Diversified Portfolios - Intelligent Investor Growth - 31 March 2016

COMMENTARY

PORTFOLIO COMMENTARY

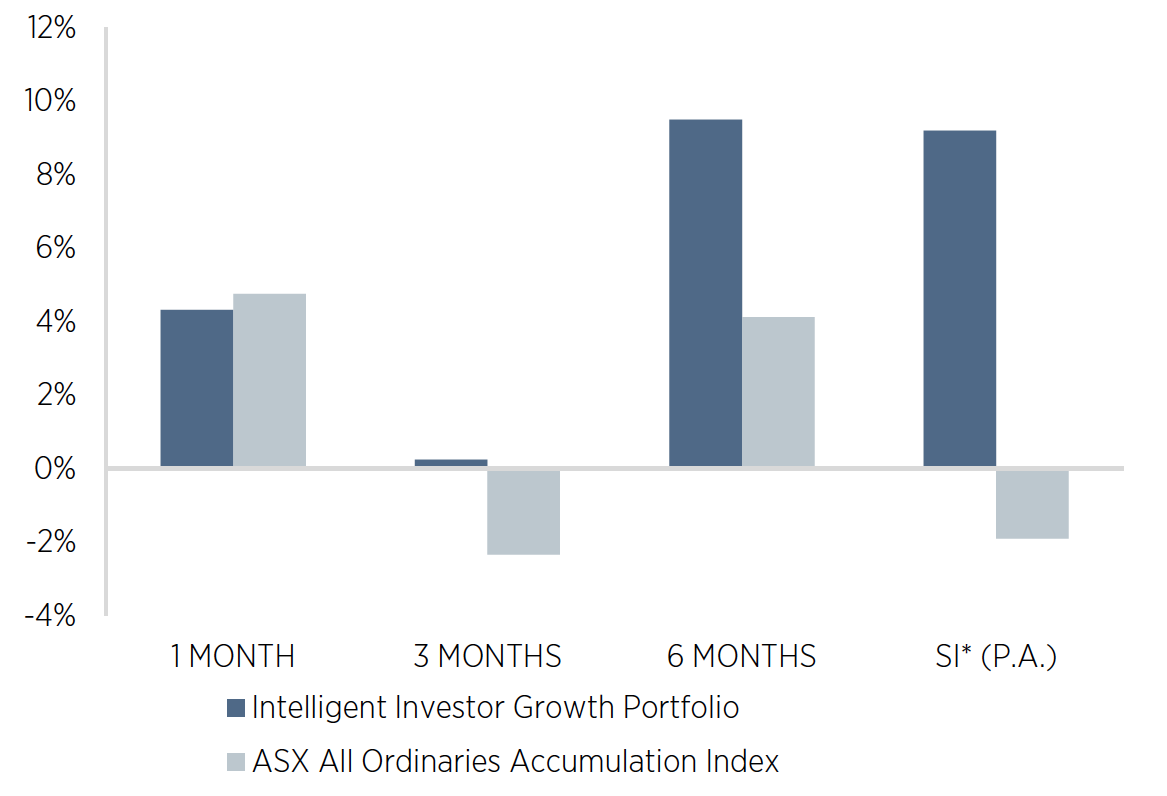

After the market’s January wobbles, things settled down in February and March and our Growth Portfolio actually managed to scrape a profit for the quarter, returning a not very grand total of 0.2%. Still, it compares with the All Ordinaries’ loss for the period of 2.4%, so we’re reasonably satisfied.

Since 1 July 2015, when we opened it up for direct investment, it has returned 9.2%, which is just over 11% ahead of the All Ords’ 1.9% loss. Since inception in 2001, the portfolio has returned 10.2% a year compared to 7.4% a year for the All Ords.

As has been the case for most of the past year, we were helped by our limited exposure to the banking sector, with the big four banks – which account for about a quarter of the All Ords – each losing around 10% (and ANZ dropping 16%). We’re not averse to investing in the big banks but, with bad debt provisions currently at historically low levels, we’re minded to exercise caution.

Macquarie Group hasn’t been spared and we took the opportunity to buy a 3% stake in the company in February, at $60.28, down 27% since the start of the year. The negativity surrounding global markets had pushed the stock down to just ten times forecast earnings per share for the year to March, which we feel undervalues the company given its shift towards more stable streams of earnings.

Our other purchase for the quarter was Ansell, in which we invested about 3% at$15.05 also in February, after its share price tumbled as much as 20% after management warned that earnings per share would fall by around 17% in 2016, in US dollar terms, compared to previous guidance of a 9% fall.

Making way for these purchases were the redoubtable Washington H Soul Pattinson and Servcorp. We’re great fans of both these companies and would gladly have continued to hold them, but neither is particularly cheap after returning 24% and 20%respectively this financial year.

So far, Macquarie and Ansell have rewarded us with returns of 10% and 13%. The standout performer of the quarter, though, was South32, which leapt 38% from what we considered to be very oversold levels, as commodity prices recovered. Origin Energy also benefitted, with an 11% gain, while, elsewhere, Hansen Technologies and Monash IVF also enjoyed returns of around 11%.

