Dark Deutsche clouds. Trump and the markets. Oil.

Robert Gottlieben

Dark Deutsche clouds

Over the years I have watched hedge funds execute many raids on stocks. Sometimes they win and sometimes they lose. But when the target is a big bank with deep problems, it's money for jam. They will keep shorting and undermining Deutsche Bank until it is rescued.

Lehman was, incorrectly, regarded as expendable but there is no doubt Deutsche Bank is in the coveted 'too big to fail' classification, so global central banks – and probably the German government – will do what ever is required to prop up the German-based giant to avoid the real risk to the global banking system itself. Deutsche Bank is a key pillar of a vast and mysterious derivative market so its failure would trigger enormous damage to world capital.

The sooner they act the better because the hedge funds will double their shorting and other efforts to grind Deutsche down and scare the world.

And remember while the action of the US Justice department to fine Deutsche an amount equal to its market capitalisation is the trigger, the real problem is that the German bank still has legacy problems from the global financial crisis. The global risk is that the hedge funds have at least eight other European banks in their sights. This is a big global shorting play.

If it is allowed to gather momentum it will affect Australian bank stocks – they are already in retreat – because we are big borrowers on the world market, albeit that we no longer borrow short term.

I think one way or another the world will get through this crisis so if our banks get hammered – particularly if the Parliamentary inquiry puts them into the eye if the storm – then if you are substantially underweight bank it will be worth considering a lift. But be aware of the global risks. We will keep you posted.

