Diversified Portfolios - InvestSMART Balanced - 30 June 2016

COMMENTARY

PORTFOLIO COMMENTARY

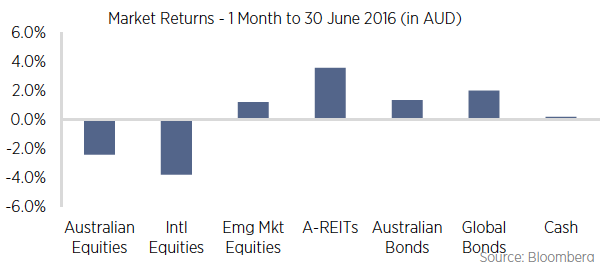

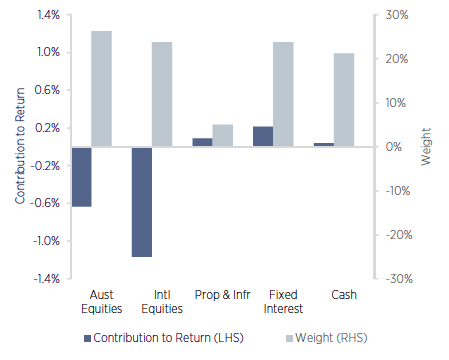

The big news in markets for the month of June centred around the UK's decision toleave the European Union, this generally impacted equity markets negatively but hada positive impact on bond prices as investors flocked to the safety that these assetspurportedly provide. This impacted the portfolio negatively over the month as theportfolio is overweight Australian equities and within international equities tends tohave a bias towards Europe due to the portfolio’s underweight to the US.

The InvestSMART Balanced Portfolio returned -1.4% over the month of June. TheAustralian equity exposure returned -2.4% for the month, while the internationalequity exposure was impacted by the bias to Europe which was down around 9%versus the broader market return of -3.8%. Positively, the allocation in emergingmarkets (which were broadly flat) had a positive impact on the portfolio, mitigatingsome of the fall in European exposures.

The portfolio's exposure to Australian REITs contributed positively to the portfolioover the month with local REITs up 3.8% over the month. It is apparent that A-REITsare being supported by a low interest rate environment and investors desire for yield.From this perspective we believe that valuations in the REIT sector appear stretchedand may look to trim the exposure in coming months. The global property exposurewas broadly flat, which would have been positive had it not been mainly impacted bythe currency.

Within fixed interest the portfolios exposure to Australian government bondsperformed well returning 1.4%, while the exposure to Macquarie Income OpportunitiesFund lagged the broader bond market, returning 0.1%.

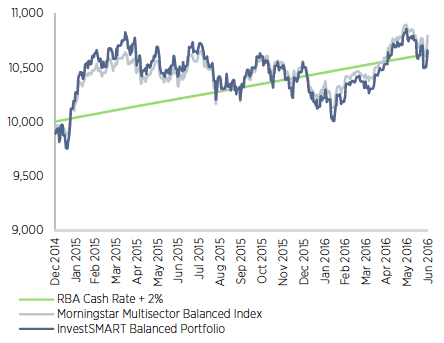

Since inception the portfolio continues to track ahead of its cash 2% objective by around 0.2%.

PORTFOLIO OBJECTIVE

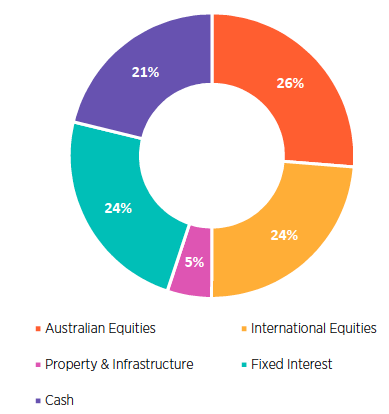

The portfolio remains overweight Australian equities on the basis that valuationsappear reasonably compelling when compared to other asset classes and given theattractive yield characteristics of the asset class. Within fixed interest the portfolioholds Australian government bonds and has an exposure to Australian credit andoverseas securities. The portfolio is expected to do well in an environment whereAustralian equities outperform other asset classes and where credit outperformsgovernment bonds. Within international equities the portfolios have a bias towardsemerging markets and an underweight to US equities, therefore the portfolio willbenefit when US equities underperform broader equity markets and emergingmarkets do well.

