Dividend Dazzlers 2015

Summary: Numerous studies have analysed the importance of dividends and found a strong relationship with high dividend paying stocks to attractive investment returns in the long term. Aside from stating the obvious, the danger with this principle is that it categorises high yield stocks into one ‘safe' group rather than separating them into subsets. When they are separated into ‘defensive' and ‘cyclical' categories, a clearer picture emerges. |

Key take-out: In contrast to the 2007 bear market, defensive high yield stocks have performed significantly better because these companies, especially in the infrastructure and utilities sector, have been able to restructure their debt and are in a much stronger financial position than they were during the GFC. Faced as we are with weak economic growth, defensive high-yield stocks are set to do well again. |

Key beneficiaries: General investors. Category: Shares. |

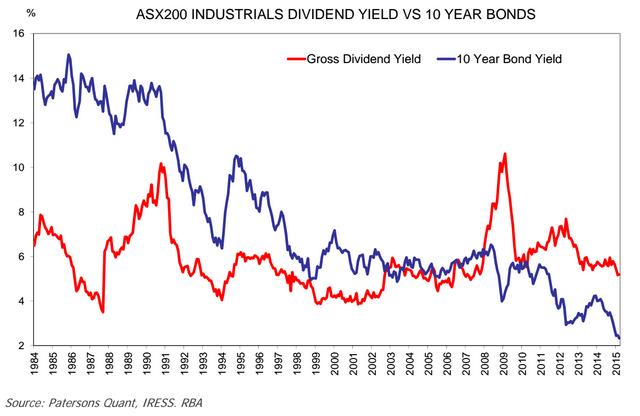

The gap between S&P/ASX200 Industrials dividend yield and 10 year bond yield has remained relatively stable. Indeed, it's still a very decent gap. No wonder dividend seeking investors still dominate the market.

Now there have been numerous studies, largely from academic literature, analysing the importance of dividends, and the strong relationship of seemingly high dividend paying stocks with attractive investment returns in the long term.

This relationship is known as the “yield effect” and a number of investing strategies have emerged as a result of this research, including Dogs of the Dow theory.

The basis of these strategies relies on the longstanding opinion that value stocks tend to outperform growth stocks in the long term. Among the first studies was a paper published by Fama and French in 1992 called "The Cross-Section of Expected Stock Returns".

The problem with this underlying principle and others like is that it is stating the obvious. Ignoring the idiosyncratic risks, it is well known that high beta (low yields) stocks will almost always underperform in bear markets.

The danger with this principle is that it broadly categorises high yield stocks into one “safe” group rather than separating them into subsets which have a significantly higher information coefficient to alpha, especially in the context of the current market cycle.

High yield stocks should be classified as either defensive high yields (low risk dividends) or cyclical high yields (high risk dividends). By their nature, cyclical stocks are considered growth stocks and usually have low yields in rising markets. Hence, when a cyclical company falls into the high yield group, it is usually the result of a sharp decline in its share price (negative sentiment) which, more often than not, indicates that its forecast distribution will be cut.

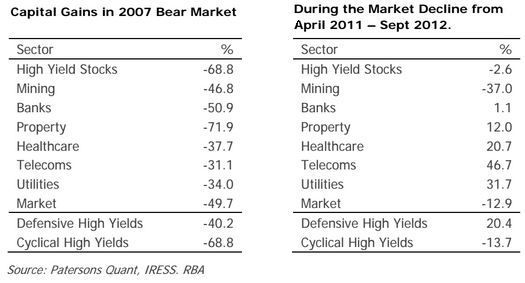

The table below provides a comparison of the average capital gain achieved for various classifications during the GFC.

At the end of 2007, if investors had concentrated on high yield stocks, they would have underperformed the market significantly. The reason for this is that the high yield stocks in 2007 consisted of many serial underperformers, especially companies with exceptionally high debt levels, e.g. Allco Finance Group, Zinifex, Centro Property. This explains why property and infrastructure stocks also underperformed during this time, even though the investment mantra misconstrued them as being “defensive”.

High yield classification

By separating high yield stocks into the “defensive” vs “cyclical” categories, a completely different picture emerges. During the last bear market, defensive high yield stocks such as those in telecoms, utilities and infrastructure, consumer staples, and property, did well relative to the cyclical high stocks (retail, media, steel and financials). Faced as we are with weak economic growth, defensive high-yield stocks are set to do well again.

Keeping all that in mind here's the situation today. Outside the major banks, the stocks with sustainable fully franked high yields are shown in the table below. However, to isolate the stocks we regard as purely defensive among this group means a considerable reduction in choice - the list would be confined to Telstra, AusNet, Duet, Wesfarmers and Woolworths.

Company | Dividend yield |

Telstra | 5.0% |

AusNet Services | 6.0% |

Duet Group | 7.0% |

Wesfarmers | 4.9% |

Woolworths | 4.8% |

Outside the S&P/ASX100, Maca, MMA Offshore and Skilled Group have the most attractive yields but these lie in the “yield trap” category.

The stocks that appear to have sustainable yields in this group include the listed investment companies (LICs) Cadence Capital and WAM Capital, Programmed Maintenance (7.5 per cent), Data#3 (6.8 per cent), Mortgage Choice (6.5 per cent), Chandler Macleod Group (6.3 per cent), Energy Developments (5.9 per cent partially franked), and Automotive Holdings (5.5 per cent).

Currently G8 Education has a perceived fully franked yield at 7.0 per cent but we remain concerned with its free cashflow, assuming further acquisitions of childcare centres are undertaken in the coming year.

The industrial sectors which are most at risk of dividend cuts include retail, media, and mining services. Those stocks on our high risk list that have now cut dividends during the eporting season are: Coca-Cola Amatil, Leighton Holdings, James Hardie, Arrium, Bradken, Cabcharge, Mineral Resources, Cardno, Oroton Group, ALS, The Reject Shop, Fortescue Metals Group and Cochlear.

It was interesting to see WorleyParsons maintain its first-half dividends despite the company forecasting a decline in revenue and margins. In fact, debt is currently being used to maintain dividends.

The highest dividend yield stocks in the S&P/ASX100 for this month are Metcash and Suncorp but these are at risk of dividend reductions over the coming years. Metcash is currently undertaking a strategic review after cutting its interim dividend in December.

Both BHP and Rio Tinto have attractive fully franked yields at 5.1 per cent and 5.3 per cent respectively but the sustainability of these distributions is a function of the movement in the underlying commodity prices.

Analysts have questioned whether a progressive dividend policy is ideal in the current market climate because it reduces the ability for these large resource companies to acquire cheap assets. Over the month, earnings expectations for these companies have declined by 4 per cent and 16 per cent respectively.

Sam Fimis published Premiership Portfolio (lIVE lINK). This is an edited version of a report first published on March 27