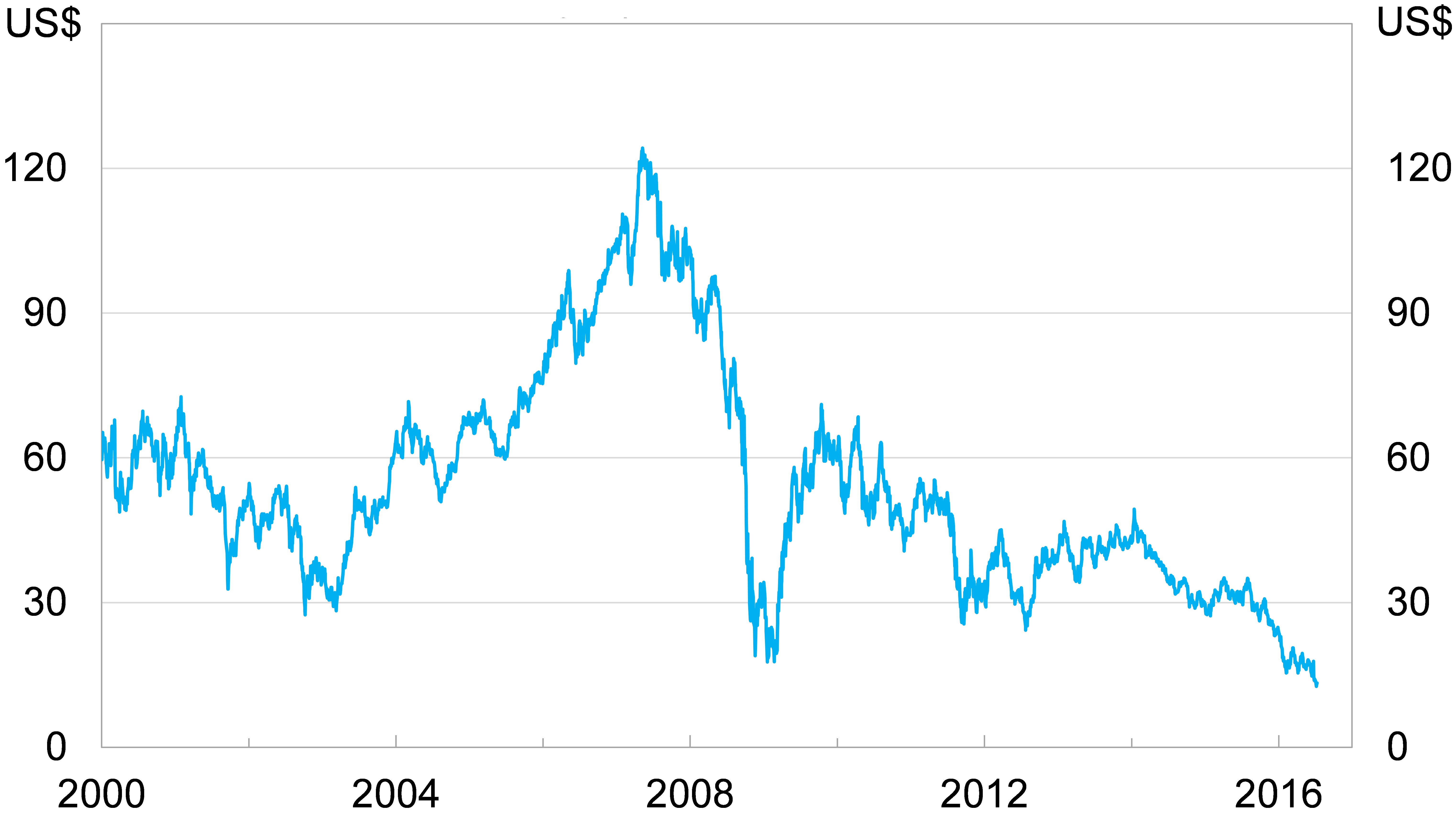

Chart 1: Deutsche Bank share price (NYSE adjusted)

Source: Yahoo Finance

Underestimating Trump

Also at the top of our agenda is Donald Trump. Let me start my Trump remarks in an unusual way – citing the New South Wales banning of the greyhound training and racing industry. I have no personal knowledge of the greyhound industry but when Premier Mike Baird announced the plan he was loudly applauded by almost all sections of the media and the political class.

Now, suddenly, he finds his approval ratings and those of his party have slumped because the general population has a different view of the world than that expressed by the media and the political class.

This is a graphic illustration in Australia of what is happening in the US and why it is very dangerous to follow the popular media and write off Donald Trump. And if Trump looks like winning in November – and worst still if he actually does win – there will be great convulsions on Wall Street highlighted by some significant falls.

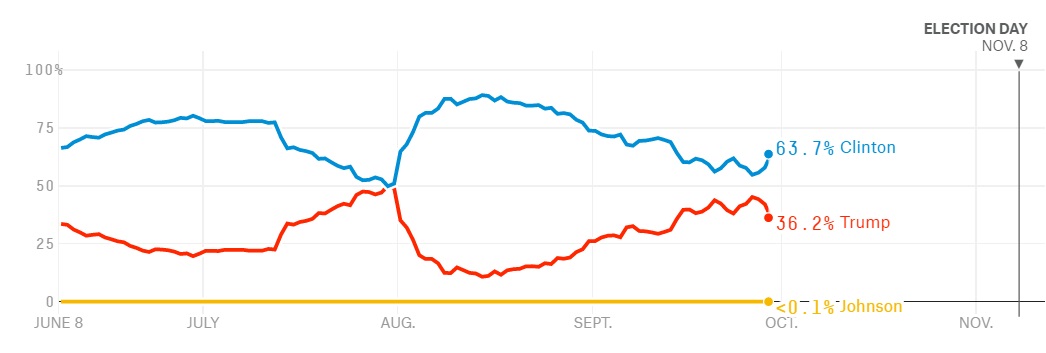

If Hillary Clinton takes a big lead in the opinion polls, then markets will be relatively safe. But if prior to the election in November the outcome looks close then prepare yourselves for falls in the markets as shorters exploit the situation. If the bank crisis is still going then those falls will be very large. Those investing in the current market should be aware of this risk. The November US opinion polls will, therefore, be market indicators.

And Trump underlined the turmoil that is ahead when he attacked Federal Reserve President Janet Yellen for her decisions.

Yellen had no warning of the attack but immediately went on the front foot to explain the Federal Reserve's actions, but the market immediately concluded that it was less likely that there would be an interest rate rise in December. The dollar fell but recovered as the banking scare gathered momentum.

In simple terms Donald Trump plans to lower US taxes, increase tariffs on China and Mexico, be tough on migrants and basically create a more isolationist US. The world as we have known it would change. Clinton's plan is to increase taxes on the wealthy and spread that money around the community, including raising the minimum wage – exactly what the politically correct people want to happen.

