ETFs: the hard way or the smart way

By now most investors will have heard about exchange-traded funds. In case you’ve been in hiding for the past few years, the gist of the story is ETFs can be a cheap way to buy major sharemarket indices. For example, one ASX-listed product will get you the S&P/ASX200 for as little as 0.15% a year. If that doesn’t set you alight, consider a managed fund that aimed to beat the same benchmark might charge at least 10 times that amount, with no guarantee of outperformance after fees.

ETFs are a simple way to diversify across asset classes and international markets, a proven route to cutting the risk of sudden negative shocks to a portfolio.

LITTLE AND LARGE

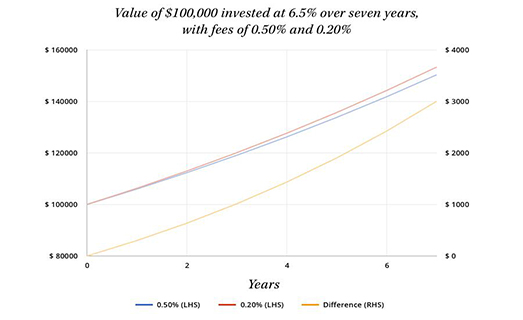

The benefit of low annual fees is enjoyed most of all by those who are patient. Let’s say an investor finds two products with the same long-term objective return, but one provider is charging 0.5% a year and the other 0.2%. Is that such a big difference? If the more expensive product comes from a brand which is always mentioned in the media (and is backed up by expensive marketing), maybe it will look like a better deal?

But the corrosive effects of even small differences in fees for the same gross returns become obvious as time passes. Although over the long term returns to the end investor may not look all that different on an annualised percentage basis, the difference in capital value will be significant. Here’s an example of what we mean, where a 0.30% difference in the cost of an investment product that returns 6.5% over 7 years results in a $3000 shortfall in capital on an initial investment of $100,000.

BIG DIFFERENCE

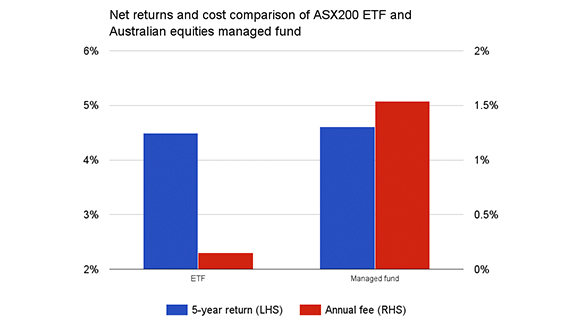

The difference in fees between investments which deliver roughly the same result can be very large when ETFs and retail managed funds are lined up against each other.

Here is an example, where five-year annualised returns (to February 29) for an ETF over the ASX200 are compared with an active fund which aims to beat the same benchmark.

WHAT’S ON THE MENU

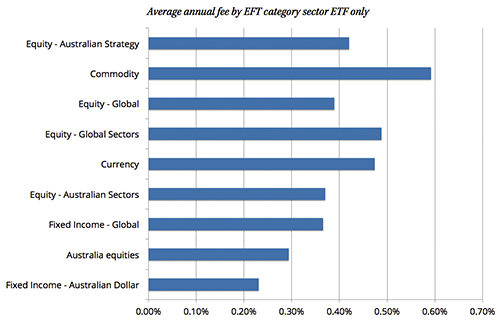

As ETFs have gained attention in Australia the providers have responded by offering ever more products. The most recent sectors to blossom and bloom on the ASX are global fixed interest ETFs and ethical ETFs, but as the menu gets longer and the job of picking funds to hold becomes harder it’s worth remembering the original case for ETFs is about cutting costs and risk.

To stand out in the crowd new ETFs have to offer something different, and if that requires a more complex strategy than tracking an index then it will be reflected in a higher fee. Sure enough, the range of fees charged for ETFs of different types has spread wider.