Growth of $10,000

Income Reinvested

Asset Allocation as at 30 JUNE 2016

Source: Praemium, RBA

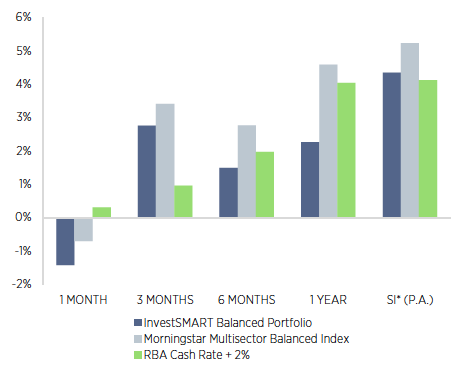

Returns are before expenses and fees. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 29 December 2014.

PORTFOLIO POSITIONING

The portfolio remains overweight Australian equities on the basis that valuationsappear reasonably compelling when compared to other asset classes and given theattractive yield characteristics of the asset class. Within fixed interest the portfolioholds Australian government bonds and has an exposure to Australian credit andoverseas securities. The portfolio is expected to do well in an environment whereAustralian equities outperform other asset classes and where credit outperformsgovernment bonds. Within international equities the portfolios have a bias towardsemerging markets and an underweight to US equities, therefore the portfolio willbenefit when US equities underperform broader equity markets and emergingmarkets do well.

Current market pricing implies that the portfolio's RBA Cash Rate 2% objective isachievable over the long-term but only through a reasonable allocation to relativelyvolatile equity investments. This means that investors should be comfortable withabove average volatility, which could result in a short-term fall in the portfolio's valueof around 18%.

| PERFORMANCE TO 30 JUNE 2016 | 1 MONTH | 3 MONTH | 6 MONTH | 1 YEAR | SI* (P.A.) |

|---|---|---|---|---|---|

| InvestSMART Balanced Portfolio | -1.43% | 2.75% | 1.49% | 2.26% | 4.34% |

| Morningstar Multisector Growth Index | -0.71% | 3.40% | 2.76% | 4.58% | 5.22% |

| Excess to Benchmark | -0.72% | -0.65% | -1.27% | -2.32% | -0.89% |

| RBA Cash Rate 2% | 0.31% | 0.96% | 1.96% | 4.03% | 4.11% |

| Excess to Objective | -1.73%% | 1.80% | -0.47% | -1.77% | 0.23% |

Peformance Summary to 30 June 2016

Contribution to Return 1 Month to 30 June 2016

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.

Frequently Asked Questions about this Article…

The UK's decision to leave the EU negatively impacted the InvestSMART Balanced Portfolio in June, as it led to a decline in equity markets. However, bond prices rose as investors sought safety, which partially offset the negative effects.

In June 2016, the Australian equity exposure in the InvestSMART Balanced Portfolio returned -2.4%, contributing to the overall negative performance of the portfolio for the month.

The portfolio is overweight in Australian equities because valuations appear compelling compared to other asset classes, and they offer attractive yield characteristics.

The performance objective of the InvestSMART Balanced Portfolio is to achieve a return that exceeds the RBA Cash Rate by 2% over the long term.

The portfolio's exposure to Australian REITs positively impacted its performance in June, as local REITs were up 3.8% for the month, supported by a low interest rate environment and investor demand for yield.

The portfolio has a bias towards emerging markets and is underweight in US equities. This strategy is expected to benefit the portfolio when US equities underperform and emerging markets perform well.

For the month of June 2016, the InvestSMART Balanced Portfolio returned -1.43%, underperforming the Morningstar Multisector Growth Index, which returned -0.71%.

Investing in the InvestSMART Balanced Portfolio involves risks, including potential short-term volatility and the possibility that the total return may be less than the amount invested. Investors should be comfortable with above-average volatility and consider their individual financial situation and objectives.