I am very suspicious that the US wealthy will pay a lot more tax. They will simply move their businesses offshore – but that is another matter. I have some contact with global security analysts and their fear is that, given what is happening in the Middle East, one of the branches of Islamic terrorism will seek to achieve a major terror attack in the US in the final two weeks of the election campaign. As the theory goes, that would ensure a Trump win and create great turmoil in what Islamic terrorists regard as “the Satan state”.

You will remember that the 9/11 attacks on the World Trade Centre not only achieved enormous death and destruction but the consequent military spending of the US in the Middle East greatly damaged the American economy.

From an Islamic terrorist point of view it was a fantastic victory and security strategists are fearful that they may seek to duplicate that impact, albeit probably with a different mode of terrorism. In the event of such an attack Trump would be a hot favourite to be president. But enough of the danger news.

Chart 2: Poll averages, US election

Source: FiveThirtyEight.com

Oil, iron ore and coal

You will remember that I have been bullish about the long term oil market because the most dominant person in the world today is no longer the US president but rather Russian President Vladimir Putin. He is calling the shots in the Middle East and clearly needs a higher oil price. It seems that the OPEC conference in Algiers would not have achieved any gains but for the fact that the Russians were invited to attend. The Russians played a huge role in achieving some progress and, accordingly, we saw a rise in oil prices and BHP Billiton, Santos and other oil shares.

I am less confident about iron ore and coal. We have seen a very big rise in coal prices and the Chinese have responded by encouraging more production from their coal mines to bring down the price and importers of coal are being encouraged to take the local product to justify the increase in local production. In other words the Chinese are telling the coal industry that if they allow prices to rise too far they will be hit on the head and I think the same things will apply to iron ore. Of course, to keep their mines at least partially viable the Chinese do not want coal or iron ore prices to fall to very low levels, but as we have seen in coal they will move in once the price escalates sharply.

And a few other things

Here in Australia, the media and politically correct class are putting great pressure on state governments to increase their level of renewable energy over and above the Commonwealth standard levels. South Australia went off on its own and is now suffering the penalty. Victoria is looking to do likewise and will suffer accordingly if they do not learn from the South Australian experience.

And while on the subject of commodities keep your eye on nickel. China has substantially reduced the market share of pure nickel by producing what is called pig nickel (nickel with impurities) for use in the stainless steel sinks, etc, where pure nickel is not required. To produce pig nickel they first purchased concentrates from Indonesia and when Indonesia stopped exporting concentrates, the Philippines filled the gap. Now the Philippines are shutting nickel mines on environmental issues. This will underpin the nickel price. BHP's offshoot, South32, will be a beneficiary.

Finally, it's unpopular among institutions and it can lead to some catastrophic failures but increasingly Australian companies are going to need to operate internationally to gain growth. That involves high risk. It was fascinating to see how Cover-More marketed their US acquisition to the institutions, so the stock was not decimated when the takeover was announced. On the surface it is an excellent move and gives Cover-More global reach. But like all these situations it depends on the ability of the Australian managers to adapt to the US culture and market practices. But in so many situations growth is going to come to Australian companies that take this step and manage it.

Readings and Viewings

With lots happening around the world, here's some links to various articles and videos you may find interesting...

More views on the Deutsche Bank story. Could it be the next Lehman Brothers? And is there something that Deutsche Bank has in common with Twitter?

Meanwhile, in a report titled What lies beneath, PIMCO says it's closely watching the three Ps of productivity, (monetary and fiscal) policy and politics.

There's another important P, too – Property. There's no shortage of doomsayers who claim the Australian property market is in bubble territory. But a new report from Swiss bank UBS says it's the Canadian market that's in bubble trouble.

Staying in Canada, it seems Ontario's securities watchdog is taking no prisoners, thanks to its new whistleblower program. With rewards of up to $5 million, since July it has received tips on more than 30 securities law violations.

Now, Sinead O'Connor was always a much better singer than a whistleblower, but she's currently on the sharp end of a huge €160,000 settlement with Ireland's Revenue for unpaid taxes. It's a big blow.

But that also begs the question, does Donald Trump pay tax? Based on his response to Hillary Clinton on Tuesday, paying tax is not high on his agenda.

And it wasn't the only thing in Hillary's sights. Trump also came under fire for his past comments about Alicia Machado, a former Miss Universe (1996), actress and singer who was thrust into the middle of the US presidential campaign.

