Eight standout graphs from the Murray inquiry's interim report

David Murray’s interim report into Australia's financial system makes for some interesting reading, if you have a spare couple of weeks.

The 400-plus page tome covers a wide range of topics, from superannuation through to how technology and globalisation are affecting the banking sector. If this is just the interim report, it makes you wonder how comprehensive the full version will be when it's released in November.

Business Spectator has already covered a number of topics from the report (you can see them all here), but for some lighter reading, we've pulled together the key graphs from the document.

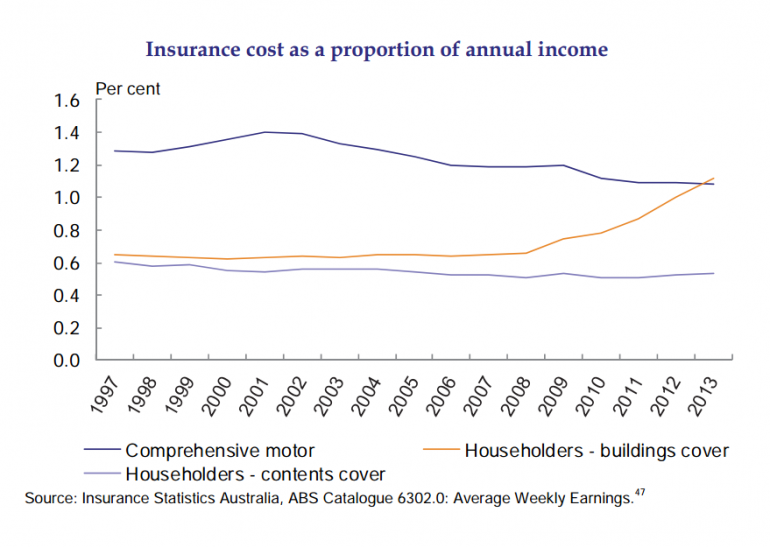

First off, Australians are spending more insuring their homes than their beloved cars.

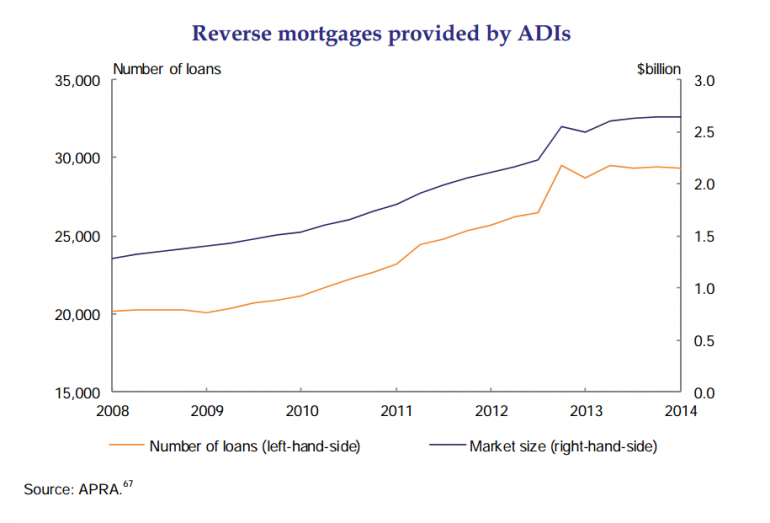

Meanwhile, more and more older Australians are now opting to sell part of their home to the bank in order to retire. Reverse mortgages are on the rise.

On retirement, self-managed super funds are the clear winner for Australians saving for retirement. Could this be the work of excessive fund fees?

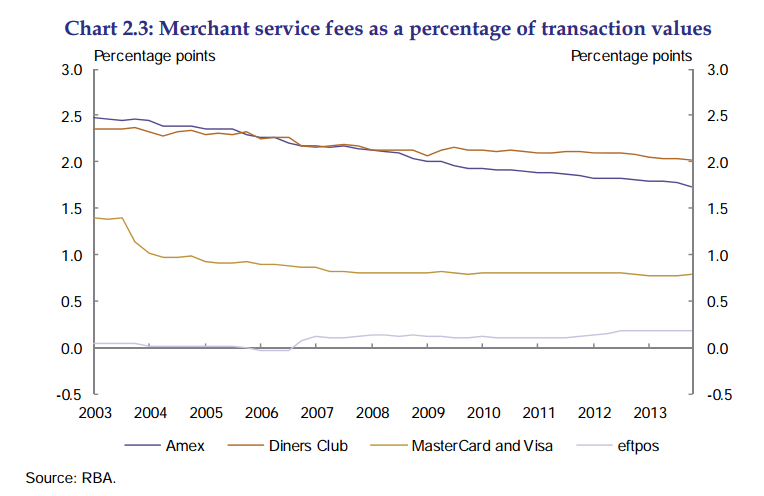

While our love affair with plastic may be waning, declining credit card transaction fees will be welcome news for the shoppers out there. This graph also reinforces why you should always consider pressing ‘savings’ rather than ‘credit’ on any given EFTPOS machine. It results in lower charges for retailers.