THE MORE YOU PAY THE LESS YOU LOSE

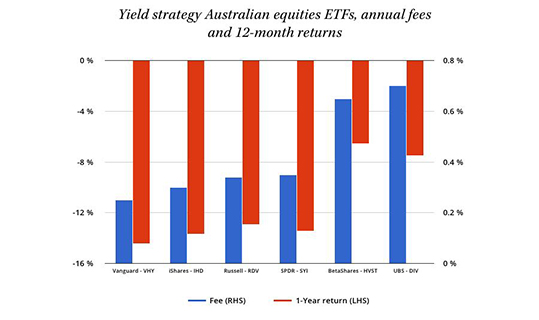

With fixed income and cash paying almost nothing after inflation, some investors have been attracted to stocks that pay reliable generous dividends. ETF providers have responded by launching funds they say are tailored to harvest a better dividend yield than the benchmark.

Market returns for the past year have been pretty terrible, unfortunately, but judging by the six yield strategy ETFs in the chart (which uses Bloomberg data to March 29) it looks as though the more that was paid in fees, the less capital was lost. Annual fees for the funds shown range between 0.25% and 0.70%.

Past performance is no indicator of future returns, of course, so no-one can say whether the relationship between fees and performance shown in the chart will last. If the providers’ common objective of chasing income leads to them all achieving roughly the same returns, the more expensive funds will stand out for the wrong reason.

ETFs … NOT SO SIMPLE AFTER ALL

The introduction of ETFs has delivered investors some powerful tools, but these “simple” listed products are far from trivial. Sometimes it pays to hand over the task to professionals who manage model portfolios of ETFs, like the InvestSMART model portfolios that are constructed to suit a range of investor styles and risk profiles.

Managers of model ETF portfolios carry out deep research to refine their selection of funds to a bare minimum, to reduce transaction costs, and investment decisions will reflect forecasts calculated on the back of reams of economic data. It’s full-time work.

Investors at home have to ask if they can do a better job of it. It’s all too easy to built a satisfactory portfolio of ETFs only for it to slowly go out of shape over time as new products prove too much distraction and the investment media does its job of planting doubt.

Life’s too short for that.

Frequently Asked Questions about this Article…

Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges, much like stocks. They are popular because they offer a cost-effective way to invest in major sharemarket indices, providing diversification across asset classes and international markets, which helps reduce the risk of sudden negative shocks to a portfolio.

ETFs generally have lower fees compared to managed funds. For example, an ETF tracking the S&P/ASX200 might charge as little as 0.15% annually, whereas a managed fund aiming to beat the same benchmark could charge at least 10 times that amount. Over time, even small differences in fees can significantly impact the capital value of an investment.

Fees are crucial because they can erode investment returns over time. Even a small difference in fees can lead to a significant shortfall in capital value. For instance, a 0.30% difference in fees on an investment returning 6.5% over seven years can result in a $3,000 shortfall on an initial $100,000 investment.

In Australia, global fixed interest ETFs and ethical ETFs are gaining popularity. As the variety of ETFs expands, investors have more options, but it's important to remember that the original appeal of ETFs is their ability to cut costs and reduce risk.

Dividend-focused ETFs are designed to harvest a better dividend yield than the benchmark. These ETFs have been launched in response to investor interest in stocks that pay reliable, generous dividends, especially when fixed income and cash offer minimal returns after inflation.

Not necessarily. While some data suggests that higher fees might correlate with less capital loss in certain market conditions, past performance is not an indicator of future returns. If all providers achieve similar returns, more expensive funds may stand out for the wrong reasons.

Model ETF portfolios managed by professionals, like those offered by InvestSMART, benefit from deep research and economic data analysis. These portfolios are constructed to suit various investor styles and risk profiles, reducing transaction costs and ensuring the portfolio remains aligned with investment goals.

Individual investors might struggle to maintain a well-balanced ETF portfolio over time. New products and media influence can lead to distractions, causing portfolios to drift from their intended strategy. Managing an ETF portfolio requires ongoing attention and expertise, which can be challenging for those without the time or resources.