With the clock ticking down on the US election, some voters will have a gut feeling on the outcome. But probably not the same gut feeling as a team of UK researchers.

Hopefully Elon Musk has the medical side of things covered, and not just the ticket prices, as he advances on plans to send humans to Mars.

But has Musk been spending too much time studying old Steve Jobs' presentations at Apple?

In any event, inhabiting Mars may not be such a bad idea, based on the latest evidence on climate change.

Then, in a Samsung Galaxy far away – actually a Note 7 – a Chinese man has reported another troubling malfunction. It's a total recall, and we're not talking about the Arnold Schwarzenegger movie.

And, just as things couldn't get much worse for the Korean manufacturer, we now have the company's self-destructing washing machines making news.

Could this be a case of money laundering gone wrong? A new report says Singapore needs to get much tougher.

The Victorian Government this week launched free Wi-Fi across the Melbourne CBD, said to be the country's largest Wi-Fi network.

Rolling Stone magazine released its list of the 100 greatest TV shows of all-time this week. After a cursory glance, we think it looks pretty good.

The $50bn industry that was crushed by the Obama Administration: “It could be one of the defining legacies of the Obama era.”

A new book details the astonishing and largely untold story of Nazi drugs abuse: “I guess drugs weren't a priority for the historians,” Ohler says.

Social policy is based on the assumption people's motives are primarily selfish. But are we more virtuous than we think?

It's grand final weekend, and in the NRL Cronulla are shooting for their first premiership. The ABC's Luke Pentony details the Sharks' history of heartbreaking finals losses.

In the AFL, meanwhile, the Western Bulldogs are in their GF since 1961. One wag reckons their emotional win last Saturday is better with the music from Titanic.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Shares had a volatile week, with support from higher oil prices but weakness in banks led by concerns around Deutsche Bank with most share markets ending lower, although Australian shares were little changed. Bond yields also fell continuing to reverse the back up in yields seen a few weeks ago. Commodity prices were little changed except oil which rose 7 per cent on the back of OPEC's reported agreement to reduce output. The US dollar was little changed as was the Australian dollar.

The main issues around Deutsche Bank appear to relate to the size of a US Department of Justice penalty relating to mortgage backed securities where the DoJ's opening position is $US14 billion but the final settled outcome may be closer to $US8bn-$US9bn and whether it will require a capital raising. This appears to be affecting sentiment around banks generally, although many US banks have already settled with the US Department of Justice. It seems whenever there are issues with banks these days, investors start to fear a re-run of the GFC.

OPEC's agreement to cut oil production for the first time in eight years adds to confidence we have seen the low in the oil price. The reported agreement will see production cut to around 32.5 to 33 million barrels per day from around 33.25 mbd in August, but the details and individual country targets won't be agreed until OPEC's next meeting in late November. The deal if stuck to could signal better cooperation between Saudi Arabia and Iran and a return to discipline by Saudi Arabia. Time will tell but it adds to confidence that we have seen the low in the oil price. That said while the oil price has bounced 6 per cent or so on the news it's just normal volatility and the oil price remains below its June high of $US53 a barrel. Expect a bit of an upwards drift in the oil price but constrained demand growth, the prospect of shale oil production picking up again as the oil price pushes through break-evens for such producers of around $US50-$US60 and the ongoing switch to alternatives and efficiencies should to limit the upside in the oil price, probably to around $US0.60.

For the time being it's hard to see a big flow on to Australian petrol prices as the bounce in the oil price around the OPEC news has only been around $US3/barrel which would translate to about 3c a litre at the bowser in Australia and in any case the petrol price is still averaging around 10-20c a litre above levels normally implied by current oil prices suggesting wider than normal margins. More broadly to the extent that the OPEC deal reflects better supply discipline and is consistent with the bottoming in commodity prices seen generally over the last nine months and energy in particular it's positive for Australia and adds to a lessening in downwards pressure on the RBA to cut interest rates again. The only complication is the Australian dollar which briefly rose above $US0.77 and is at risk of re-test of April's high of $US0.78.