The whole merchant fee system is pretty complex, so the report actually drew out this diagram to explain it. Notice all the fees.

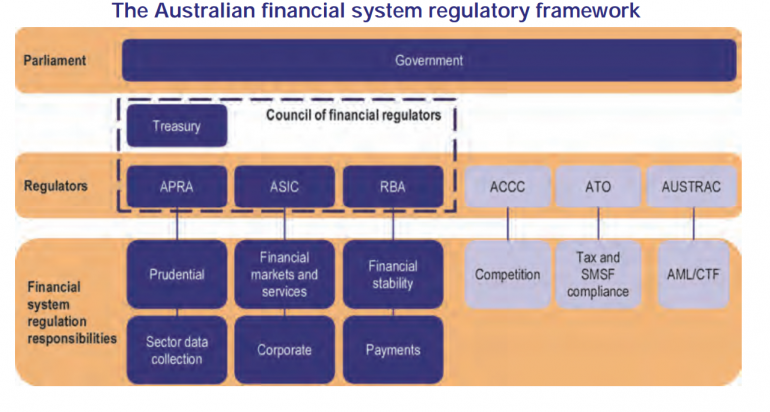

Talking about complex, it’s tough to keep up with all of the bodies involved in regulating Australia. So here’s another flow chart showing who's in charge of what.

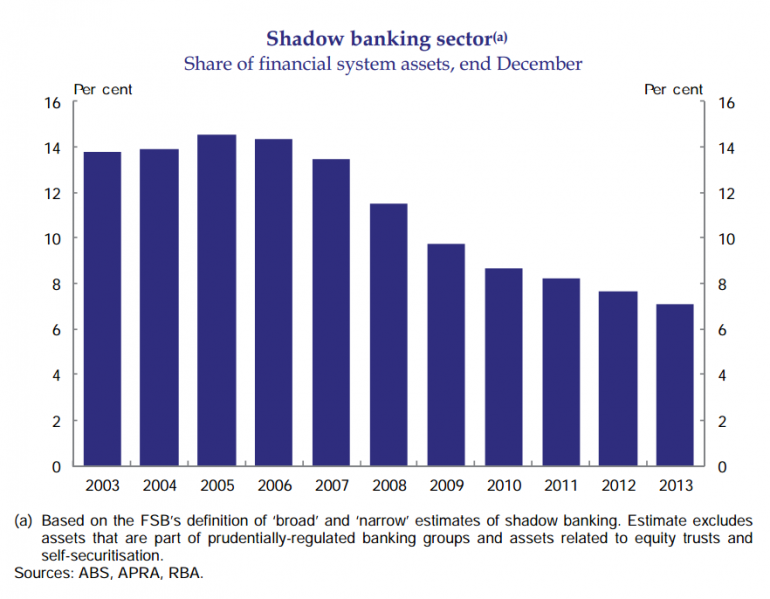

As a result of increased scrutiny from regulators across the globe, shadow banking is on the decline. Simply put, shadow banking is any lending undertaken by an institution other than a registered bank. It operates without any regulatory oversight.

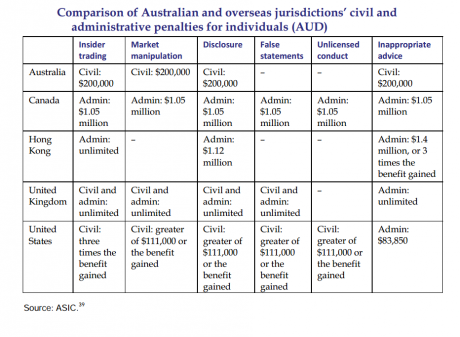

Meanwhile, the report also highlights another area that may be due for tighter scrutiny: market-related civil penalties. Comparatively, it’s quite cheap to break securities laws in Australia.

Again, this is just a brief skim of the report. Check out our more detailed coverage here.

Got a question? Let us know in the comments below or contact the reporter @HarrisonPolites on Twitter.