Don't forget the Trump bump

The long-term importance of having a portion of your portfolio in overseas shares or exposed to US dollars was underlined again this week as the Australian dollar crumbled.

A lot of economic analysts have been forecasting higher Australian interest rates in the first half of 2018 —or even earlier— but it is becoming increasingly clear that those forecasts are likely to be wrong.

And they will look even further off the mark when the full extent of the fall in city apartments becomes apparent. As I understand it, the Reserve Bank has been fully briefed on the looming decline in apartment construction rates, so it is most unlikely to lift rates any time soon, especially given the sluggishness in pay increases.

But remember, for many companies the current economic environment is very good. Wages are not rising, the dollar has fallen, and costs are being reduced by technology. To take advantage of such a situation, the enterprise needs price and volume stability.

Meanwhile, we got a further whiff this week of just how important Donald Trump is to share markets. While “The Donald” was prancing around in Asia he was not looking after the political numbers for his tax package, so support drifted. Wall Street got wind of this and the 10-year bond rate slipped and shares eased. And that flowed through to Australia.

But, on his return, Wall Street firmed and the US 10-year bond rate recovered lost ground. We need to be aware that imbedded in the US market, and therefore the Australian market, is the expectation that the US tax package will be delivered. And leaving aside the local interest rate position, which I discussed above, we may face higher interest rates if the US rates rise.

Higher American interest rates will require the US tax package, and secondly that the tax package must suck American offshore money back to the US. There are no certainties but, as you all know, I have a sneaking optimism that the tax package will go through, but I wouldn't put the house on it.

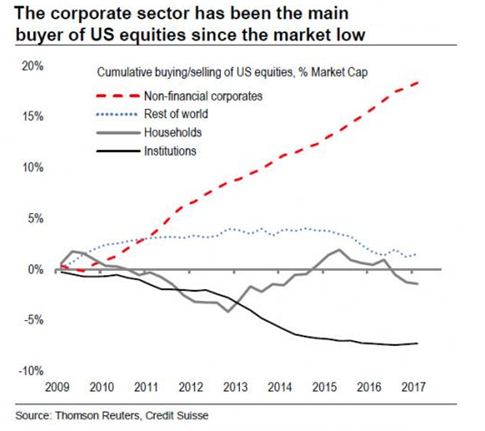

Meanwhile this graph below crossed my desk this week. It shows that the US market is being supported at these levels by corporate money. If the tax package booms in the US, then that money will be diverted to capital investment, but hopefully others will switch to shares.

Qantas aims for low succession turbulence

Now to people and issues.

It very fashionable to debate chief executive salaries, but far more important is the calibre, talents and plans of any new CEO or chairman. During the week Qantas chairman Leigh Clifford was asked whether he planned to retire. And he was also asked about the future plans of CEO Alan Joyce. Clifford and Joyce have been the outstanding team on the Australian industrial list.

Ten years ago the board of Qantas, led by Clifford, had a string of candidates to choose as CEO (including current Virgin boss John Borghetti) and picked Joyce. What followed was turmoil that would have broken most CEOs, and there was a well-orchestrated campaign to have Joyce removed. But Clifford stood behind his CEO and gave him the backing required to totally transform Qantas, including dramatically lowering its cost base.

The prosperity of today's Qantas comes back to the combination of Clifford and Joyce. There are few CEOs and chairman with a closer relationship. The challenge for Qantas going forward is how to handle the transfer from the global dominance of Middle Eastern carriers, like Emirates and Etihad, to Chinese airlines.

Qantas played the Middle Eastern game successfully with its link to Emirates. But now it is loosening the ties somewhat by cutting its exposure to Dubai Airport and it will need to cope with a much greater presence of China in the global airline market. There is a significant difference between the strategy of Emirates/Etihad and the Chinese airlines.

The Middle Eastern carriers had a fantastic hub, but they did not have a substantial passenger base. Moreover, Etihad thought it might be a good idea to buy troubled European carriers to lock in passengers. The Europeans saw them coming and they lost heavily, affecting their momentum and leaving them more vulnerable to the Chinese.

The Chinese middle-class are becoming the biggest tourist market in the world, and with that lift will come great prosperity for the airlines. How Qantas handles that will play a big role in its future, and it would seem that Clifford and Joyce believe they will tackle the early skirmishes while testing two executives Gareth Evans (now head of Jetstar) and Jayne Hrdlicka, who is heading the Qantas loyalty and digital ventures business.

When Joyce decides to step down, Evans and Hrdlicka are the two front runners. But Qantas should not have both Clifford and Joyce leaving at the same time.

Former Wesfarmers boss Richard Goyder has been brought in to potentially replace Clifford when he is ready, and/or when Joyce signals he wants to retire. Clearly there has been a lot of thought put into the Qantas succession.

But Rio's path could be rockier

Not nearly as much thought has been put into the succession at Rio Tinto. If Mick Davis becomes chairman of Rio Tinto, then shareholders should fasten their seat belts. When Davis was in charge of Xstrata he went on a takeover binge, buying just about anything he could get his hands on.

As it turned out, a boom followed and Xstrata made a lot of money and then Davis convinced Glencore to buy the minority holding in Xstrata at the top of the market. Davis and Xstrata shareholders did very well. Glencore did not do nearly as well because some of Davis's acquisitions were second-grade mines, which suffered in the downturn.

If the press reports are correct and Davis gets the job at Rio Tinto, then there is clear danger that he will follow his Xstrata pattern. The man who has kept Rio Tinto on track in the last decade has been Australian Chris Lynch as chief financial officer. Lynch said he will step down in September 2018, so whoever becomes Rio chairman will have enormous power.

It is possible that Davis has changed his spots and could be a chairman for Rio Tinto in the conservative mould. The great fear Rio Tinto shareholders should have is that Davis will convince the Rio Tinto board to buy the trader Glencore, which still owns a lot of the assets that he bought in the Xstrata days.

BHP shares will then look very attractive, unless you want a fun ride with lots of action.