Consumers are leading the US' economic charge

Economic conditions in the United States remain bright despite finishing the year on a weaker than expected note. In the near term, a stronger US dollar and lower oil prices will support the US household sector, which will be music to the ears of the global economy.

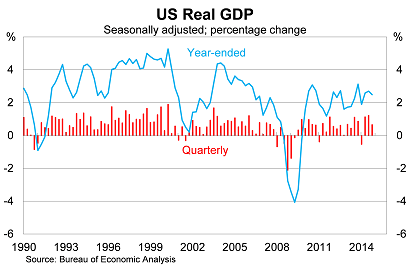

In the United States, real GDP rose by 0.7 per cent in the December quarter, missing market expectations, to be 2.5 per cent higher over the year. This follows growth of 1.2 per cent during the September quarter.

Real GDP should pick up further in the March quarter, as the effect of the abnormally cold winter drops from the annual calculations, to between 3.5 and 4.0 per cent -- the strongest growth in around a decade. But that will likely be the peak of the current cycle, with growth returning to a more sustainable 2.6 to 3.0 per cent range in the medium term.

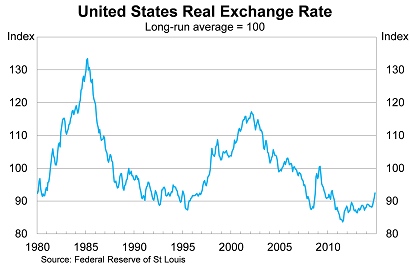

One of the more important narratives coming out of the US since the end of the Federal Reserve's asset purchasing program has been the sharp rise in the US dollar. We are beginning to see the effect of this in a number of economic indicators, including the national accounts.

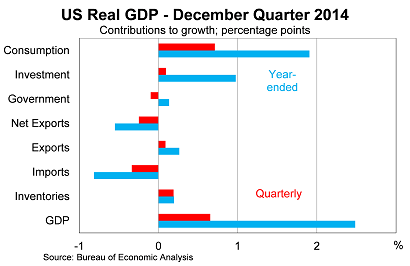

For example, growth in the December quarter was driven almost entirely by the household sector. Household consumption rose by 1.0 per cent in the quarter, to be 2.8 per cent higher over the year -- the strongest quarterly outcome in almost nine years.

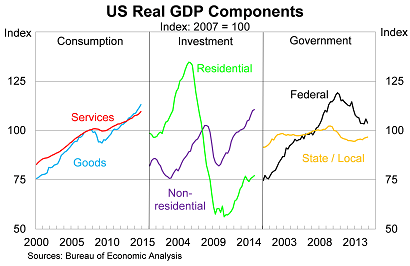

Leading the charge has been purchases of durable goods -- always a good sign of a cyclical upswing. Durable goods rose by 1.8 per cent in the December quarter, following growth of 2.2 per cent last quarter, to be 8.4 per cent higher over the year.

Those numbers won't be sustainable -- growth of that nature never is -- but it highlights some of the factors affecting the household sector. A much stronger dollar and the sharp fall in the oil price has had a significant impact on the purchasing power of US households, which is expected to persist throughout the remainder of this year.

These developments have effectively offset weak wage growth, which remains an ongoing problem for the US recovery. The household sector has also benefited from historically strong employment growth.

Elevated demand in the household sector has fed directly through to stronger imports. The volume of imports rose by 2.2 per cent in the quarter and is now 5.3 per cent higher over the year. That's a lot stronger than exports, with net exports subtracting 0.2 percentage points from growth in the December quarter.

That's the inevitable downside of a dollar-led consumer recovery. So far it doesn't appear to have hurt domestic production to any great extent -- employment growth is evidence of this -- but it's a trend that is worth keeping track of.

But the reality is that the dollar probably has a lot longer to run and remains, by historical standards, at a fairly low level. That's good news for the rest of the global economy, which will benefit through stronger demand for their exports.

Business investment, an important part of any recovery, was fairly mixed in the December quarter. Business investment rose by 0.5 per cent, following strong gains in the previous six months, to be 5.5 per cent higher over the year.

Investment in equipment fell by 0.5 per cent, partially offsetting some stronger recent gains, while investment in non-residential buildings rose by 0.7 per cent.

Residential investment rose by 1.0 per cent and has climbed for the past three quarters. Nevertheless, property investment remains 43 per cent below its pre-crisis peak. What was once a property overhang has probably become a property shortage and points to stronger house prices and eventually stronger residential construction over the next few years.

Government spending remains a source of weakness for the US economy. Spending at the federal level was down by 1.9 per cent in the December, led by softer defence spending, while spending at the state and local level rose modestly.

The decline in defence spending almost completely offset a similar rise in the September quarter. Given the nature of defence spending -- it can be volatile due to the existence of large projects -- it is sometimes best to simply smooth through that volatility. Doing so suggests that the underlying strength in the economy is a little stronger than the headlines suggest.

The outlook for the US economy remains bright. The factors driving household spending should continue to support consumer activity and wage growth will begin to pick-up as spare capacity across the economy continues to diminish.

Business investment should respond to improved conditions but there will obviously be pockets of weakness, particularly in the oil and energy sectors. Residential investment remains uncertain but with a genuine risk of shortages developing there is good reason for analysts and policy-makers to be optimistic.

The data itself won't mean much for monetary policy. The reality is that monetary policy will remain tied to measures of the unemployment rate, wage growth and underlying inflation. Real GDP is important, but for now it takes a backseat to those other indicators.