Dollar doldrums put a shine on Platinum

| Summary: The Australian dollar is expected to continue to retreat, providing some excellent investment opportunities. Global equities manager Platinum Asset Manager is likely to be as a key beneficiary of the declining Australian dollar, but the market has already factored it into the share price. |

| Key take-out: Platinum is positively leveraged to a decline in the Australian dollar. |

| Key beneficiaries: General investors. Category: Growth. |

Recommendation: Outperform. |

The Australian dollar has declined by approximately 14% since its April peak of US$1.05. Last week the dollar reached its lowest level since September 2010 following the RBA Governor Glenn Steven’s ‘light-hearted’ comments that the RBA “deliberated for a very long time” over the decision to keep the cash rate unchanged at 2.75%. The seemingly innocuous comment sent economists and traders scrambling to revise their cash rate and currency expectations downward. After a clarification from RBA Deputy Governor Philip Lowe that the RBA indeed deliberates for a very long time over every decision, negative sentiment was somewhat tempered.

Semantics aside it is our view the Australian dollar weakness will continue, reflecting a resurging US economy, the tapering of quantitative easing by the Fed, and softening fundamentals in Australia. As the RBA Governor Glenn Stevens highlighted: “The Australian dollar has depreciated by around 10 per cent since early April, although it remains at a high level. It is possible that the exchange rate will depreciate further over time, which would help to foster a rebalancing of growth in the economy.”

Evidence of a US recovery continues with the US adding 195,000 jobs for the month of June. Well above market expectations of ~165,000. The higher than expected jobs figures strengthened expectations of tapering Fed asset purchases. The rallying US job market is in stark contrast to the domestic economy which shows evidence of increasing unemployment. On Monday, ANZ job advertisements recorded its fourth consecutive negative month as the number of job advertisements fell 1.8% in June. Seasonally adjusted job advertisements are at its lowest level since July 2009. Declining job advertisements are a reliable indicator of higher unemployment and lower interest rates.

One of our Big Calls for 2014 is for the Australian dollar to retreat to around US$0.85. The negative consequences will of course be that as the Australian dollar falls, offshore investors will rush to repatriate their “hot money” offshore. The good news is that once the Australian dollar stabilises at a lower level, there are likely to be some excellent opportunities. We identify Platinum Asset Management (PTM.AX) as a healthy beneficiary.

Platinum Asset Management (ASX:PTM)

Current Valuation: $4.56 2014 Valuation: $4.74

Platinum Asset Management (ASX:PTM) is a boutique fund manager that specialises in global equities offering a range of funds covering specific regions and sectors. They currently manage just under A$20bn, with their flagship, Platinum International Fund holding approximately A$8.3bn in funds under management (FUM), as at May 2013. Their high exposure to international equities, which are enjoying relative outperformance to Australian equities, makes them highly leveraged to the devaluation of the Australian dollar and will support FUM levels. These outcomes will provide upward pressure on our valuation over the coming 12 months.

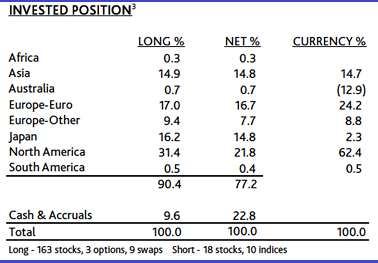

Platinum’s International Fund update for May 2013 advised that at a regional level they have increased their exposure to North America, particularly through increases in technology stocks. They added that with respect to currency strategy they have increased their exposure to the US dollar and Euro, and since early May (at 102c) the fund has been short the Aussie dollar. This strategy will be highly beneficial to their earnings profile given the recent and continuing weakness in the Australian dollar.

Source: Platinum Investment Management. Platinum International Fund, May 2013, Monthly Update

The competitive advantage for any fund manager is their performance, which is driven by their investment process and team. Renowned fund manager, co-founder, and majority shareholder Kerr Neilson is a proven operator providing consistent outperformance for their funds. He is the CEO and despite stepping back from CIO responsibilities in May, he retains portfolio management responsibility for the global mandates. Co-founder, and substantial shareholder Andrew Clifford has assumed the role of CIO, after managing the Asia Fund and portion of the International Fund in previous years. Since PTM’s 2007 listing, employees have retained approximately 70% of total shares on issue. We like it when fund managers have ‘skin in the game’ and the investment team’s entrenchment in equity reduces any ‘key man risk’. One need not look any further than the departure of John Sevior from Perpetual and the subsequent outflows to witness the FUM implications of losing key people.

