Decoding the lack of logic on Wall Street

Summary: Confusion on US markets is a result of a breakdown in the value to price metric, as market momentum continues despite evidence of a sustained fall in US earnings. Lower energy prices could benefit the broader market, and the fallout of reporting season will highlight the effect the oil price has had on the S&P 500. |

Key take out: Negative real cash rates have been the real tailwind for US stocks, as the cash rate has not covered inflation for the past six years. We believe earnings may not justify holding US equities in the short term, and these negative real rates may hold the market overall. |

Key beneficiaries: General investors. Category: Shares. |

Confusion abounds with current equity market pricing behavior – and it is most clearly observable in the US stock market. For instance, it's well reported that US corporate earnings are falling but this is having little if any effect on the US stock market which remains resilient. Falling earnings should result in lower equity prices; therefore if this is not occurring, it implies a breakdown in the value to price metric. Perhaps momentum investing is dominating US stock prices.

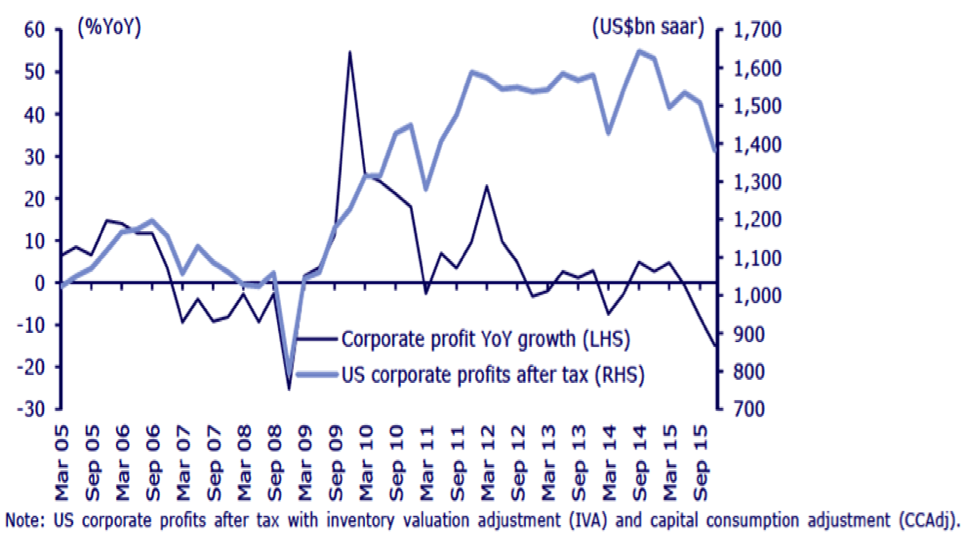

The first chart shows that US earnings have been in decline for nearly 12 months, and flat-lining for two years. Market consensus forecasts suggest that the next few weeks are likely to show a 10 per cent decline in earnings across the market, magnified by lower oil company earnings.