Has global trade peaked? A World Trade Organisation report downgrading its estimate for global trade growth to 1.7 per cent this year from 2.8 per cent and five years of low or stagnant trade growth obviously begs the question that global trade may have peaked. This is a risk but the recent stagnation appears to owe more to a return to trend after the trade boom of the 2000s, slower demand driven growth due to slower growth in Europe, the end of the commodity price boom and a shift in China's growth from industrial production to services (which is less trade oriented). That said all the talk of protectionism (e.g. from Donald Trump) and the stalling of the Doha trade round is a concern.

The first presidential debate between Hilary Clinton and Donald Trump has kicked off financial markets focus on the November 8 election. While the general conclusion was that Clinton won and she reinforced her key strength of being more “presidential”, there was no knockout blow and it's unclear whether it will really change the outcome which looks close but with a slight lean to Clinton. Financial markets appeared to like Clinton's performance. There are still two presidential debates to go on October 9 and 19 and a debate between the vice presidential candidates on October 4. See this for an analysis of the coming US election.

The Bank of Japan's latest moves are more profound than first appeared. There has been much debate as to whether the BoJ actually did anything of substance at its meeting a week or so ago. There was no big increase in quantitative easing or change in interest rates. But by the same token if it actually does what it says it really could be a big thing. Put simply the BoJ has committed to pumping cash into the Japanese economy until inflation rises above its 2 per cent target and stays there. If it actually does this then inflation expectations will rise and investors will naturally want to sell bonds. But the BoJ has committed to keeping the 10-year bond yield at zero and if private investors start selling bonds it will have to buy even more bonds to keep the yield at zero. Which all means that real yields will fall which will encourage spending and push the Yen down, all of which will reinforce the pick-up in inflation. At the same time the commitment to keep the 10-year bond yield at zero is an open invitation to the Government for more fiscal stimulus. This is all kind of heavy, but if the BoJ actually does what it says – even though I suspect it may need a bit of helicopter money along the way – then what it has announced is actually quite profound. Time will tell, but I suspect that the BoJ under Kuroda should be given some benefit of the doubt.

Major global economic events and implication

US economic data was mostly better than expected. Consumer confidence rose to its highest level since 2007 in September (despite election uncertainty), the Markit services conditions PMI rose in September resulting in overall business conditions continuing their rising trend, regional business conditions surveys rose, durable goods orders were stronger than expected, jobless claims remained low, the goods trade deficit narrowed, new home sales were stronger than expected and home prices continue to see modest growth. Various Fed speakers offered nothing new with Yellen reiterating that the current environment calls for a gradual increase in rates and that a majority of Fed officials see a rate hike as likely this year.

Eurozone economic data was good with a rise in the German IFO business conditions survey to its highest since May 2014, a rise in overall eurozone economic confidence to an eight month high and stronger growth in bank lending all of which points to continuation of moderate economic growth at least.

Japanese labour market indicators remained strong in September and industrial production rose but household spending slowed sharply and headline inflation remained in deflation with core inflation falling to 0.2 per cent year-on-year highlighting the BoJ has a lot of work to do to get inflation above its 2 per cent target.

Chinese industrial profits rose 19.5 per cent year on year in August helped by less severe producer price inflation, the Caixin manufacturing conditions PMI rose a bit further and consumer confidence rose to its highest since June all of which is consistent with a stabilisation in Chinese economic growth.

Australian economic events and implications

- In Australia job vacancies rose solidly in the three months to August which is consistent with continued solid jobs growth. Growth in private sector credit decelerated further with credit to property investors slowing further to 4.6 per cent year on year, which is well below APRA's 10 per cent threshold. So APRA can claim a victory, although it does look like monthly growth in property investor credit may have bottomed and the Sydney and Melbourne property markets remain uncomfortably hot.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Reserve Bank Board meeting, retail trade dominate focus

The Reserve Bank Board meeting and ‘top shelf' economic data dominate the economic calendar in the coming week. The Reserve Bank Board meets on Tuesday, while the data to watch includes building approvals and retail trade, due out on Tuesday and Wednesday respectively. In the US, the focus is on the employment data, released on Friday. And in China, Europe and the US the services sector purchasing manager indexes will be watched closely.