At the other end of the scale, OzForex lost 39% after it announced a profit warning alongside news that Western Union had failed to come up with an offer for the company following its due diligence. The company said the lower expected profits were due to a reduction in marketing expenditure while the group switches over to its new global logo: OFX. At current prices the stock looks cheap, but we’re reluctant to add our 3% holding due to the increased risks.

Computershare was the other notable faller, losing 16% after a disappointing interim result compounded concerns over potential disruption to its business from distributed ledger (aka ‘block chain’) technology. One way or another, it’s becoming clear that Computershare isn’t as good a business as we once thought, but that is already more than reflected in its share price, which represents a multiple of just over 13 times this year’s expected earnings per share.

PORTFOLIO OBJECTIVE

The investment objective is to achieve a return of 1% above the All Ordinaries Accumulation Index per annum over three year rolling periods by investing in a diverse mix of Australian equities and cash.

PERFORMANCE SUMMARY

The InvestSMART Diversified Growth portfolio returned 2.09% over the month of March, outperforming the benchmark by 0.49% and the RBA Cash Rate 3% objective by 1.67%. Since inception the InvestSMART Diversified Growth portfolio is behind its benchmark by 0.82% but ahead of its cash-plus objective by 0.43%.

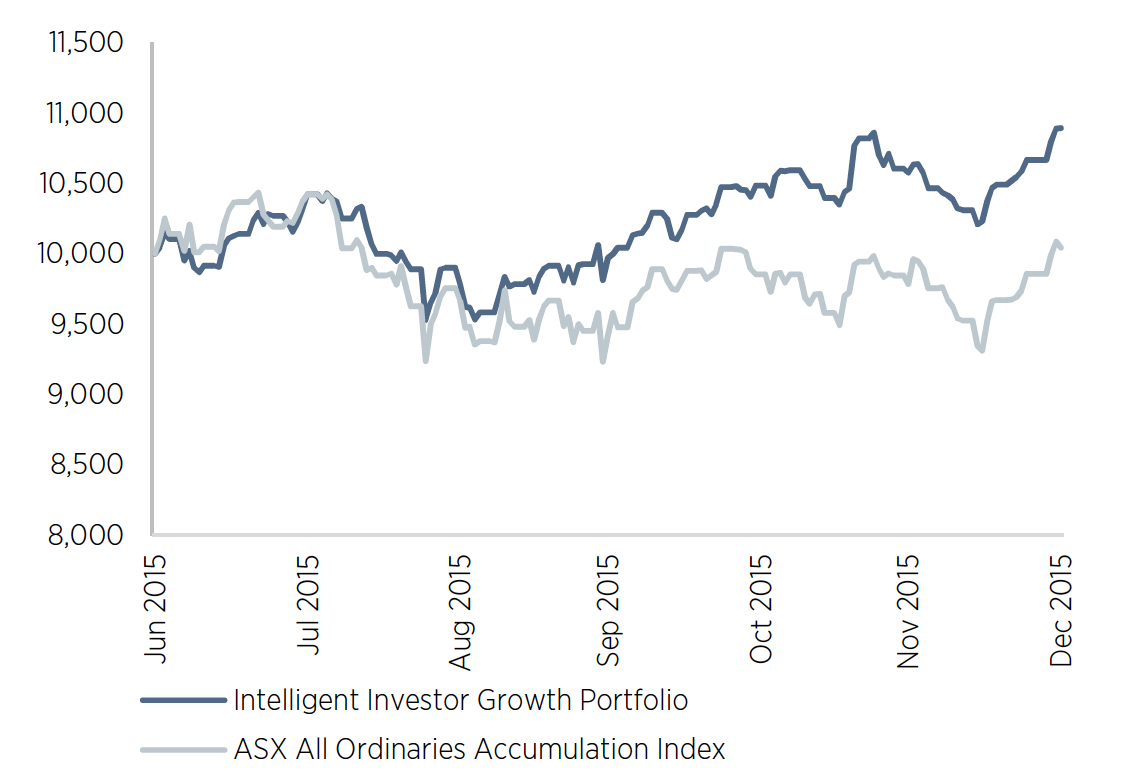

GROWTH OF $10,000

Income Reinvested

PEFORMANCE SUMMARY TO 31 MARCH 2016

Source: Praemium, RBA. Returns are before expenses and fees. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 1 July 2015.

| PERFORMANCE TO 31 MARCH 2016 | 1 MONTH | 3 MONTH | 6 MONTH | SI* (P.A.) |

|---|---|---|---|---|

| Intelligent Investor Growth Portfolio | 4.32% | 0.24% | 9.50% | 9.20% |

| ASX All Ordinaries Accumulation Index | 4.74% | -2.35% | 4.11% | -1.92% |

| Excess to Benchmark | -0.42% | 2.59% | 5.39% | 11.11% |

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.