Figure 8. US corporate profits after tax

Source. CLSA; US Bureau of Economic Analysis

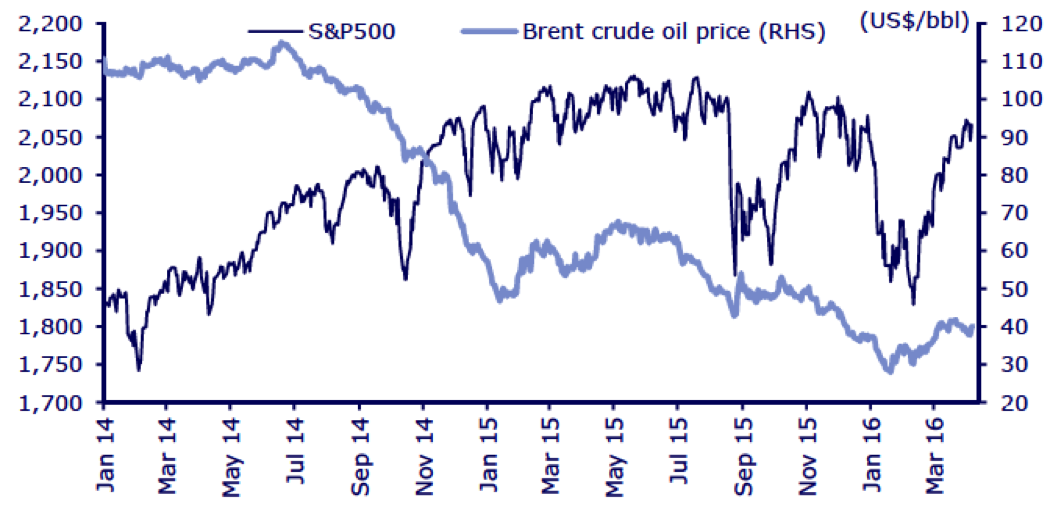

The following chart tracks the oil price against the S&P 500 Index and suggests that the benefits of a lower energy price to the broader market are more significant than the profit decline reported by the energy sector. The next few weeks will give us an insight into whether this is actually true. We will see if US companies disclose the benefits of lower energy prices on their bottom line. Further, lower gasoline prices should be spurring consumption by households. The market has pushed equities higher based on lower energy prices, but at this point profit guidance has been downbeat. To our eye, something has got to give and the US equity market should pull back. But irrational pricing and the breakdown of logic makes forecasting exceedingly difficult.

Figure 9. S&P500 and Brent crude oil price

Source. CLSA; Bloomberg

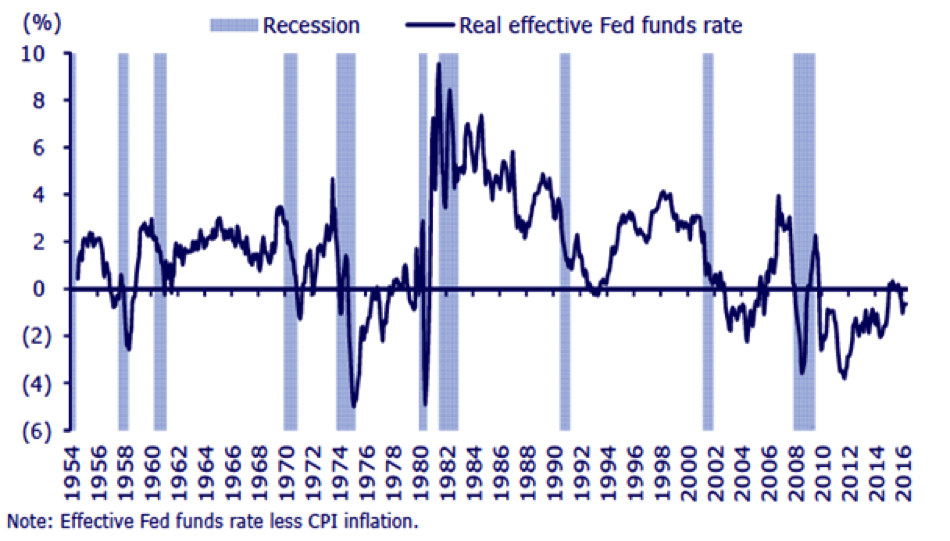

That leads us to the tailwind for the US equity market – negative real cash rates. The final chart shows that cash rates in the US do not cover inflation and have not done so for six years. Logical asset pricing suggests capital will flow from cash to higher returning assets. Therefore, equities have been a beneficiary.

Figure 10. Real effective Fed funds rate

Source. Federal Reserve; Bureau of Labour Statistics; NBER

So will earnings justify holding US equities? Our view (in the short term at least) is no, but sustaining negative real interest rates may well hold the US market. It seems likely that if US earnings do not start growing, then higher cash rates will cause a correction in US stock prices; higher cash rates will send the US dollar higher and jolt US earnings. No wonder markets are confused - because nothing makes much sense!

John Abernethy is a leading Australian fund manager and the chairman of Clime Capital (ASX: CAM).