Corporate ignorance is threatening Australia's future

I fear many Australian companies have no real idea what is set to happen to the incomes of their ultimate customers: consumers. And the yield-driven sharemarket is in total ignorance.

During the last few days I was in the company of several senior executives of large corporations and I told them of Treasury's future projections, which show that unless we boost productivity substantially there will be a dramatic fall in Australia's per capita growth. They were shocked. The Treasury predictions were completely different to the assumptions their corporations were using for long-term planning.

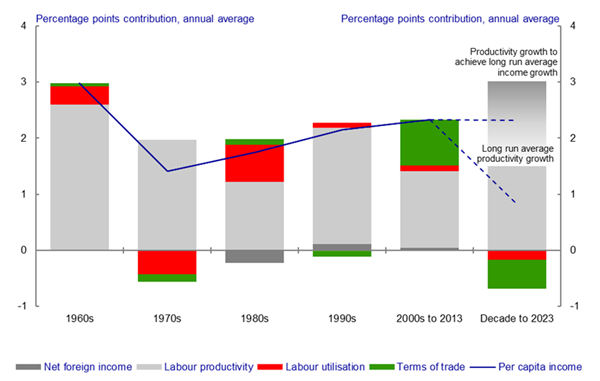

So at this point let's repeat the Treasury graph that Harrison Polities was the first to highlight publicly, although a number of us had seen the graph under the Chatham House Rule and it was a key document in shaping the budget (The budget graph that brought a 'stunned silence' to the Coalition, May 22).

That stark Treasury message about what happens if we don’t lift our efficiency goes completely over the heads of too many company executives and public servants.

Instead Australia is currently engaged in a yield boom and companies that distribute profits via high dividends are rewarded with big sharemarket premiums, which translate into executive bonuses. As a result, productivity investment using retained earnings does not go down well with the sharemarket.

Senior public servants are often rewarded by size of department, not productivity. But unless our companies and governments invest, productivity will not improve and our per capita income growth is set for a nasty downturn, as per the Treasury graph. Consumers have not seen Treasury’s graph but can smell that something is wrong and in time the consumer alarm bells will ring in the boardrooms and in the public service.

Dun & Bradstreet’s Consumer Financial Stress Index is forecast to hit 24.8 points by July, the second-highest level in its four-year history, as consumers find it more difficult to make their finance repayments and the quality of credit applications deteriorates. Dun & Bradstreet say that with household income and sentiment expected to be impacted by the federal budget, and the first-quarter figures from the Australian Bureau of Statistics showing that wages grew at a moderate 0.7 per cent, the stress forecast will trend into a higher range as the year progresses.

It’s no surprise the Australian Prudential Regulation Authority is warning the banks this is a bad time to lower credit quality. The ANZ-Roy Morgan Consumer Confidence index has fallen 15 per cent over the past five weeks and has now dipped below 100 -- the ‘neutral’ line -- for the first time since May 2009. The budget and consumer confidence measures are surface manifestations of the deeper problem that Treasury has pinpointed.

There are some encouraging signs, however. The Barwon model can slash the cost of the Australian medical system if governments can be bothered to use it – it’s much easier to complain (How to save our sick health system without GST hikes, May 21); Woolworths’ Mercury Two campaign is a model for all companies (Woolworths' $1 billion plan to rewrite the retail rule book, March 5); and Telstra will announce how it will share capital demands against higher dividend pressure in its 2013-14 profit announcement (Thodey's Telstra plans have huge implications for shareholders, May 23).

But we need companies to understand that the drive for yield could come at a very big cost if companies do not invest in better productivity.