Could a renewable energy target delay and extend help everyone?

Renewable energy market analyst Green Energy Markets has released the latest update of its quarterly Renewables Report. This report tracks the need for new large-scale renewable energy projects to meet Australia’s Renewable Energy Target. As part of this, Green Energy Markets has analysed the implications for power project development if the federal government were to reduce the target from its current legislated 41,000 gigawatt-hours down to 25,500 GWh.

This would contain renewables to about 20 per cent market share of electricity demand and is what many expect the government wants to do. The analyst has also looked at a scenario modelled by the Warburton RET Review of scaling back the target in the short-term to about 30,000 GWh in 2020, but then shooting for 30 per cent renewable energy by 2030 (53,000 GWh).

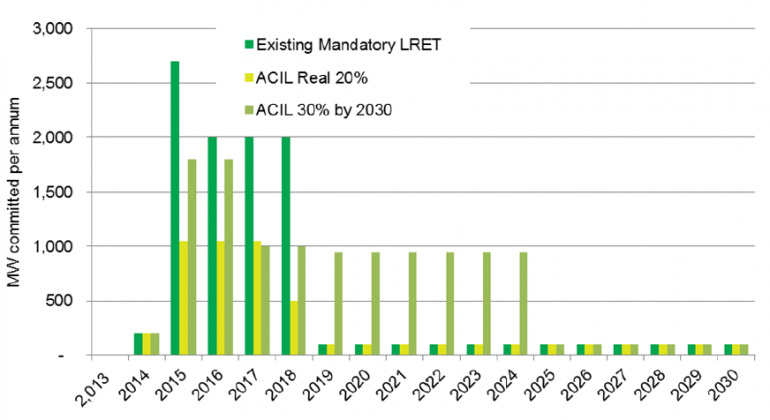

The chart below illustrates Green Energy Markets’ estimates of the level of project commitments required to meet the different targets (this is when a project is committed to construction – it will then take another two years before becoming fully operational).

In spite of the pessimism pervading the spot market for renewable energy certificates right now (known as LGCs) Green Energy Markets believes that no matter which of the three target scenarios eventuate, the large surplus of certificates overhanging the market currently will have largely evaporated by 2017. And because it takes around two years for a project to be built after it is committed to construction, we have little time to spare with construction needing to lift from next year.

Figure 1: Timing for power project commitments to meet different large-scale renewable targets (megawatts)

Source: Green Energy Markets – Renewables Report June 2014

If the existing legislation for the large-scale RET was left unchanged (dark green bars) we’d need a total of 9100 megawatts of new projects to 2020. We need to get absolutely cracking, beginning next year, committing to begin construction of 2500MW of capacity. This would equate to building six wind farms of the scale of Australia’s biggest – the 420MW Macarthur wind farm in Victoria. We’d then have another three years of hell-for-leather activity, installing 2000MW annually before a collapse in 2019.

To put this into perspective, last year only two nations – China and Germany – installed more than 2000MW of wind power. (Although one should also recognise that 2013 was a slow year for wind power installations and our 2015 installs, based on Global Wind Energy Council forecasts, would still represent less than 5 per cent of total global sales in that year.)

If the target were dropped to the target known as a ‘real 20 per cent’ (the yellow bars) then the total amount of new build required would be more than halved to 4050MW by 2020. The 1000MW required, beginning next year, should pose few challenges with similar levels achieved in the past. However, we still end up with a bust situation by 2018-19.

The 30 per cent by 2030 target (khaki green bars) provides a more steady demand for power projects. We’d still be a significant market for wind turbines with the build rate in 2015 and 2016 putting us on par with 2013 installations in Canada, India and the UK. After that there would still be another eight years of construction at close to 1000MW per year.

This 30 per cent by 2030 target seems to offers the potential for a win-win compromise.

The renewable energy industry would have to sacrifice 1400MW of projects to 2020 but with the benefit of a longer and more manageable flow of construction work. In addition such a target, with a longer lifetime to earn revenue, should make new projects less difficult to finance.

Also, for those who have concerns about wind farms, such a target is more likely to be met with a contribution from utility-scale solar. In addition, according to modelling by ACIL Allen, it would provide a greater benefit for energy consumers in terms of reducing their power bills by suppressing wholesale electricity prices for longer

It offers the potential for the Coalition to convert a very difficult situation with a hostile Senate into a vote-winner where they look like the hero. This would be the case even though they are, in fact, significantly delaying the achievement of 41,000GWh to 2025 instead of 2020, and significantly reducing the level of renewable energy project construction out to 2020.

Furthermore, if they wanted to be clever, the government could reduce the cost of this delay and extend the target by excluding old hydro projects from eligibility for support after 2020 and excluding all projects built to date from support beyond 2030. Indeed, it could be argued that all projects built prior to 2006 – when the RET was expanded via state government initiatives – should never have been eligible for support beyond 2020.

Such tweaks could mean 30 per cent by 2030 would cost consumers less, while having the same effect in depressing wholesale electricity prices.