Emissions intensity still rising - fully offset by reduced generation

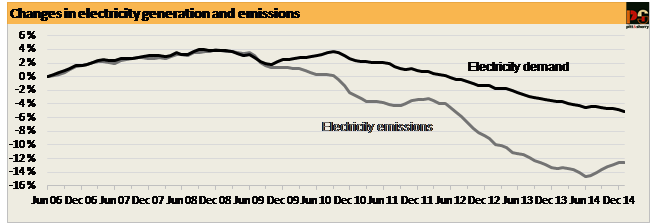

For the first time since last June, this month's Cedex Update is not reporting an increase in annualised emissions from electricity generation in the NEM. Emissions in the year to January 2015 were almost precisely the same as in the year to December 2014. The main reason for the halt in absolute emissions growth is that annualised generation fell more sharply than it has over most of the past seven months (Figure 1).

Figure 1

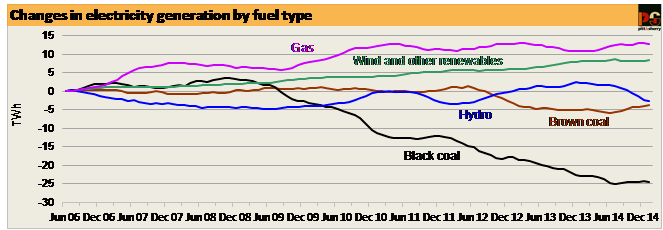

While generation dropped, emissions remained flat, with this result made possible, as usual, by various changes in the mix of generation (Figure 2). The steady rise of annualised brown coal generation continued, but black coal generation, which has also been rising steadily since July 2014, fell slightly. The fall in hydro generation slowed, whereas annualised wind generation rose slightly, while still remaining below the peak annualised level recorded in the year ending last July. Finally, annualised gas generation fell, as small increases in Queensland and NSW were insufficient to offset falls in Victoria and SA. It remains likely that the peak in gas fired generation, which we have been anticipating in recent issues of Cedex Update, was reached in the year to December 2014. However, the recent fall in crude oil prices, to which Australian gas prices are now ultimately linked, may affect this assessment.

Figure 2

The overall effect of these changes was that the annual share of coal-fired generation rose again to reach 74.7% in the year to January 2015. Total emissions in the year to January 2015 were 2.6% higher than in the year to June 2014, and the emissions intensity of NEM electricity was 3.3% higher.

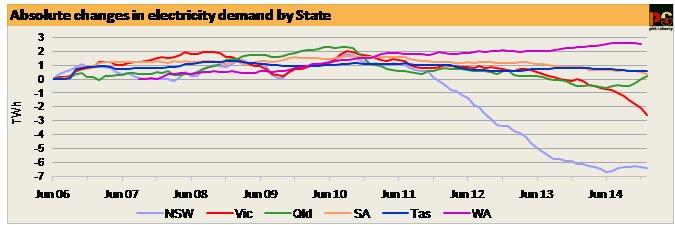

State by state changes in demand for electricity in the year to January 2015 show contrasting stories (Figure 3). Demand fell quite sharply in both Victoria and SA, as the effect of the Point Henry aluminium smelter closure in Victoria was augmented by the absence of any heatwave events comparable to the event from 13 to 18 January 2014. As we have previously explained, extreme heat has a much larger effect on electricity demand in these two states than in the other three states in the NEM. These falls were offset by a large increase in Queensland demand, almost entirely caused by an apparent new, but mysterious, major industrial load*. Note that WA demand data for the full month of January 2015 were not available at the time of publication of this issue of Cedex Update.

Figure 3

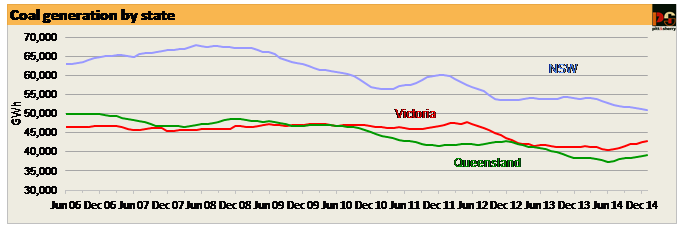

To end this issue of Cedex Update we present some figures on the changing fortunes of coal-fired generation in NSW, Queensland and Victoria, where most of Australia's coal-fired power stations are located (Figure 4). The dramatic decline in NSW is particularly obvious. In the year to January 2015, NSW coal generation was no less than 25% lower than the peak reached in the year to June 2008, and 10% less than at the start of the NEM in 1999. Over that period three power stations have been closed: Munmorah (soon to be demolished), Wallerawang C and, most recently, Redbank, a small plant which was only commissioned in 2001. NSW generation has continued to fall since last June, whereas coal-fired generation in both Victoria and Queensland has been able to take advantage of the removal of the carbon price by increasing output. When NSW demand was at its maximum, in the year to March 2009, local coal generators supplied 88% of total state requirements. In the year to January they supplied 76% of demand, which had itself fallen by 10%. Supply through interconnectors from Victoria and Queensland accounted for 14.5% of total NSW demand in the year to January 2015, with the balance shared by gas, hydro and wind.

Since the removal of the carbon price, Victorian brown coal generation has been steadily climbing back to the relatively stable level of total output it achieved up until the introduction of the carbon price. In doing so, it is supplying in net terms a significant share of demand in not only NSW, but also SA and Tasmania.

Several interesting conclusions can be tentatively drawn from these changes in the pattern of generation and supply. Firstly, in the absence of a price on greenhouse gas emissions, the very low marginal cost of brown coal generation gives it a distinct competitive advantage; this advantage, thanks to very low fuel costs, was eroded to a significant degree when the carbon price was in place.

Figure 4

Secondly, the recent changes in ownership of NSW power stations, from the NSW Government to companies holding generation capacity across state borders, may have encouraged this shift to Victorian supply. NSW has five large coal-fired power stations. Bayswater and Liddell, respectively the largest and the third largest, are now owned by AGL, which also owns Loy Yang A, the largest brown coal power station in Victoria. Mount Piper, the fourth largest NSW station is owned by Energy Australia, which also owns Yallourn W, the third largest of the four large Victorian stations. Energy Australia also owns Wallerawang, which it recently closed down. AGL's purchase of Bayswater and Liddell was completed only recently, and does not yet seem to have had much effect on the operation of its three major plants. However, Energy Australia appears to have steadily increased output from Yallourn W over the past year, with annual capacity factor rising from 61% in the year to June 2014 to over 76% in the year to January 2015. By contrast, the capacity factor of Mount Piper has fallen over the same period from 78% to 68%, while Wallerawang has been completely closed down.

For information, only one of the five NSW coal-fired power stations, the 1320 MW Vales Point B, now remains under government ownership. Eraring is owned by Origin Energy, who owns several large gas-fired power stations in Queensland and Victoria, but no other coal-fired power stations.

This is the latest Carbon Emissions Index report on Australia's energy emissions from pitt&sherry. Data analysis, text and graphs: Hugh Saddler, Hannah Meade and Mark Johnston.

*The data suggest that this is a very large new continuous industrial load of around 400 MW, which came on line on 27 October. The identity of this load appears, surprisingly, to be commercial in confidence. It is about the same size as either one of the two recently closed aluminium smelters. In a full year, a load of this size would add about 3.5 TWh to annual electricity demand, equal to almost 2% of current NEM demand and over 7% of Queensland demand prior to its connection.