Editor's picks: Up or down?

We seem to be in very strange waters at the moment. Consumer confidence figures show that Australians are increasingly worried about the future, despite the fact that job numbers came in much better than expected and economic growth remains strong.

The big thing giving the markets the willies right now is China. Robert Gottliebsen and Stephen Bartholomeusz help explain what is happening in China and what that means for Australia;

The hidden crisis behind copper and iron ore price collapses

Hedge funds are shorting copper, BHP and Rio Tinto because they see dangerous weaknesses in China's banking system. The next stop for the market manipulators could be the Aussie dollar.

A Chinese burn for Australian miners

The major miners’ plan to expand production to blunt the impact of iron ore price declines will come under further pressure as China reduces its dependence on exports.

We’ve unlocked Stephen’s article for you – here’s a taste;

With China’s growth spluttering, its exports falling and banks starting to call in loans to loss-making steel mills, the trading and financing games have stopped. The big iron ore miners have become obvious and compelling targets for hedge funds.

The last time China started to look wobbly, it unleashed a massive stimulus program that not only saved Australia from recession but catapulted us to greater wealth. Will they do it again?

Here’s China Spectator’s Peter Cai in A return to stimulus in China?

The overriding political objective for the ruling Communist party is maintaining social stability. Beijing cannot afford to have unemployed people massing on the streets as a threat to its rule. So one of the most figures for China analysts to watch out for this year is the jobless rates, which will be the key determinant of Beijing’s economic policy.

China’s stimulus program saved us last time but it also meant we collectively kicked down the road the much more pressing, fundamental problem of our long-term structural deficits. Our coverage of Ken Henry’s comments about the crisis in tax revenues outranked all our other news stories by a factor of ten on Wednesday – it is clearly an issue that is of great concern to Business Spectator readers.

Unfortunately, Callam Pickering says; Henry and the tax experts are wasting their breath.

Most Read

Turning Conroy's NBN legacy to dust, by Supratim Adhikari

Stephen Conroy won’t have to worry about NBN Co staffers speaking ill of him behind his back for much longer. The latest NBN audit will have enough ammunition to dismantle his NBN legacy root and branch.

Most commented

Voters will punish Shorten's lack of vision, by Rob Burgess

The opposition leader’s tired and vague messages of protecting jobs and democratising the Labor party are not enough to cut through the serious economic issues facing the nation.

Article you should have read but probably didn't

The radio stations making waves for all the wrong reasons, by Ben Shepherd

Listeners are still tuning into radio, despite increased competition from online. But a new survey shows how some networks are making all the right moves, while others are seeing their market share take a dive.

Pic of the week

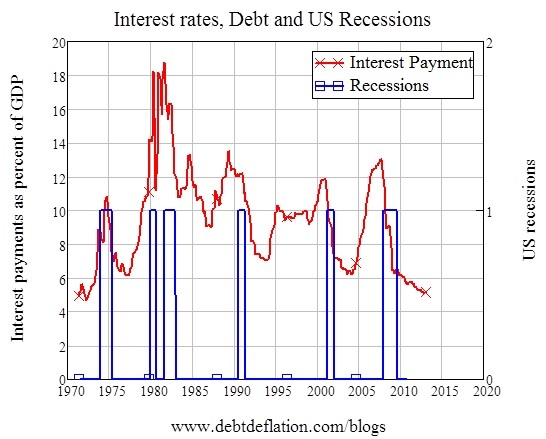

The US economy has been out of recession for five years although not many feel particularly convinced by that fact. Steve Keen says that growing debt demand is a sign that the US has recovered but also includes a warning. Growing debt is a good thing for economic revival but there are very clear correlations for the amount of money paid to service debt and recessions.

“If you look not at interest rates alone, but interest payments as a percentage of GDP, then the US economy seems prone to fall into a recession whenever this level stays above 10 per cent for a sustained period.”

So it looks like if your numbers are up above ten, then your number’s up. Something to keep an eye on.

Have a good weekend.

Jackson