Efficiency eats away energy demand

The Australian Bureau of Statistics has just released its energy account statistics up to 2011-12. It illustrates how greater household energy efficiency and the contraction of manufacturing have put a lid on electricity and gas demand over the last four years.

In addition, petrol consumption has barely grown. The one area of major growth has been use of diesel fuel, driven by 79 per cent growth in its use in the mining sector and 138 per cent growth in its usage in household passenger vehicles.

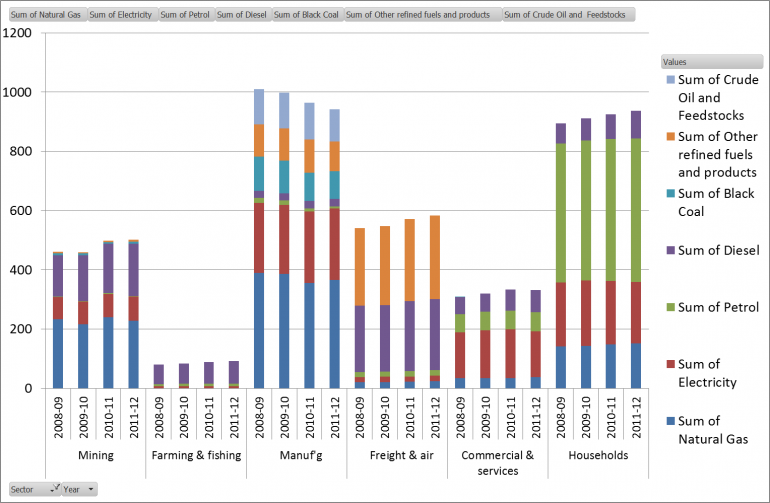

The chart below illustrates how the structural decline in manufacturing, driven by the high Australian dollar, has hit domestic energy consumption. Natural gas consumption, in particular, has been hit by the downturn in manufacturing (although electricity consumption in manufacturing has not declined). Meanwhile, gas consumption in mining has stagnated, with 2011-12 consumption lower than 2008-09, and household use has grown very little.

Given the likely rocketing in gas prices, this decline in usage in manufacturing will probably accelerate. While both mining and household energy consumption have grown, this is almost entirely concentrated in consumption of transport fuels, particularly diesel.

Figure 1: Australian final energy consumption by sector and fuel (petajoules)

Source: Australian Bureau of Statistics (2013) Energy Account 2011-12

Now, of course, this data leaves out the last financial year which, regular Climate Spectator readers would be aware, experienced noticeable declines in electricity consumption. Data from the Australian Energy Market Operator suggests that eastern states’ electricity consumption in both 'manufacturing' and 'commercial and households' experienced notable declines. This would further reinforce the picture of stagnating domestic energy demand outside of transport fuels.

Besides the major decline in manufacturing’s consumption of natural gas (but not electricity) the other interesting finding from the ABS data is the considerable improvement in household energy efficiency.

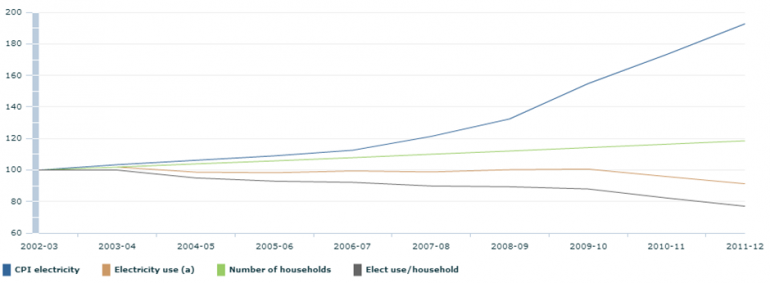

Electricity consumption per household is 23 per cent lower today than in 2002-03. One can also see a decline in overall electricity consumption across all households in 2010-11 and 2011-12. Part of this is likely to be a lagged response to spiking electricity prices, which commenced in 2008-09 under new electricity network regulatory arrangements put in place under Ian Macfarlane during the Howard government.

Figure 2: Household electricity use and prices relative to 2002-03 (index = 100 in 2002-03)

Source: Australian Bureau of Statistics (2013) Energy Account 2011-12

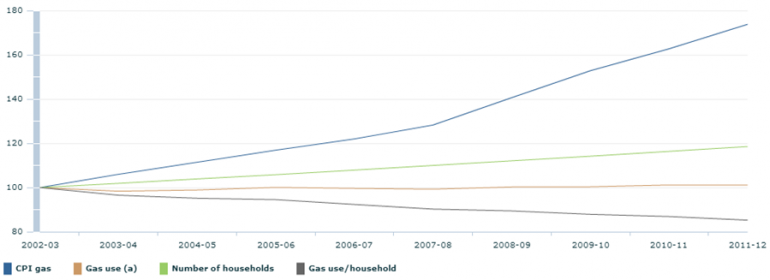

Gas consumption per household is down 15 per cent and absolute consumption across all households has only grown by 1 per cent since 2002-03.

Figure 3: Household gas energy use and prices relative to 2002-03 (index = 100 in 2002-03)

Source: Australian Bureau of Statistics (2013) Energy Account 2011-12

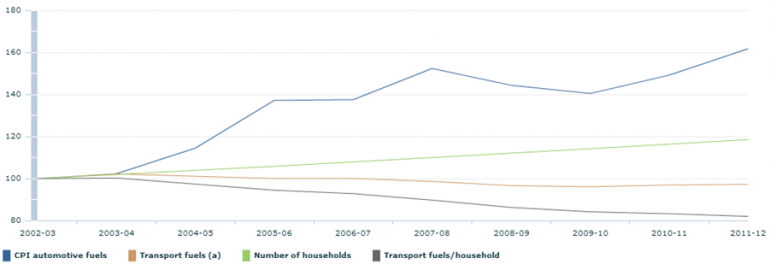

And even though there was a slight rise in transport fuel use since 2008-09 across the entire household sector, looking back further to 2002-03 fuel use is down 3 per cent. And on a 'per household' basis it is 18 per cent lower than 2002-03.

This is probably partly a function of an overall improvement in vehicle fuel economy and partly due to the rise in the use of diesel vehicles, which are more efficient than petrol engines.

Figure 4: Household transport fuel energy use and prices relative to 2002-03 (index = 100 in 2002-03)

Source: Australian Bureau of Statistics (2013) Energy Account 2011-12

Australia’s domestic energy market appears to be experiencing a major structural shift. The rise in the value and volume of Australia’s energy exports is coming at the expense of domestic manufacturing consumers of energy. Manufacturers face a triple whammy – the price of energy is rising as export markets are prepared to pay higher prices; in addition they get hit by a higher Australian dollar as a consequence of mining growth; and they face wage pressures through mining competing for labour.

Overall, energy suppliers are better off but domestic demand for natural gas is not looking good.

In addition, the household sector is becoming more efficient. Rising prices are an important part of this change... but it is more complex. Government policy and technological change are also driving change and it's possible that we are reaching saturation levels for motor vehicle use.