Disastrous jobs data will create more work for the RBA

The unemployment rate rose sharply in July -- and now sits higher than the United States unemployment rate -- but it might take a few months to sort the signal from the noise. Nevertheless, the Australian economy remains weak and the Reserve Bank of Australia needs to take decisive actions to support the economy.

On a seasonally-adjusted basis, the unemployment rate rose to 6.4 per cent -- its highest level in twelve years -- and is 0.7 percentage points higher over the year. The result missed market expectations that the unemployment rate would be unchanged at 6.0 per cent.

In light of such a disastrous set of data, it seems like a good time to remind readers that monthly seasonally-adjusted data can be quite volatile. The trend measure, by comparison, sits at 6.1 per cent and has increased only moderately over the past year.

Today’s data may reflect the next stage of Australia’s downturn but it may also reflect volatility. It might take another month or two to separate the signal from the noise.

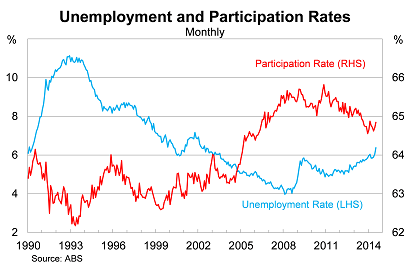

As always, a correct assessment of Australia’s labour market requires consideration of both the unemployment and participation rates. Considering either one in isolation can be misleading.

The participation rate rose slightly in July, following a modest rise in June, which has placed a little upward pressure on the unemployment rate. One possible reason for the recent surge is that it reflects renewed job-searching efforts following the federal budget. Unfortunately, that search has been in vain due to insufficient job creation.

In the medium-term, the participation rate is set to fall further, with more baby boomers entering retirement. This will be partially offset by high population growth but that could result in a persistently high unemployment rate if the labour market cannot absorb that growth.

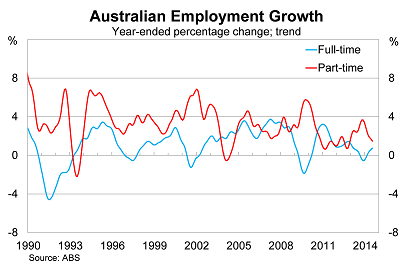

Employment growth eased further on a trend basis, with part-time employment now declining consistently on a monthly basis. Employment among women continues to rise but is being partially offset by a fall in the number of men employed.

What this means for monetary policy is unclear.

The initial response from the Reserve Bank of Australia will indicate surprise followed by some scepticism. Labour force data can be particularly volatile month-to-month and today’s result could be a rogue indicator.

At the same time, the result flies against expectations and provides further evidence that the economy is not rebalancing as quickly or successfully as the RBA has envisaged. The RBA still believes that the full effect of low interest rates has not yet been seen and it may be correct. Construction, for example, has only just started to rise.

Low interest rates have supported lending activity but most of that has flowed through to mortgages on existing properties, which does little to increase the productive capacity of the Australian economy. Housing construction is beginning to pick up, which will support employment, but it remains an incredibly small share of real GDP.

There is a lot riding on the next few meetings for the RBA. In setting rates low, they have wisely taken a forward-looking approach to policy, which has often been at odds with some market economists. However, with each passing month, it appears more certain that they have been too optimistic.

Australia’s unemployment rate is now higher than the United States -- which is at 6.2 per cent -- but the Federal Reserve is currently rocking emergency level rates that are stuck firmly at the zero lower bound. That doesn’t mean that the RBA should follow suit; I believe the US could support higher rates. But it highlights the different philosophy that holds sway at each central bank.

The RBA is optimistic because the Australian economy has proved resilient to economic shocks for over two decades. The Fed remains pessimistic because the US economy has suffered a once-in-a-lifetime financial crisis.

Unfortunately, blind faith in Australian exceptionalism won’t be sufficient to rebalance the economy. The RBA needs the dollar to decline, non-mining investment to rise and the household sector to strengthen. We need an economy that isn’t entirely reliant on Chinese demand.

Facilitating this shift is difficult but manageable if the RBA is decisive. A couple of rate cuts, combined with macroprudential policies to curb mortgage lending, will boost confidence, ease household budgets and redirect lending activity towards the non-mining sector. A word in the ear of the federal Treasurer to develop a jobs plan wouldn’t be a bad idea either.