Despite volatility in global markets, PTM have achieved strong long term performance, outperforming industry benchmarks. Their May 2013 update was very encouraging, displaying evidence of improved performance. The International Fund returned 3% above the benchmark on a one month basis, while the Global Fund and the Asian fund returned 1.9% and 0.9% ahead of benchmarks respectively. Continued performance will translate to a boost in performance fees, which are similarly leveraged to a declining currency. The relatively strong performance of international markets also provides healthy support for their FUM. In the last 6 months, the MSCI USD World index returned around 7% versus the All Ordinaries which returned around 2.5% for that same period.

On a sector view, the current outlook for the Australian funds management sector is very positive. The industry’s growth is underpinned by compulsory superannuation, which will be rising to 9.25% this year. Regardless of the election outcome, both the Labor and Liberal parties have flagged their intent to increase the compulsory superannuation in the years ahead which will support further funds growth. The pull-back in the cash rate will also drive a rotation out of the ‘safety’ of cash, which currently provides close to a negative real return. Fund managers will benefit from net inflows and market performance as investors switch into riskier assets such as equities.

Dollar devaluation provides uplift

Platinum is a solid company, with a strong balance sheet and cash flows. It provides a solid dividend yield of 3.7%, and grossed up dividend yield of 5.2%. In our view Platinum should benefit from further investment performance, sector inflows and due to their global exposure, the further devaluation of the Australian dollar will provide a greater uplift in earnings growth. The current 2014 valuation of $4.74 versus the market price of $5.89 suggests the market has more than factored the above into the share price.

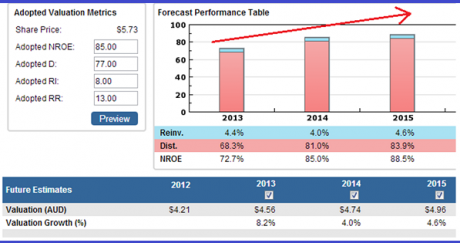

Source: StocksInValue

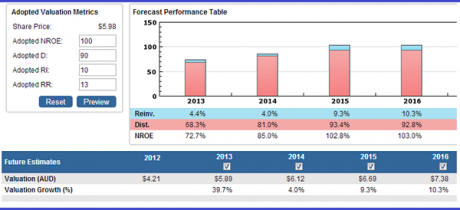

However if this trend of improving performance and declining AUD continues, the probability of improving profitability and thus valuation increases. In a bull case, there will be a significant lift in forecast net profit, which will drive NROE back to levels in excess of 100%. Modelling this in our Stocks in Value Dashboard, we come to a 2013 valuation approaching $6.

Source: StocksInValue

Platinum are therefore on the radar, with any price weakness an opportunity to include PTM in the growth portfolio should we continue to see fund outperformance coupled with further devaluation of the Australian dollar.

John Abernethy is the Chief investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To find out more about Clime Asset Management, visit their website at www.clime.com.au.

Clime Growth Portfolio Statistics:

Return since June 30, 2012: 37.12%

Returns since Inception (April 19, 2012): 27.50%

Average Yield: 6.36%

Start Value: $111,580.24

Current Value: $152,997.11

Clime Growth Portfolio - Prices at close on 9 July 2013 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton | BHP | $31.65 | $31.61 | 5.60% | $47.21 | 49.35% |

| Commonwealth Bank | CBA | $53.38 | $70.14 | 7.80% | $66.70 | -4.90% |

| Westpac | WBC | $21.29 | $28.95 | 8.98% | $30.95 | 6.91% |

| Woolworths | WOW | $26.88 | $33.23 | 6.06% | $34.28 | 3.16% |

| The Reject Shop | TRS | $9.33 | $18.16 | 3.78% | $16.85 | -7.21% |

| Brickworks | BKW | $10.15 | $12.56 | 4.78% | $12.48 | -0.64% |

| McMillan Shakespeare | MMS | $11.88 | $17.67 | 4.85% | $18.56 | 5.04% |

| Mineral Resources | MIN | $8.98 | $8.43 | 10.17% | $14.04 | 66.55% |

| Rio Tinto | RIO | $56.86 | $52.04 | 5.19% | $80.58 | 54.84% |

| SMS Management & Technology Limited | SMX | $4.35 | $5.14 | 7.50% | $5.90 | 14.79% |