In Australia, the week kicks off on Monday with three data releases and also a public holiday in NSW. The Melbourne Institute releases the monthly inflation survey, while the AiG Performance of Manufacturing index is also slated for release. In addition CoreLogic will release figures on home prices for September

Inflation remains well contained, so it is clear that the focus on Monday will be on the home price figures. The Spring selling season has begun in earnest. Auction clearance rates are holding at around 75-80 per cent, particularly across the Eastern Seaboard. In August capital city home prices surged by 1.1 per cent to be up 7 per cent on a year ago. Yet regional prices were only up 1.4 per cent over the year – highlighting the diversity of housing activity across regions. Overall it looks like capital city home prices may have lifted by a further 0.8 per cent in September.

The Reserve Bank Board meeting on Tuesday should be treated as a dead rubber. Rates are unlikely to move in any direction. Recent commentary from the Reserve Bank makes it clear that while there is an “implicit” easing bias, the focus is on getting readings of timely economic data and waiting for the next inflation data.

Interestingly the statement following the interest rate decision will be closely scrutinised for any views on the Australian dollar. Despite recent benign comments on the currency, the Reserve Bank may have more to say given the Aussie dollar is comfortably holding closer to US77c.

While we have a November rate cut pencilled in, it is looking less likely that the Reserve Bank will shift rates over the rest of 2016. Inflation remains well contained but stronger activity and growth may result in the Reserve Bank keeping its powder dry.

Also on Tuesday, ANZ issues its job advertisements report for March and also teams up with Roy Morgan to issue the weekly consumer confidence data. In addition the Australian Bureau of Statistics (ABS) will release figures on building approvals.

The consumer confidence results have been decidedly more optimistic in the past couple of weeks – particularly when it comes to family finances, a result that bodes well for future spending.

Building approvals have been volatile, over the past few months. Dwelling approvals rose by 11.3 per cent in July, driven by a 23.4 per cent rise in apartment approvals. Over the past year 234,996 new homes were approved, just shy of the record high 240,880 in the year to October 2015. The anticipated lift in housing supply should ensure a more balanced environment – in essence house price growth is likely to be more contained over the medium term.

On Wednesday, retail trade figures are issued alongside the Performance of Services index and new car sales figures for September.

Consumer spending has been mixed over the first half of 2016. In fact retail trade is only up 2.7 per cent over the year and non-food retailing is recording the weakest annual growth in three years. However there are more encouraging signs with the Commonwealth Bank Business Sales Indicator showing a recent lift in broader-based economic activity. In addition the strength in household finances resonates well for a lift in retail activity in coming months. For the record we expect that retail trade lifted by 0.5 per cent in August.

Also on Wednesday, Reserve Bank Assistant Governor Christopher Kent (economics) will be a panel participant at the Melbourne Institute Macroeconomic Policy Meeting in Melbourne (4:30pm AEDT).

On Thursday, data on international trade is issued with the Performance of Construction index.

Overseas: US employment data hogs the spotlight

The start of a new month ensures that there is plenty to watch overseas – notably the US jobs data on Friday.

The week kicks off on Monday with a number of indicators for release in the US. The Markit reading on the manufacturing sector is issued alongside construction spending data.

On Tuesday in the US, domestic vehicle sales for September are released.

On Wednesday the usual weekly data on US home purchase and refinancing is issued with the ADP survey of private sector payrolls. Economists tip a 157,000 lift in job numbers for the month of September, slightly lower than the August result.

Also on Wednesday in the US, factory orders, trade data, the Markit service sector gauge and the final estimate on durable goods orders – a key measure of business spending – is released. Orders for durable, or long-lasting, goods may have fallen by 1.5 per cent in August, while the trade deficit may have widened from $39.5 billion to $42.5bn.

On Thursday, the usual weekly data on claims for unemployment insurance is released in the US, together with the Challenger job layoffs series.

And on Friday in the US, the all-important monthly jobs report is issued. Main interest is in job numbers – in particular, the change in non-farm payrolls. And economists expect that 178,000 jobs were created in September, up from 151,000 in August. The unemployment rate may have held steady at 4.9 per cent with average earnings (wages) up 0.3 per cent. The wage reading is important. Higher wages infer higher inflation and higher interest rates.

Also on Friday, consumer credit and wholesale inventories are released.

In China, the Caixin purchasing managers' index for the services sector is released on Saturday.

Craig James is chief economist at CommSec.