Debt investors take the sidelines

|

Summary: Almost $2.4 billion in ASX-listed debt securities matured in June, and the data suggests that investors didn't reinvest in the same market. The market appears undersupplied. A couple of high-performing subordinated notes propped up June index returns, namely those issued by Qube and Crown Resorts. |

|

Key take-out: Debt security investors are indicating the market is too expensive, or they are waiting on the sidelines for new issues to appear. Some may have reinvested their funds elsewhere. |

Over the course of June, almost $2.4 billion of debt securities that had been listed on the ASX were called or matured. Most of the money released by the redemptions was left to find a new home, and for the most part, it did not get reinvested in the market.

Among the maturing securities was $633 million of NAB subordinated notes (NABHB). This was old-fashioned Basel II subordinated debt that featured a call date and a subsequent final maturity date, but could not be converted into ordinary equity should the bank be declared non-viable.

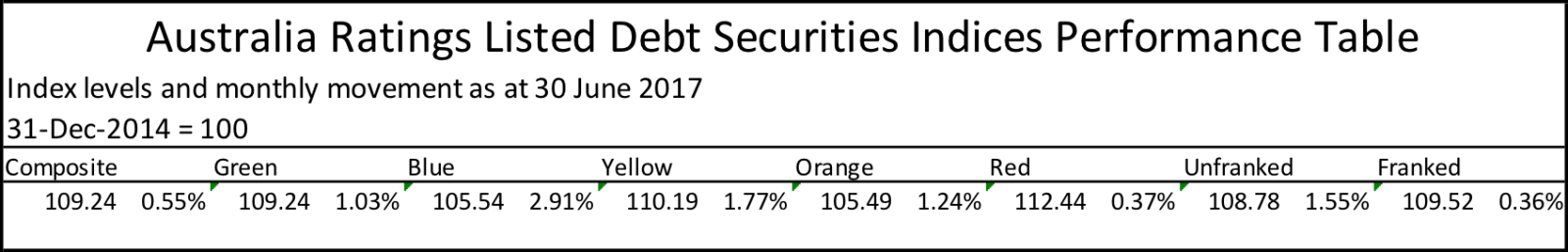

Some of this amount was rolled over into a new Basel III compliant NAB subordinated debt issue (NABPE) earlier in the year, however, the remainder was left to look for a new home. The Australia Ratings listed debt securities composite index tells the story.

Let's adjust for the departure of Macquarie capital notes (MQGPA) from the index, as the call date is less than one year away. So, when considering the $334 million of distributions paid during the month – the index is an accumulation index – the capital value of the index actually fell by more than $92 million. The called or maturing securities were excluded from the index one year ago, and therefore, if any of the funds released had been reinvested in the market, the capital value of the index would have increased.

A change in sentiment

Clearly, this didn't happen. What's more, the fact that it didn't happen indicates a change in investor sentiment towards the market.

Fundamental changes are impacting on the market with $9.1 billion of securities being called or maturing over the course of 2017. This is the largest annual volume of securities to exit the market ever seen.

As at the end of June, $4.5 billion of securities had already departed market. On the contrary, new issuance amounted to less than $3.5 billion, and no further issuance had been flagged.

In previous months, the expectation of a shortfall in supply drove up secondary market prices for the remaining securities. But while prices of some individual securities continued to rise in June, this did not occur across the broader market.

Investors are acting like the market is too expensive. They are either sitting on the sidelines waiting for new issues to appear, or have reinvested their funds elsewhere.

Looking at the performance of the individual Australia Ratings listed debt securities indices that make up the composite index, the red index definitely tells this story:

Red means investors stopped

The red index is comprised of the most complex hybrid securities issued by financial institutions (it should be noted, MQGPA were also removed from this index). The red index is, by far, the largest of the individual indices. It is the main influence on composite returns.

Distributions made during the month of June drove a 0.37 per cent increase in red index value, as the weighted average security price fell from $102.82 to $102.34 a month earlier. Some investors took profits on hybrid security prices that had become very elevated, and perhaps, this money has been reinvested in less risky securities available on the market. The simpler and higher ranking subordinated debt issues and senior debt issues have enjoyed some price appreciation over the month.

The blue index was the strongest performer, increasing by almost 3 per cent from the end of May. This performance is attributable to the very popular Qube subordinated note (QUBHA).

Qube in the spotlight

QUBHA would qualify as a simple corporate bond in every respect but one – it is subordinated. But it is a simple subordinated bond that does not come with just deferrable coupons, but rather, cumulative coupons (or deferrable but non-cumulative coupons). These coupons come with variable or multiple maturity dates. QUBHA is the only one of its type.

QUBHA went ex-distribution in June, but the price increased from $105.40 to $107.40 during the month. Investors who have held the notes since listing in October last year have so far enjoyed a total return of more than 10 per cent on their investment.

Next cab off the rank is the yellow index, which returned almost 1.8 per cent for the month. The performance was mainly driven by the continuing price appreciation of Crown Resorts subordinated notes (CWNHA and CWNHB).

Crown Resorts sparkles

These Crown Resorts notes have been volatile performers in the past. They have gained on Crown reducing its international exposure and refocusing on its Australian business, and because the threat of company privatisation has dissipated. Crown Resorts' securities have enjoyed substantial price appreciation, particularly CWNHB notes.

On a weighted average basis, the price of the securities increased over the month even though both went ex-distribution. However, CWNHA notes could tip into a period of relative weakness and price depreciation. This is because Crown Resorts announced in the last week of June the suspension of its buyback program, at least until its full year results are released in August.

Adding colour to orange and green

Moving on to the orange index, which covers more complex corporate subordinated debt issues and Basel III compliant Tier 2 bank subordinated debt issues, this returned 1.24 per cent during the month. Half of the index constituents went ex-distribution in June but the weighted average security price across them still increased from $102.50 at the end of May to $103.28.

The green index didn't exactly speed through a green light, but it still managed to gain slightly more than 1 per cent for the month. The weighted average price of securities in the senior ranking green index increased from $103.66 to $104.25 during June, despite half of its constituents going ex-distribution.