling a portion of future upside for dividends.

“Covered call strategies are designed to perform well when the market is flat or is falling, like the volatility we are currently seeing on global markets,” says Vynokur.

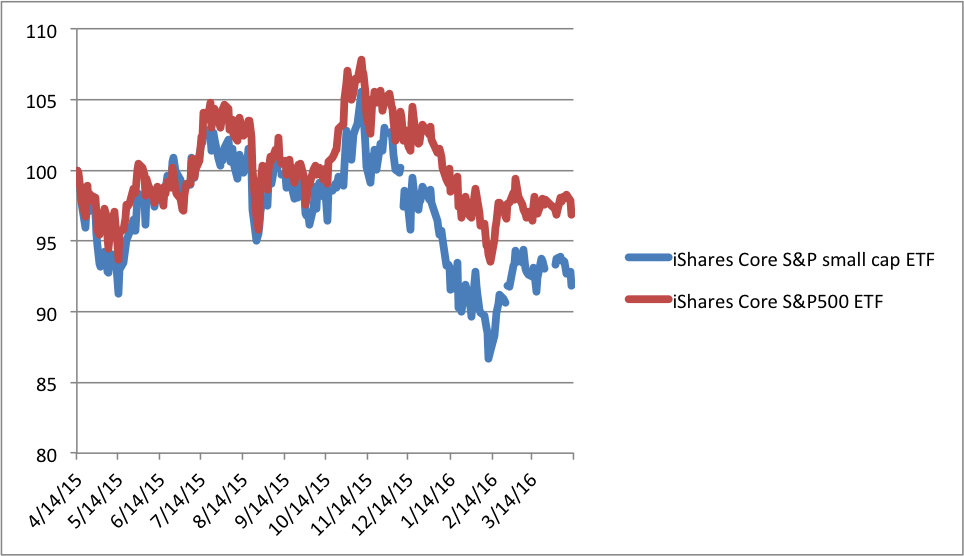

Then there's the option of tracking small, mid or large caps only – you can get a sense of the different returns in this comparison of the iShares Core S&P500 ETF and the iShares small cap ETFs:

If investors want exposure to one particular segment of the market, there's always the option of looking at ETF and index funds available on US markets. You can buy many of these through online brokerage platforms, and while the brokerage will most likely be higher and fees and investment will be in US dollars, this could give access to parts of the market an investor believes will outperform.

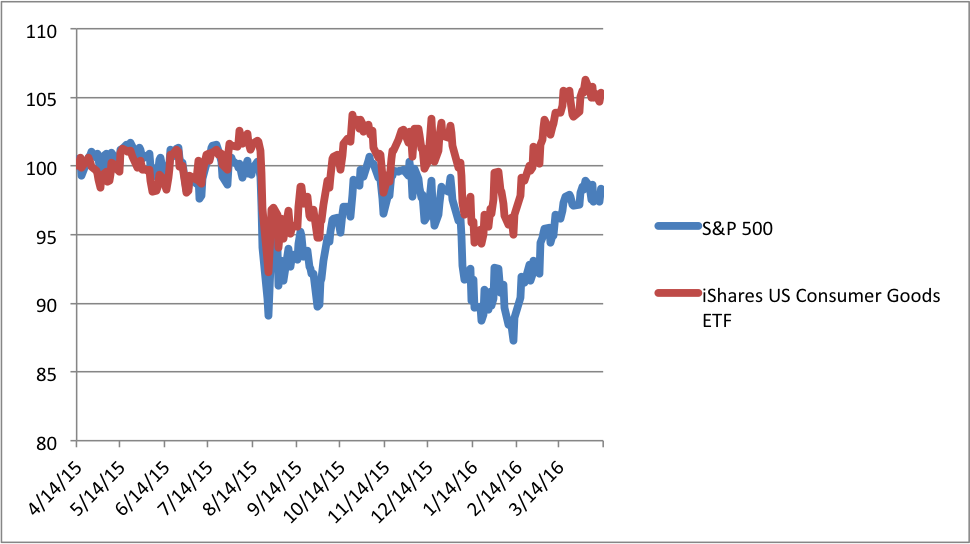

For example, here's the performance of the US Consumer Goods ETF, managed by iShares US, against the broader S&P500:

Conclusion

While they are simple structures, you can't use an ETF to track “The US market” – each option is designed to mirror a different benchmark, with different fees producing different results. Many of the funds Eureka Report as surveyed have only recently come on to the Australian market and have inception dates within the last 18 months – analysts and managers alike suggest considering ETF investment in a time frame beyond this, as many of these funds are designed to be held for the long term. The actual returns of these funds can vary significantly; due to the part of the market they track, whether they are hedged in US or Australian dollars, and what the overall management fee is. Having an idea of what type of US exposure is desired, and what different indexes hold, is a good starting point for working out what fits best in a portfolio.